Abercrombie & Fitch 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

For construction allowances, the Company records a deferred

lease credit on the consolidated balance sheet and amortizes the

deferred lease credit as a reduction to rent expense on the consoli-

dated statement of income over the terms of the leases. For sched-

uled rent escalation clauses during the lease terms, the Company

records minimum rental expenses on a straight-line basis over the

terms of the leases on the consolidated statement of income. The

term of the lease over which the Company amortizes construction

allowances and minimum rental expenses on a straight-line basis

begins on the date of initial possession, which is generally when

the Company enters the space and begins to make improvements

in preparation of intended use.

Certain leases provide for contingent rents, which are deter-

mined as a percentage of gross sales in excess of specified levels.

The Company records a contingent rent liability in accrued

expenses on the consolidated balance sheets and the corresponding

rent expense when management determines that achieving the

specified levels during the fiscal year is probable.

STORE PREOPENING EXPENSES Pre-opening expenses related

to new store openings are charged to operations as incurred.

DESIGN AND DEVELOPMENT COSTS Costs to design and

develop the Company’s merchandise are expensed as incurred and

are reflected as a component of “Cost of Goods Sold, Occupancy

and Buying Costs.”

FAIR VALUE OF FINANCIAL INSTRUMENTS The recorded

values of current assets and current liabilities, including receivables,

marketable securities and accounts payable, approximate fair value

due to the short maturity and because the average interest rate

approximates current market origination rates.

STOCK-BASED COMPENSATION The Company reports stock-

based compensation through the disclosure-only requirements

of SFAS No. 123 (“SFAS 123”), “Accounting for Stock-Based

Compensation,” as amended by SFAS No. 148, “Accounting for

Stock-Based Compensation–Transition and Disclosure–an

Amendment of FASB No. 123,” but elects to measure compensa-

tion expense using the intrinsic value method in accordance with

Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issued to Employees.” Accordingly, no compensation

expense for options has been recognized as all options are grant-

ed at fair market value at the grant date. The Company does rec-

ognize compensation expense related to restricted share awards.

If compensation expense related to options had been determined

based on the estimated fair value of options granted in 2004, 2003

and 2002, consistent with the methodology in SFAS 123, the pro

forma effect on net income and net income per basic and diluted

share would have been as follows:

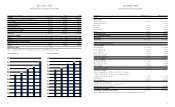

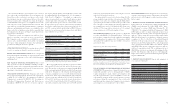

(Thousands except per share amounts) 2004 2003 2002

Net Income:

As reported $216,376 $204,830 $194,754

Stock-based compensation expense

included in reported net income, net of tax 6,358 3,250 1,414

Stock-based compensation expense

determined under fair value based method,

net of tax(1) (27,720) (27,274) (27,673)

Pro forma $195,014 $180,806 $168,495

Basic net income per share:

As reported $2.33 $2.12 $1.98

Pro forma $2.10 $1.87 $1.72

Diluted net income per share:

As reported $2.28 $2.06 $1.94

Pro forma $2.05 $1.83 $1.68

(1) Includes stock-based compensation expense related to restricted share awards actually

recognized in earnings in each period presented using the intrinsic value method.

The average weighted-average fair values of options were $15.05,

$14.18 and $12.07 for the 2004, 2003 and 2002 fiscal years, respec-

tively. The fair value of each option was estimated using the Black-

Scholes option-pricing model, which are included in the pro forma

results above. For purposes of the valuation, the following weight-

ed-average assumptions were used: a 1.28% dividend yield in the

2004 fiscal year and no expected dividends in the 2003 and 2002 fis-

cal years; average price volatility of 56%, 63% and 53% in the 2004,

2003 and 2002 fiscal years, respectively; average risk-free interest

rates of 3.2%, 3.0% and 4.3% in the 2004, 2003 and 2002 fiscal years,

respectively; assumed average forfeiture rates of 28%, 23% and 15%

for the 2004, 2003 and 2002 fiscal years; and vesting lives of 4 years

in the 2004, 2003 and 2002 fiscal years.

For options granted to non-associates directors during 2004, the

average weighted-average fair value of the options was $5.22. The

fair value of each option was estimated using the Black-Scholes

option-pricing model, which is included in the pro forma results

above. For purposes of the valuation, the following weighted-aver-

age assumptions were used: a 1.28% dividend yield; average price

volatility of 37%; average risk-free interest rate of 2.0%; assumed

average forfeiture rate of 12%; and vesting life of 1 year.

NET INCOME PER SHARE Net income per share is computed in

accordance with SFAS No. 128, “Earnings Per Share.” Net income

per basic share is computed based on the weighted-average number

of outstanding shares of common stock. Net income per diluted

share includes the weighted-average effect of dilutive stock options

and restricted shares.

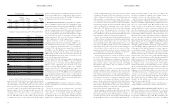

Weighted–Average Shares Outstanding (thousands):

2004 2003 2002

Shares of Class A Common stock issued 103,300 103,300 103,300

Treasury shares oustanding (10,523) (6,467) (5,129)

Basic shares outstanding 92,777 96,833 98,171

Dilutive effect of options and

restricted shares 2,333 2,747 2,460

Diluted shares outstanding 95,110 99,580 100,631

Options to purchase 5,213,000, 6,151,000 and 9,218,000 shares of Class A Common

Stock were outstanding at year-end 2004, 2003 and 2002, respectively, but were not

included in the computation of net income per diluted share because the options’ exercise

prices were greater than the average market price of the underlying shares.

USE OF ESTIMATES IN THE PREPARATION OF FINANCIAL

STATEMENTS The preparation of financial statements in con-

formity with generally accepted accounting principles (“GAAP”)

requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities as of the date

of the financial statements and the reported amounts of revenues

and expenses during the reporting period. Since actual results

may differ from those estimates, the Company revises its estimates

and assumptions as new information becomes available.

RECLASSIFICATIONS Certain amounts have been reclassified to

conform to current year presentation. The amounts reclassified did

not have an effect on the Company’s results of operations or share-

holders’ equity.

3. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In December 2004, the Financial Accounting Standards Board

("FASB") issued Statement No. 123R ("SFAS 123R"), "Share-

Based Payment," a revision of FASB issued Statement No. 123

("SFAS 123"), "Accounting for Stock-Based Compensation." SFAS

123R requires an entity to recognize compensation expense in an

amount equal to the fair value of share-based payments granted to

employees. The pro forma disclosures previously permitted under

SFAS 123 will no longer be an alternative to financial statement

recognition. See Note 2 of the Notes to Consolidated Financial

Statements for the pro forma net income and earnings per share

amounts for fiscal 2002 through fiscal 2004, as if the Company had

used a fair-value based method similar to the methods required

under SFAS 123R to measure compensation expense for employee

stock-based compensation awards. The accounting provisions of

SFAS 123R are effective for reporting periods beginning after June

15, 2005. The Company is still in the process of determining the

impact on the results of operations and financial position upon the

adoption of SFAS 123R.

4. PROPERTY AND EQUIPMENT Property and equipment, at

cost, consisted of (thousands):

2004 2003

Land $ 15,985 $ 15,985

Building 110,971 110,726

Furniture, fixtures and equipment 516,127 469,135

Leasehold improvements 402,535 332,231

Construction in progress 27,782 27,901

Beneficial leaseholds 12 5,839

Total $1,073,412 $961,817

Less: Accumulated depreciation and amortization 386,401 331,795

Property and equipment, net $ 687,011 $630,022

Abercrombie &Fitch

30 31