Abercrombie & Fitch 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

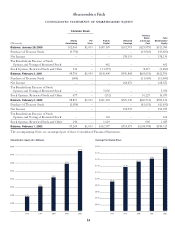

Abercrombie &Fitch

SHAREHOLDERS’ EQUITY At February 1, 2003 and February

2, 2002, there were 150 million shares of $.01 par value Class A

Common Stock authorized, of which 97.3 million and 98.9 mil-

lion shares were outstanding at February 1, 2003 and February

2, 2002, respectively, and 106.4 million shares of $.01 par value

Class B Common Stock authorized, none of which were out-

standing at February 1, 2003 or February 2, 2002. In addition,

15 million shares of $.01 par value Preferred Stock were autho-

rized, none of which have been issued. See Note 13 for infor-

mation about Preferred Stock Purchase Rights.

Holders of Class A Common Stock generally have identical

rights to holders of Class B Common Stock, except that holders

of Class A Common Stock are entitled to one vote per share while

holders of Class B Common Stock are entitled to three votes per

share on all matters submitted to a vote of shareholders.

REVENUE RECOGNITION The Company recognizes retail

sales at the time the customer takes possession of the mer-

chandise and purchases are paid for, primarily with either

cash or credit card. Catalogue and e-commerce sales are

recorded upon customer receipt of merchandise. Amounts

relating to shipping and handling billed to customers in a sale

transaction are classified as revenue and the related costs are

classified as cost of goods sold. Employee discounts are clas-

sified as a reduction of revenue. The Company reserves for

sales returns through estimates based on historical experience

and various other assumptions that management believes to

be reasonable.

CATALOGUE AND ADVERTISING COSTS Costs related to the

A&F Quarterly, a catalogue/magazine, primarily consist of cata-

logue production and mailing costs and are expensed as

incurred. Advertising costs consist of in-store photographs and

advertising in selected national publications and are expensed

when the photographs or publications first appear. Catalogue

and advertising costs amounted to $33.4 million in 2002, $30.7

million in 2001 and $30.4 million in 2000.

STORE PREOPENING EXPENSES Preopening expenses relat-

ed to new store openings are charged to operations as incurred.

FAIR VALUE OF FINANCIAL INSTRUMENTS The recorded

values of current assets and current liabilities, including receiv-

ables, marketable securities and accounts payable, approximate

fair value due to the short maturity and because the average

interest rate approximates current market origination rates.

STOCK-BASED COMPENSATION The Company reports stock-

based compensation through the disclosure-only requirements of

SFAS No. 123, “Accounting for Stock-Based Compensation,” as

amended by SFAS No. 148, “Accounting for Stock-Based

Compensation–Transition and Disclosure–an Amendment to

FASB No. 123,” but elects to measure compensation expense

using the intrinsic value method in accordance with Accounting

Principles Board Opinion No. 25, “Accounting for Stock Issued to

Employees.” Accordingly, no compensation expense for options

has been recognized as all options are granted at fair market value

at the grant date. The Company does recognize compensation

expense related to restricted share awards. If compensation

expense related to options had been determined based on the esti-

mated fair value of options granted in 2002, 2001 and 2000,

consistent with the methodology in SFAS No. 123, the pro forma

effect on net income and net income per basic and diluted share

would have been as follows:

(Thousands except per share amount) 2002 2001 2000

Net Income:

As reported $194,935 $168,672 $158,133

Stock-based compensation expense

included in reported net income, net of tax 1,414 2,401 2,626

Stock-based compensation expense

determined under fair value based method,

net of tax(1) (25,979) (22,453) (21,706)

Pro forma $170,370 $148,620 $139,053

Basic earnings per share:

As reported $1.99 $1.70 $1.58

Pro forma $1.74 $1.50 $1.39

Diluted earnings per share:

As reported $1.94 $1.65 $1.55

Pro forma $1.73 $1.48 $1.38

(1) Includes stock-based compensation expense related to restricted share awards actually

recognized in earnings in each period presented.

The pro forma effect on net income for 2002, 2001 and 2000

is not representative of the pro forma effect on net income in

future years because it takes into consideration pro forma com-

pensation expense related only to those grants made subsequent

to May 19, 1998.

The weighted-average fair value of all options granted during fis-

cal 2002, 2001 and 2000 was $12.07, $14.96 and $8.90, respectively.

19