Abercrombie & Fitch 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

corporate governance practices and procedures, (ii) at least a major-

ity of the members of the Compensation Committee shall be direc-

tors who were not members of the Compensation Committee at the

time of the events giving rise to the Litigation and who have no sub-

stantial business or professional relationship with A&F other than

their status as directors, (iii) the Compensation Committee shall

retain independent counsel and an independent compensation

expert, (iv) A&F shall adopt FAS 123 providing for the expensing of

stock option compensation, (v) for a period of five years A&F shall

not nominate for election to the Board any director who does not

meet the New York Stock Exchange standards for director inde-

pendence (provided, however, this provision shall not apply to any

current member of the Board or to up to three members of A&F’s

senior management), (vi) one member of the Board who does not

meet such standards shall not be nominated for re-election in con-

nection with the 2005 annual meeting, and (vii) the Company shall

review the disclosures to appear in A&F’s proxy statement for its

2005 Annual Meeting relating to executive compensation and will

provide plaintiffs’ counsel with an opportunity to comment on the

disclosures. The stipulation of settlement provides for a release of

all claims that A&F has or may have against any of the defendants

relating to the matters and claims that were or could have been

raised in the Litigation. The plaintiffs will apply to the Court for an

award of attorneys’ fees.

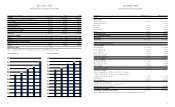

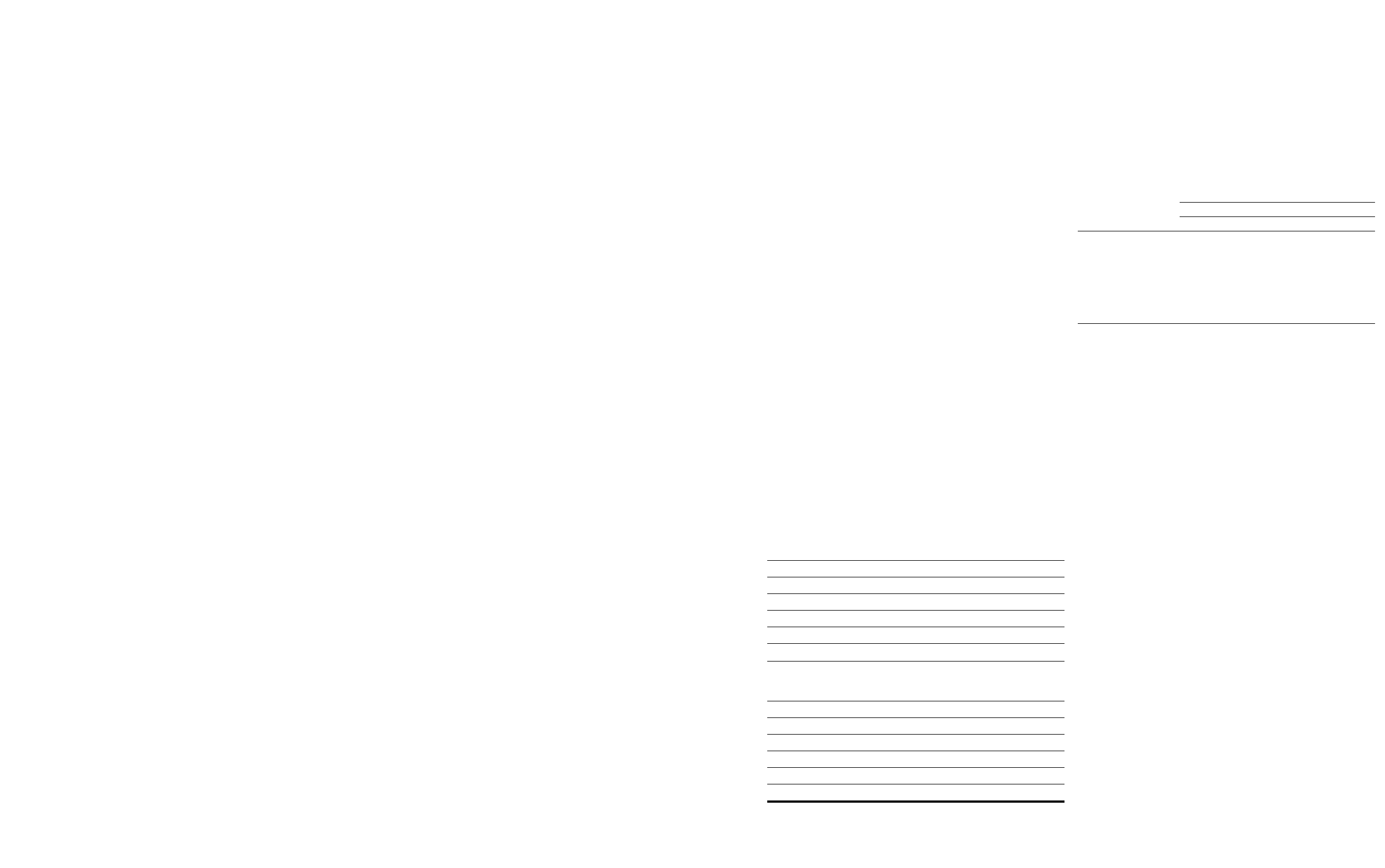

15. QUARTERLY FINANCIAL DATA (UNAUDITED) Summarized

quarterly financial results for 2004 and 2003 follow (thousands

except per share amounts):

2004 Quarter First Second Third Fourth

Net sales $411,930 $401,346 $520,724 $687,254

Gross income 164,991 181,643 226,537 336,624

Operating income 46,722 68,762 61,978 170,175

Net income 29,317 42,888 39,911 104,261

Net income per basic share $0.31 $0.45 $0.43 $1.19

Net income per diluted share $0.30 $0.44 $0.42 $1.15

2003 Quarter First Second Third Fourth

Net sales $346,722 $355,719 $444,979 $560,389

Gross income 128,578 143,850 182,993 261,523

Operating income 40,680 55,134 80,578 154,788

Net income 25,785 34,528 49,934 94,583

Net income per basic share $0.26 $0.36 $0.52 $0.98

Net income per diluted share $0.26 $0.34 $0.50 $0.97

37

Abercrombie &Fitch

Stock issued after July 28, 1998 and prior to the Distribution Date

described below will be issued with a Right attached. Under certain

