Abercrombie & Fitch 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

■Indirect guarantees of the indebtedness of others.

In addition to the disclosures required by current GAAP related

to guarantees, this interpretation requires additional disclo-

sures including:

■ Details about the nature of the guarantee;

■ The maximum potential amount of future payments

■ (undiscounted);

■ The current carrying amount of the liability for the guaran-

■ tor’s obligation under the guarantee;

■ The nature of any recourse provisions.

Guarantees issued or modified after December 31, 2002 must fol-

low the new accounting. The disclosure requirements were

effective for the 2002 financial statements and did not have an

impact on the Company’s results of operations or its financial

position in 2002. The recognition provisions will be adopted by

the Company in 2003 and are not expected to have a significant

impact on the Company’s financial statements.

SFAS No. 145, “Rescission of FASB Statements No. 4, 44, and

64, Amendment of FASB Statement No. 13, and Technical

Corrections,” was effective February 2, 2003 for the Company. The

standard rescinds FASB Statements No. 4 and 64 that deal with

issues relating to the extinguishment of debt. The standard also

rescinds FASB Statement No. 44 that deals with intangible assets

of motor carriers. The standard modifies FASB Statement No. 13,

“Accounting for Leases,” so that certain capital lease modifications

must be accounted for by lessees as sale-leaseback transactions.

Additionally, the standard identifies amendments that should

have been made to previously existing pronouncements and for-

mally amends the appropriate pronouncements. The provisions

of this standard related to the rescission of SFAS No. 4 are in effect

in 2003. The remaining provisions of the statement were adopted

by the Company for transactions occurring after May 15, 2002.

SFAS No. 146, “Accounting for Costs Associated with Exit or

Disposal Activities,” requires that a liability for a cost associated

with an exit or disposal activity be recognized and measured ini-

tially at fair value when the liability is incurred. The provisions

of the standard are effective for exit or disposal activities initiated

after December 31, 2002. The adoption of SFAS No. 146 did not

have a significant impact on the Company’s financial statements.

SFAS No. 148, “Accounting for Stock-Based Compen-

sation–Transition and Disclosure–an Amendment to FASB No.

123,” was issued on December 31, 2002. Pursuant to this standard,

companies that choose to adopt the accounting provisions of FASB

No. 123, “Accounting for Stock-Based Compensation,” will be

permitted to select from three transition methods (prospective,

modified prospective, and retroactive restatement).

Companies that choose not to adopt the accounting provisions

of FASB No. 123 will be affected by the new disclosure requirements

of FASB No. 148. The new disclosures include tabular presenta-

tion of the following information for all periods presented:

1. Net income and earnings per share (basic and diluted), as

reported;

2. Compensation expense (if any), net of tax, included in

reported net income;

3. Compensation expense that would have been included in net

income had the Company adopted the accounting provisions of

FASB No. 123 for all awards granted, modified or settled since

December 15, 1994;

4. Pro forma net income and earnings per share.

The transition and annual disclosure provisions of FASB No. 148

are effective for the 2002 financial statements. The new interim dis-

closure provisions are effective in the first quarter of 2003.

Emerging Issues Task Force (“EITF”) Issue 02-16, “Accounting

by a Customer (Including a Reseller) For Cash Consideration

Received from a Vendor,” addresses the accounting treatment for

cash vendor allowances received. The adoption of EITF Issue 02-

16 in 2003 did not have an impact on the Company’s financial

position or results of operations.

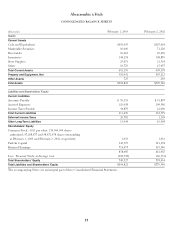

4. PROPERTY AND EQUIPMENT Property and equipment, at

cost, consisted of (thousands):

2002 2001

Land $ 15,450 $ 15,414

Building 92,680 91,531

Furniture, fixtures and equipment 386,289 316,035

Beneficial leaseholds 7,349 7,349

Leasehold improvements 46,969 42,273

Construction in progress 36,905 28,721

Total $585,642 $501,323

Less: accumulated depreciation and amortization 192,701 136,211

Property and equipment, net $392,941 $365,112

5. LEASED FACILITIES AND COMMITMENTS Annual store

rent is comprised of a fixed minimum amount, plus contingent rent

21