Abercrombie & Fitch 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

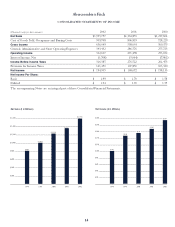

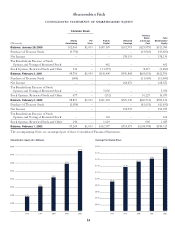

GROSS INCOME: FOURTH QUARTER 2002 The gross income

rate (gross income divided by net sales) for the fourth quarter of

fiscal year 2002 was 45.5%, up 80 basis points from last year’s rate

of 44.7%. The increase in gross income rate resulted largely from

an increase in initial markup (IMU), partially offset by an increase

in buying and occupancy costs, as a percent of sales.

Continued progress in sourcing has been an important fac-

tor in improving the IMU in all three concepts. The Company

continued to make progress increasing the IMU in Hollister,

where IMU improved over 700 basis points versus the fourth

quarter of 2001.

Additionally, the Company’s less aggressive approach to promo-

tions during the fourth quarter of fiscal 2002 resulted in selling at

higher average retail prices as compared to the fourth quarter of 2001.

The increase in buying and occupancy costs, as a percent of sales,

reflected the inability to leverage fixed costs such as rent, deprecia-

tion and other real estate related charges with a comp store decrease.

The Company ended the fourth quarter of 2002 with inven-

tories up 12% per gross square foot versus the fourth quarter of

2001 at cost.

FOURTH QUARTER 2001 The gross income rate during the

fourth quarter of 2001 was 44.7%, down from 46.2% for the

same period in 2000. The decrease was primarily due to an

increase in the markdown rate, attributable to the expected higher

level of promotional business. The planned promotional strate-

gies for the quarter resulted in selling at lower average retail

prices. For the quarter, average unit retail prices decreased in the

low-double digits.

Additionally, buying and occupancy costs, expressed as a per-

centage of net sales, increased as a result of the inability to

leverage fixed expenses with lower sales volume per average

store. These decreases were partially offset by higher IMU and

tight control of inventory. The increase in IMU was a result of

continued improvement in the sourcing of merchandise, partic-

ularly in womens.

The tight control of inventory resulted in inventories being

down 30% per gross square foot at year-end 2001 as compared with

year-end 2000. These low levels of inventory provided downside

profit protection as season-end merchandise was significantly

lower on a per square foot basis in the fourth quarter of 2001 as

compared to the same period in 2000.

Overall, the women’s and girls’ businesses continued to increase

in share of the total business and accounted for greater than 57%

of the adult and kids’ businesses, respectively, in fiscal year 2002.

For the year, women’s comps were negative low-single digits

while girls’ comps were positive mid-single digits. The Company

will continue to focus on providing more frequent newness in

both womens and girls in 2003. Items will flow into the stores

faster and remain in stores for a shorter time period. This strat-

egy gives the customer more new items without an increase in

inventory investment.

Hollister continued to perform well. For fiscal year 2002, sales

per square foot in Hollister stores were approximately 86% of the

sales per square foot in Abercrombie & Fitch stores in the same malls.

The Company’s catalogue, the A&F Quarterly and the

Company’s Web sites represented 4.7% of 2002 net sales compared

to 4.2% in 2001.

FISCAL 2001 Net sales for the 2001 fiscal year increased 10% to $1.36

billion from $1.24 billion in 2000. The sales increase was attributable

to the net addition of 137 stores offset by a 9% comparable store sales

decrease. The decline in comps was largely due to continued weak-

ness in mens. Men’s comps decreased in the high-teens for the

year; however, denim, knits and gymwear performed well.

Comps were up in the mid-single digits in womens for the 2001

fiscal year. The strongest performing categories were denim, knits,

skirts, gymwear and women’s accessories. Overall, womens increased

as a percentage of the overall business. In fiscal 2001, womens

accounted for 55% of the total adult business.

In 2001, the kids’ business had a mid-teen decline in com-

parable store sales for the year with girls performing better than

boys. As in the adult business, girls outperformed boys.

For the 2001 fiscal year, sales per square foot in Hollister stores

were approximately 75% of the sales per square foot in Abercrombie

& Fitch stores in the same malls.

The Company’s catalogue, the A&F Quarterly and the

Company’s Web sites represented 4.2% of fiscal 2001 net sales

compared to 3.8% of 2000 net sales. Operating improvements

in e-commerce fulfillment helped reduce the number of back-

orders, increasing sales by improving in-stocks. The Company

produced only three A&F Quarterly’s in fiscal 2001 versus four

in 2000, dampening the increase over the prior year in the

direct business.

Abercrombie &Fitch

6