Abercrombie & Fitch 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

35

Abercrombie &Fitch

the above mentioned grants to the Chairman and the non-associate

directors is generally four years. Compensation expenses related to

restricted share awards amounted to $10.4 million, $5.3 million and

$2.3 million in 2004, 2003 and 2002, respectively.

11. RETIREMENT BENEFITS The Company maintains a qualified

defined contribution retirement plan and a nonqualified supple-

mental retirement plan. Participation in the qualified plan is available

to all associates who have completed 1,000 or more hours of service

with the Company during certain 12-month periods and attained

the age of 21. Participation in the nonqualified plan is subject to

service and compensation requirements. The Company’s contribu-

tions to these plans are based on a percentage of associates’ eligible

annual compensation. The cost of these plans was $9.1 million in

2004, $6.4 million in 2003 and $5.6 million in 2002.

Effective February 2, 2003, the Company established a

Supplemental Executive Retirement Plan (the “SERP”) to pro-

vide additional retirement income to its Chairman. Subject to

service requirements, the Chairman will receive a monthly bene-

fit equal to 50% of his final average compensation (as defined in

the SERP) for life. The SERP has been actuarially valued by an

independent third party and the expense associated with the

SERP is being accrued over the stated term of the Amended and

Restated Employment Agreement, dated as of January 30, 2003,

between the Company and its Chairman.

Effective May 17, 2004, the Company established a Supplemental

Executive Retirement Plan (the “SERP”) to provide additional

retirement income to its President and Chief Operating Officer.

Subject to service requirements, upon retirement at age 57 the

President and Chief Operating Officer would receive a monthly

annuity of $8,333.33 for life. The monthly amount would be actu-

arially increased for retirement after age 57, or reduced 20% per year

for retirement prior to age 57. The SERP has been actuarially valued

by an independent third party and the expense associated with the

SERP is being accrued over the stated term of the Employment

Agreement, dated as of May 17, 2004, between the Company and its

President and Chief Operating Officer.

12. CONTINGENCIES The Company is involved in a number of

legal proceedings that arise out of, and are incidental to, the conduct

of its business.

In 2003, five actions were filed in different state courts under

various states’ laws on behalf of purported classes of employees and

former employees of the Company alleging that the Company

required its associates to wear and pay for a “uniform” in violation

of applicable law. In each case, the plaintiff, on behalf of his or her

purported class, sought injunctive relief and unspecified amounts of

economic and liquidated damages. Two of the actions were ordered

coordinated in November of 2003 and on February 28, 2005, were

settled and dismissed with prejudice as to the individual claims and

without prejudice as to the putative class claims. Two other cases

were stayed in the state court proceedings and the plaintiffs in those

cases joined in the action in federal court described in the immedi-

ately following paragraph. In connection with the settlement of that

federal court action, the two related state court cases were dismissed

with prejudice. The Company has filed an answer in the remaining

state court action. The plaintiffs in that action filed, and the

Company opposed, a motion to certify a class of employees in the

State of Washington. The Court granted the plaintiffs’ motion and

the Company has commenced a discretionary appeal thereof.

In 2003, an action was filed in the United States District Court for

the Western District of Pennsylvania, in which the plaintiff alleged

that the “uniform,” when purchased, drove associates’ wages below

the federal minimum wage. The complaint purported to state a col-

lective action on behalf of part-time associates under the Fair Labor

Standards Act. On November 17, 2004, the Court gave final approval

of the settlement of this case and the two state court cases whose

plaintiffs had joined in the federal court action, and dismissal of the

case with prejudice was entered. The settlement is not material to

the consolidated financial statements of the Company.

As previously mentioned, five of the above-described cases have

been settled. The Company does not believe it is feasible to predict

the outcome of the remaining state court legal proceeding described

above and intends to vigorously defend against it. The timing of the

final resolution of that proceeding is also uncertain. Accordingly,

the Company cannot estimate a range of potential loss, if any, for

that legal proceeding.

In each of 2004, 2003 and 2002, one action was filed against the

Company involving overtime compensation. In each action, the

plaintiffs, on behalf of their respective purported class, seek injunctive

relief and unspecified amounts of economic and liquidated damages.

In the action which was filed in state court under California law in

2002, the parties are in the process of discovery, and the trial court has

ordered a class of store managers in California certified for limited

purposes. In the action which was filed in the United States District

Court for the Southern District of Ohio in 2003, the Company has

filed a motion to dismiss which was denied as to certain of the plain-

tiffs and remains pending as to certain claims of a third plaintiff. The

parties in this action have commenced discovery.

In the remaining case, which was filed on December 28, 2004 in

the United States District Court for the Eastern District of Tennessee,

the Company has filed an answer. The Company does not believe it

is feasible to predict the outcome of the legal proceedings described in

this paragraph and intends to defend vigorously against them. The

timing of the final resolution of each of these proceedings is also

uncertain. Accordingly, the Company cannot estimate a range of

potential loss, if any, for any of these legal proceedings.

