Abercrombie & Fitch 2002 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2002 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

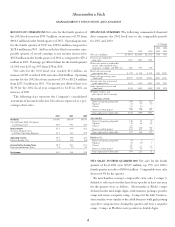

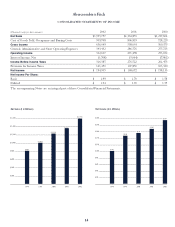

STORES AND GROSS SQUARE FEET Store count and gross

square footage by concept were as follows:

February 1, 2003 February 2, 2002

Number Gross Square Number Gross Square

of Stores Feet (millions) of Stores Feet (millions)

Abercrombie & Fitch 340 3,036 309 2,798

abercrombie 164 727 148 662

Hollister Co. 93 595 34 213

Total 597 4,358 491 3,673

CAPITAL EXPENDITURES Capital expenditures, net of con-

struction allowances, totaled $93.0 million, $126.5 million and

$153.5 million for 2002, 2001 and 2000, respectively. Additionally,

the noncash accrual for construction in progress decreased $12.7

million in 2002 and increased $1.0 million and $9.5 million in 2001

and 2000, respectively. Capital expenditures in 2002 related to new

store construction with approximately $20 million invested in

information technology and distribution center projects. Capital

expenditures in 2001 and 2000 related to the construction of a new

office and distribution center, including the noncash accrual for

construction in progress, which, accounted for approximately

$17 million and $92 million of total capital expenditures in 2001

and 2000 respectively. The office and distribution center were

completed in 2001. The balance of capital expenditures related

primarily to new stores.

The Company anticipates spending $120 to $130 million in

2003 for capital expenditures, of which $70 to $80 million will be

for new stores construction. The balance of expenditures primarily

relates to improving the in-store information technology structure,

which should be complete for back-to-school and distribution cen-

ter expansion. In addition, the Company has begun construction

planning for additional home office space to accommodate the

growth of Hollister.

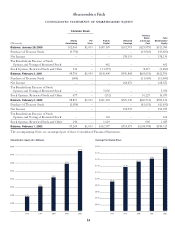

The Company intends to add approximately 726,000 gross

square feet for the three concepts in 2003, which will represent

a 17% increase over year-end 2002. It is anticipated the increase

will result from the addition of approximately 30 new

Abercrombie & Fitch stores, 10 new abercrombie stores and 70

new Hollister Co. stores. Additionally, the Company plans to

remodel 10 Abercrombie & Fitch stores.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for Abercrombie & Fitch

stores opened in 2003 will approximate $630,000 per store, after

giving effect to landlord allowances. In addition, inventory pur-

chases are expected to average approximately $330,000 per store.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for abercrombie stores

opened in 2003 will approximate $485,000 per store, after giving

effect to landlord allowances. In addition, inventory purchases

are expected to average approximately $130,000 per store.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for Hollister Co. stores

opened in 2003 will approximate $650,000 per store, after giving

effect to landlord allowances. In addition, inventory purchases

are expected to average approximately $230,000 per store.

The Company expects that substantially all future capital

expenditures will be funded with cash from operations. In addi-

tion, the Company has $250 million available (less outstanding

letters of credit) under its credit agreement to support operations.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES The

Company’s discussion and analysis of its financial condition

and results of operations are based upon the Company’s consol-

idated financial statements, which have been prepared in

accordance with accounting principles generally accepted in the

United States (“GAAP”). The preparation of these financial

statements requires the Company to make estimates and assump-

tions that affect the reported amounts of assets, liabilities, revenues

and expenses. Since actual results may differ from those estimates,

the Company revises its estimates and assumptions as new infor-

mation becomes available.

The Company’s significant accounting policies can be found

in the Notes to Consolidated Financial Statements (see note 2).

The Company believes that the following policies are most crit-

ical to the portrayal of the Company’s financial condition and

results of operations.

Revenue Recognition – The Company recognizes retail sales

at the time the customer takes possession of the merchandise and

purchases are paid for, primarily with either cash or credit card.

Catalogue and e-commerce sales are recorded upon customer

receipt of merchandise. Amounts relating to shipping and han-

dling billed to customers in a sale transaction are classified as

revenue and the related costs are classified as cost of goods sold.

10