Abercrombie & Fitch 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

1. BASIS OF PRESENTATION Abercrombie & Fitch Co. (“A&F”),

through its wholly-owned subsidiaries (collectively, A&F and its

wholly-owned subsidiaries are referred to as “Abercrombie &

Fitch” or the “Company”), is a specialty retailer of high quality,

casual apparel for men, women and kids with an active, youthful

lifestyle. The business was established in 1892.

The accompanying consolidated financial statements include

the historical financial statements of, and transactions applicable to,

A&F and its wholly-owned subsidiaries and reflect the assets, liabil-

ities, results of operations and cash flows on a historical cost basis.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION The consolidated financial

statements include the accounts of A&F and its subsidiaries. All

significant intercompany balances and transactions have been

eliminated in consolidation.

FISCAL YEAR The Company’s fiscal year ends on the Saturday

closest to January 31. Fiscal years are designated in the financial

statements and notes by the calendar year in which the fiscal year

commences. The results for fiscal years 2004, 2003 and 2002 represent

the fifty-two week periods ended January 29, 2005, January 31, 2004

and February 1, 2003, respectively.

CASH AND EQUIVALENTS Cash and equivalents include

amounts on deposit with financial institutions and investments

with original maturities of less than 90 days. Outstanding checks at

year end are reclassified in the balance sheet from cash to accounts

payable to be reflected as liabilities. At fiscal year end 2004 and 2003,

the outstanding checks reclassified were $53.6 million and $33.2

million, respectively.

MARKETABLE SECURITIES All investments with original matu-

rities of greater than 90 days are accounted for in accordance with

Statement of Financial Accounting Standards (“SFAS”) No. 115,

“Accounting for Certain Investments in Debt and Equity Securities.”

The Company determines the appropriate classification at the time

of purchase. At January 29, 2005, the Company had no investments

in marketable securities and at January 31, 2004 had $464.7 million

of investments in marketable securities. The marketable securities

consisted of auction rate securities classified as available-for-sale.

Investments in these securities are recorded at cost, which approxi-

mates fair value due to their variable interest rates, which reset every

7 to 49 days. Despite the long-term nature of their stated contrac-

tual maturities, there is a readily liquid market for these securities.

As a result, there are no cumulative gross unrealized holding gains

(losses) or gross realized gains (losses) from marketable securities.

All income generated from these marketable securities was record-

ed as interest income.

INVENTORIES Inventories are principally valued at the lower of

average cost or market, on a first-in-first-out basis, utilizing the

retail method. An initial markup is applied to inventory at cost

in order to establish a cost-to-retail ratio. Permanent markdowns,

when taken, reduce both the retail and cost components of inven-

tory on hand so as to maintain the already established cost-to-

retail relationship.

The fiscal year is comprised of two principal selling seasons:

Spring (the first and second quarters) and Fall (the third and

fourth quarters). The Company further reduces inventory at sea-

son end by recording an additional markdown reserve using the

retail carrying value of inventory from the season just passed.

Markdowns on this carryover inventory represent estimated

future anticipated selling price declines. Additionally, inventory

valuation at the end of the first and third quarters reflects adjust-

ments for inventory markdowns for the total season. Further, as

part of inventory valuation, inventory shrinkage estimates are

made, based on historical trends, that reduce the inventory value

for lost or stolen items.

The markdown reserve was $6.6 million and $5.5 million at

January 29, 2005 and January 31, 2004, respectively. The shrink

reserve was $2.9 million and $3.3 million at January 29, 2005 and

January 31, 2004, respectively.

STORE SUPPLIES The initial inventory of supplies for new

stores including, but not limited to, hangers, signage, security

tags and point-of-sale supplies are capitalized at the store open-

ing date. Subsequent shipments are expensed except for new

merchandise presentation programs, which are capitalized.

PROPERTY AND EQUIPMENT Depreciation and amortization

of property and equipment are computed for financial reporting

purposes on a straight-line basis, using service lives ranging prin-

cipally from 30 years for buildings, the lesser of 10 years or the life

of the lease for leasehold improvements and 3 to 10 years for

other property and equipment. Beneficial leaseholds represent

the present value of the excess of fair market rent over contractual

rent of existing stores as of the 1988 purchase of the Abercrombie

& Fitch business by The Limited, Inc. (now known as Limited

Brands, Inc., “The Limited”) and are being amortized over the

lives of the related leases. The cost of assets sold or retired and the

related accumulated depreciation or amortization are removed

from the accounts with any resulting gain or loss included in

net income. Maintenance and repairs are charged to expense as

incurred. Major renewals and betterments that extend service

lives are capitalized.