conditions, each whole Right may be exercised to purchase one one-

thousandth of a share of Series A Participating Cumulative Preferred

Stock at an initial exercise price of $250. The Rights initially will be

attached to the shares of Common Stock. The Rights will separate

from the Common Stock and a Distribution Date will occur upon

the earlier of 10 business days after a public announcement that a

person or group has acquired beneficial ownership of 20% or more

of A&F’s outstanding shares of Common Stock and become an

“Acquiring Person” (Share Acquisition Date) or 10 business days (or

such later date as the Board shall determine before any person has

become an Acquiring Person) after the date of the commencement

of a tender or exchange offer which, if consummated, would result

in a person or group beneficially owning 20% or more of A&F’s out-

standing Common Stock. The Rights are not exercisable until the

Distribution Date.

In the event that any person becomes an Acquiring Person, each

holder of a Right (other than the Acquiring Person and certain

affiliated persons) will be entitled to purchase, upon exercise of the

Right, shares of Common Stock having a market value two times the

exercise price of the Right. At any time after any person becomes an

Acquiring Person (but before any person becomes the beneficial

owner of 50% or more of the outstanding shares), A&F’s Board of

Directors may exchange all or part of the Rights (other than Rights

beneficially owned by an Acquiring Person and certain affiliated per-

sons) for shares of Common Stock at an exchange ratio of one share

of Common Stock per Right. In the event that, at any time following

the Share Acquisition Date, A&F is involved in a merger or other

business combination transaction in which A&F is not the surviving

corporation, the Common Stock is exchanged for other securities or

assets or 50% or more of the assets or earning power of A&F and its

subsidiaries, taken as a whole, is sold or transferred, the holder of a

Right will be entitled to buy, for the exercise price of the Rights, the

number of shares of common stock of the other party to the business

combination or sale which at the time of such transaction will have

a market value of two times the exercise price of the Right.

The Rights, which do not have any voting rights, expire on July

16, 2008, and may be redeemed by A&F at a price of $.01 per whole

Right at any time before a person becomes an Acquiring Person.

Rights holders have no rights as a shareholder of A&F, including

the right to vote and to receive dividends.