In 2003, an action was filed in the United States District Court for

the Northern District of California on behalf of a purported class

alleged to be discriminated against in hiring or employment decisions

due to race and/or national origin. The plaintiffs in this action

sought, on behalf of their purported class, injunctive relief and

unspecified amounts of economic, compensatory and punitive dam-

ages. Two other purported class action employment discrimination

lawsuits were subsequently filed in the United States District Court

for the Northern District of California, both on November 8, 2004.

One alleged gender (female) discrimination in hiring or employment

decisions and sought, on behalf of the purported class, injunctive

relief and unspecified amounts of economic, compensatory and

punitive damages. The other was brought by the Equal Employment

Opportunity Commission (the “EEOC”) alleging race, ethnicity

and gender (female) discrimination in hiring or employment deci-

sions. The EEOC complaint sought injunctive relief and, on behalf

of the purported class, unspecified amounts of economic, compensa-

tory and punitive damages. On November 8, 2004, the Company

signed a consent decree settling these three related class action dis-

crimination lawsuits, subject to judicial review and approval. The

monetary terms of the consent decree provided that the Company

would set aside $40.0 million to pay to the class, approximately $7.5

million for attorneys’ fees, and approximately $2.5 million for mon-

itoring and administrative costs to carry out the settlement. As a result,

the Company accrued a non-recurring charge of $32.9 million,

which was included in general, administrative and store operating

expenses for the third quarter of fiscal 2004. This was in addition to

amounts accrued during the first quarter of fiscal 2004 when the

Company recorded an $8.0 million charge (net of expected proceeds

of $10 million from insurance) resulting from an increase in expect-

ed defense costs related to the case filed in 2003. The preliminary

approval order was signed by Judge Susan Illston of the United

States District Court for the Northern District of California on

November 16, 2004, and that order scheduled a final fairness and

approval hearing for April 14, 2005.

The Company accrues amounts related to legal matters if rea-

sonably estimable and reviews these amounts at least quarterly.

13. PREFERRED STOCK PURCHASE RIGHTS On July 16, 1998,

A&F’s Board of Directors declared a dividend of .50 of a Series A

Participating Cumulative Preferred Stock Purchase Right (Right)

for each outstanding share of Class A Common Stock, par value

$.01 per share (Common Stock), of A&F. The dividend was paid

to shareholders of record on July 28, 1998. Shares of Common

34

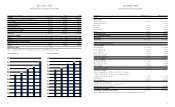

Options Outstanding Options Exercisable

at January 29, 2005 at January 29, 2005

Weighted–

Average Weighted– Weighted–

Range of Remaining Average Average

Exercise Number Contractual Exercise Number Exercise

Prices Outstanding Life Price Exercisable Price

$ 8-$23 991,000 3.3 $12.26 613,000 $13.00

$23-$38 6,130,000 5.9 $26.56 3,804,000 $25.86

$38-$51 4,908,000 4.6 $43.85 2,445,000 $43.76

$ 8-$51 12,029,000 5.2 $32.44 6,862,000 $31.09

A summary of option activity for fiscal 2004, 2003 and 2002 follows:

Number of Weighted–Average

2004 Shares Option Price

Outstanding at beginning of year 14,839,900 $30.03

Granted 484,000 36.48

Exercised (2,564,000) 19.49

Canceled (730,000) 31.67

Outstanding at end of year 12,029,900 $32.44

Options exercisable at year-end 6,862,000 $31.09

2003

Outstanding at beginning of year 16,059,000 $28.31

Granted 640,000 27.89

Exercised (1,586,600) 12.39

Canceled (272,500) 27.04

Outstanding at end of year 14,839,900 $30.03

Options exercisable at year-end 6,191,000 $27.04

2002

Outstanding at beginning of year 12,961,000 $28.65

Granted 3,583,000 26.53

Exercised (93,000) 16.44

Canceled (392,000) 26.31

Outstanding at end of year 16,059,000 $28.31

Options exercisable at year-end 4,556,000 $19.10

A total of 507,500, 78,000 and 1,046,000 restricted shares were

granted in fiscal 2004, 2003 and 2002, respectively, with a total market

value at grant date of $16.0 million, $2.1 million and $28.0 million,

respectively. Of the restricted shares granted in 2002, 1,000,000

shares were awarded to the Company’s Chairman, which become

vested on December 31, 2008 provided the Chairman remains con-

tinuously employed by the Company through such date. The

remaining restricted share grants either vest on a graduated scale

over four years for associates or over one year for the non-associate

directors. The market value of restricted shares is being amortized

as compensation expense over the vesting period, which excluding