Long-lived assets are reviewed at the store level at least annual-

ly for impairment or whenever events or changes in circumstances

indicate that full recoverability of net assets through future cash

flows is in question. Factors used in the evaluation include, but are

not limited to, management's plans for future operations, recent

operating results and projected cash flows. The Company

incurred impairment charges of $1.2 million and $1.3 million in

fiscal 2004 and fiscal 2002, respectively. There were no impairment

charges taken in fiscal 2003.

INCOME TAXES Income taxes are calculated in accordance with

SFAS No. 109 (“SFAS 109”), "Accounting for Income Taxes,"

which requires the use of the asset and liability method. Deferred

tax assets and liabilities are recognized based on the difference

between the financial statement carrying amounts of existing assets

and liabilities and their respective tax bases.

Deferred tax assets and liabilities are measured using enacted

tax rates in effect in the years in which those temporary differences

are expected to reverse. Under SFAS 109, the effect on deferred

taxes of a change in tax rates is recognized in income in the period

that includes the enactment date.

CONTINGENCIES In the normal course of business, the Company

must make continuing estimates of potential future legal obligations

and liabilities, which requires the use of management’s judgment

on the outcome of various issues. Management may also use outside

legal advice to assist in the estimating process. However, the ultimate

outcome of various legal issues could be different than management

estimates, and adjustments may be required.

SHAREHOLDERS’ EQUITY At January 29, 2005 and January 31,

2004, there were 150 million shares of $.01 par value Class A

Common Stock authorized, of which 86.0 million and 94.6 million

shares were outstanding at January 29, 2005 and January 31, 2004,

respectively, and 106.4 million shares of $.01 par value Class B

Common Stock authorized, none of which were outstanding at

January 29, 2005 and January 31, 2004, respectively. In addition,

15 million shares of $.01 par value Preferred Stock were author-

ized, none of which have been issued. See Note 13 for information

about Preferred Stock Purchase Rights.

Holders of Class A Common Stock generally have identical

rights to holders of Class B Common Stock, except that holders of

Class A Common Stock are entitled to one vote per share while

holders of Class B Common Stock are entitled to three votes per

share on all matters submitted to a vote of shareholders.

REVENUE RECOGNITION The Company recognizes retail sales

at the time the customer takes possession of the merchandise and

purchases are paid for, primarily with either cash or credit card.

Catalogue and e-commerce sales are recorded upon customer

receipt of merchandise. Amounts relating to shipping and handling

billed to customers in a sale transaction are classified as revenue

and the related direct shipping costs are classified as cost of goods

sold. Employee discounts are classified as a reduction of revenue.

The Company reserves for sales returns through estimates based

on historical experience and various other assumptions that man-

agement believes to be reasonable. The Company accounts for

gift cards by recognizing a liability at the time when a gift card is

sold. Revenue is recognized when the gift card is redeemed for

merchandise. The Company reviews its gift card liability at least

annually and adjusts the liability based on historical redemption

patterns as required.

COST OF GOODS SOLD, OCCUPANCY AND BUYING COSTS

The following expenses are included as part of Cost of Goods Sold,

Occupancy and Buying Costs: landed cost of merchandise, freight,

payroll and related costs associated with merchandise, design, pro-

curement, inspection, store rents and other real estate costs, store

asset depreciation, inventory shrink and markdowns, and cata-

logue production and mailing costs.

GENERAL, ADMINISTRATIVE AND STORE OPERATING

EXPENSES General, Administrative and Store Operating Expenses

include distribution center costs including receiving and warehouse

costs, store payroll and expenses, home office payroll and expenses

(not related to merchandise procurement) and advertising.

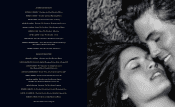

CATALOGUE AND ADVERTISING COSTS Costs related to the

catalogue, primarily consist of catalogue production and mailing

costs and are expensed as incurred as a component of “Cost of Goods

Sold, Occupancy and Buying Costs.” Advertising costs consist of in-

store photographs and advertising in selected national publications

and billboards and are expensed as part of “General, Administrative

and Store Operating Expenses” when the photographs or publica-

tions first appear. Catalogue and advertising costs, which include

photo shoot costs, amounted to $33.8 million in 2004, $33.6 million

in 2003 and $33.4 million in 2002.

OPERATING LEASES The Company leases property for its stores

under operating leases. Most lease agreements contain construction

allowances, rent escalation clauses and/or contingent rent provisions.

Abercrombie &Fitch

28 29

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS