Abercrombie & Fitch 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch Abercrombie &Fitch

32 33

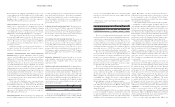

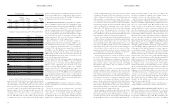

5. LEASED FACILITIES AND COMMITMENTS Annual store rent

is comprised of a fixed minimum amount, plus contingent rent

based on a percentage of sales exceeding a stipulated amount.

Store lease terms generally require additional payments covering

taxes, common area costs and certain other expenses.

A summary of rent expense follows (thousands):

2004 2003 2002

Store rent:

Fixed minimum $141,450 $122,001 $106,053

Contingent 6,932 5,194 4,886

Total store rent $148,382 $127,195 $110,939

Buildings, equipment and other 1,663 1,219 1,133

Total rent expense $150,045 $128,414 $112,072

At January 29, 2005, the Company was committed to noncancelable

leases with remaining terms of one to fifteen years. These commit-

ments include store leases with initial terms ranging primarily from

ten to fifteen years. A summary of minimum commitments under

noncancelable leases follows (thousands):

2005 $164,577 2008 145,506

2006 $166,688 2009 137,019

2007 $156,567 Thereafter 485,750

6. ACCRUED EXPENSES Accrued expenses consisted of the follow-

ing (thousands):

2004 2003

Legal $ 54,252 $ 9,248

Rent and landlord charges 46,739 42,846

Current portion of unredeemed gift card revenue 31,283 20,417

Accrual for construction in progress 15,756 31,269

Employee bonuses and incentive compensation 13,959 1,742

Other 72,221 57,867

Total $234,210 $163,389

The accrued legal expense included $49.1 million related to the

settlement of three related class action employment discrimination

lawsuits.

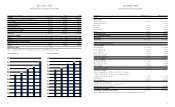

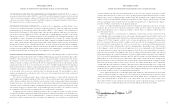

7. INCOME TAXES The provision for income taxes consisted of

(thousands):

2004 2003 2002

Currently payable:

Federal $112,537 $101,692 $ 88,238

State 19,998 18,248 13,865

$132,535 $119,940 $102,103

Deferred:

Federal $ 2,684 $ 8,601 $ 16,629

State 1,258 1,517 2,597

$ 3,942 $ 10,118)$ 19,226

Total provision $136,477 $130,058 $121,329

A reconciliation between the statutory Federal income tax rate and

the effective income tax rate follows:

2004 2003 2002

Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of Federal

income tax effect 3.9% 3.8% 3.5%

Other items, net (0.2%) 0.0% (0.1%)

Total 38.7% 38.8% 38.4%

Income taxes payable included net current deferred tax assets of

$44.4 million and $24.2 million at January 29, 2005 and January 31,

2004, respectively.

Under a tax sharing arrangement with The Limited, which

owned 84.2% of the outstanding Common Stock through May 19,

1998, the Company was responsible for and paid to The Limited its

proportionate share of income taxes calculated upon its separate tax-

able income at the estimated annual effective tax rate for periods

prior to May 19, 1998. In 2002, a final tax sharing payment was

made to The Limited pursuant to an agreement to terminate the tax

sharing agreement. As a result, the Company has been indemnified

by The Limited for any federal, state or local taxes asserted with

respect to The Limited for all periods prior to May 19, 1998.

Amounts paid to The Limited totaled $1.4 million in 2002.

Amounts paid directly to taxing authorities were $114.0 million,

$113.0 million and $82.3 million in 2004, 2003, and 2002, respectively.

The effect of temporary differences which give rise to deferred

income tax assets (liabilities) was as follows (thousands):

2004 2003

Deferred tax assets:

Deferred compensation $ 16,205 $ 10,208

Rent 98,793 86,746

Accrued expenses 7,194 2,502

Inventory 3,268 1,717

Legal expense 15,288 3,234

Total deferred tax assets $ 140,748 $ 104,407

Deferred tax liabilities:

Store supplies $ (10,542) $ (9,384)

Property and equipment (141,147) (102,022)

Total deferred tax liabilities $(151,689) $(111,406)

Net deferred income tax liabilities $ (10,941) $ (6,999)

No valuation allowance has been provided for deferred tax

assets because management believes that it is more likely than

not that the full amount of the net deferred tax assets will be real-

ized in the future.

8. LONG-TERM DEBT On December 15, 2004, the Company

entered into an amended and restated $250 million syndicated

unsecured credit agreement (the “Credit Agreement”). The pri-

mary purposes of the Credit Agreement are for trade, stand-by let-

ters of credit and working capital. The Credit Agreement has sev-

eral borrowing options, including interest rates that are based on

the agent bank’s “Alternate Base Rate”. Facility fees payable

under the Amended Credit Agreement will be based on the

Company’s ratio (the “leverage ratio”) of the sum of total debt

plus 600% of forward minimum rent commitments to consolidat-

ed EBITDAR for the trailing four-fiscal-quarter period and the

facility fees are projected to accrue at .175% of the committed

amounts per annum. The Credit Agreement contains limitations

on indebtedness, liens, sale-leaseback transactions, significant

corporate changes including mergers and acquisitions with third

parties, investments, restricted payments (including dividends

and stock repurchases), hedging transactions and transactions

with affiliates. The Amended Credit Agreement will mature on

December 15, 2009. Letters of credit totaling approximately $49.6

million and $42.8 million were outstanding under the Credit

Agreement at January 29, 2005 and at January 31, 2004. No bor-

rowings were outstanding under the Credit Agreement at January

29, 2005 and at January 31, 2004.

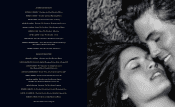

9. RELATED PARTY TRANSACTIONS Shahid & Company, Inc.

has provided advertising and design services for the Company

since 1995. Sam N. Shahid Jr., who serves on A&F’s Board of

Directors, has been President and Creative Director of Shahid &

Company, Inc. since 1993. Fees paid to Shahid & Company, Inc.

for services provided during the 2004, 2003 and 2002 fiscal years

were approximately $2.1 million, $2.0 million and $1.9 million,

respectively. These amounts do not include reimbursements to

Shahid & Company, Inc. for expenses incurred while performing

these services.

On January 1, 2002, A&F loaned $4,953,833 to its Chairman, pur-

suant to the terms of a replacement promissory note, which provid-

ed that such amount was due and payable on December 31, 2002.

The outstanding principal under the note did not bear interest as the

net sales threshold, per the terms of the note, was met. This note

was paid in full by the Chairman on December 31, 2002. This note

constituted a replacement of, and substitute for, several promissory

notes dated from November 17, 1999 through May 18, 2001.

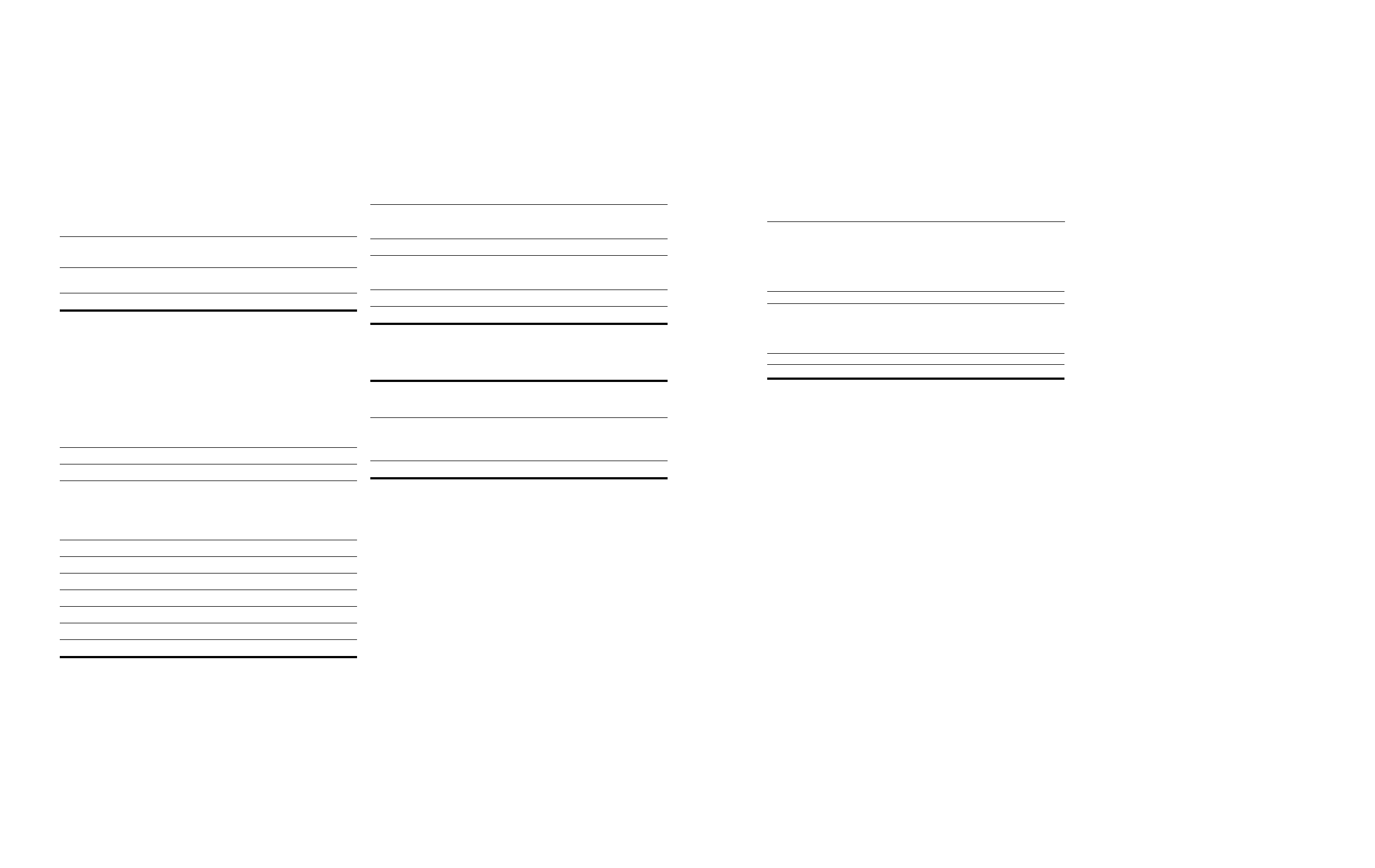

10. STOCK OPTIONS AND RESTRICTED SHARES Under the

Under the Company’s stock plans, associates and non-associate

directors may be granted up to a total of 24.0 million restricted

shares and options to purchase A&F’s common stock at the market

price on the date of grant. In 2004, associates of the Company were

granted options covering approximately 444,000 shares, with a vest-

ing period of four years. Options covering a total of 40,000 shares

were granted to non-associate directors in 2004. Options granted to

the non-associate directors vest on the first anniversary of the grant

date. All options have a maximum term of ten years.