14. SUBSEQUENT EVENTS In February 2005, two substantially

similar actions were filed in the Court of Chancery of the State of

Delaware by A&F stockholders challenging the compensation

received by A&F’s Chief Executive Officer, Michael S. Jeffries.

36

The complaints allege, among other things, that the Board of

Directors of A&F and the members of the Compensation

Committee of the Board breached their fiduciary duties in granti-

ng stock options and an increase in cash compensation to Mr.

Jeffries in February 2002 and in approving Mr. Jeffries’s current

employment agreement in January 2003 (the “Amended and

Restated Employment Agreement”). The complaints further assert

that A&F’s disclosures with respect to Mr. Jeffries’ compensation

were deficient. The complaints seek, among other things, to rescind

the purportedly wrongful compensation and to set aside the cur-

rent employment agreement. The actions have been consolidated

under the caption, In re Abercrombie & Fitch Co. Shareholder

Derivative Litigation., C.A. No. 1077 (the “Litigation”). A&F has

formed a special committee of independent directors (the “Special

Committee”) to determine what action to take with respect to the

Litigation. A&F and the defendant members of the Board of

Directors have denied, and continue to deny, any liability or

wrongdoing with respect to all claims alleged in the Litigation.

Nevertheless, the Special Committee, A&F and the other defen-

dants have determined that it is desirable to settle the Litigation and

thereby eliminate the substantial burden, expense, inconvenience

and distraction that the Litigation would entail and to dispel any

uncertainty that may exist as a result of the Litigation.

Pursuant to a stipulation of settlement dated April 8, 2005, and

subject to the approval of the Court, the parties have agreed to set-

tle the Litigation on the following terms: (i) Mr. Jeffries’s Amended

and Restated Employment Agreement will be amended to reduce

his “stay bonus” from twelve million dollars to six million dollars

and to condition receipt of the stay bonus on A&F’s achieving

defined performance criteria (except in certain circumstances), (ii)

Mr. Jeffries will not receive any award of stock options during cal-

endar years 2005 and 2006 and in subsequent years will receive

stock options only in the discretion of the Compensation

Committee, (iii) Mr. Jeffries will hold the Career Shares awarded

under Section 4(b) of his Amended and Restated Employment

Agreement for a period of one year after he ceases to be an execu-

tive officer of A&F (the “Holding Period”), and (iv) Mr. Jeffries will

hold one half of the A&F shares received from the first one million

stock options exercised following this settlement, net of shares equal

to the amount of withholding taxes and exercise price, until the

expiration of the Holding Period. Also as part of the settlement, the

Special Committee has agreed to recommend to the full Board that

the Board cause A&F to take, subject to the directors' fiduciary

duties, and A&F has agreed to use its best efforts to take, each of the

following actions, with the actions described in clauses (i) through

(iv) to be achieved not later than the one year anniversary of the set-

tlement becoming final: (i) A&F shall conduct a full review of its

MARKET PRICE AND DIVIDEND INFORMATION A&F’s Class

A Common Stock (the “Common Stock”) is traded on the New

York Stock Exchange under the symbol “ANF.” The table below sets

forth the high and low sales prices of A&F’s Common Stock on the

New York Stock Exchange for the 2004 and 2003 fiscal years:

Sales Price

High Low

2004 Fiscal Year

4th Quarter $52.13 $39.09

3rd Quarter $39.18 $28.00

2nd Quarter $39.12 $31.07

1st Quarter $36.10 $25.54

2003 Fiscal Year

4th Quarter $29.82 $23.49

3rd Quarter $31.47 $26.77

2nd Quarter $32.80 $26.14

1st Quarter $33.11 $26.98

In February 2004, the Board of Directors voted to initiate a cash

dividend, at an annual rate of $0.50 per share. A quarterly dividend,

of $0.125 per share, was paid in March, June, September and

December of 2004. The Company currently expects to continue to

pay an annual dividend of $0.50 per share, subject to Board of

Directors review and approval of the appropriateness of future div-

idend amounts.

As of April 1, 2005, there were approximately 5,300 shareholders

of record. However, when including active associates who partici-

pate in A&F’s stock purchase plan, associates who own shares

through A&F-sponsored retirement plans and others holding shares

in broker accounts under street name, A&F estimates that there are

approximately 53,000 shareholders.