Abercrombie & Fitch 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

was modified to more closely reflect interim liabilities under the

annualization method. In addition, the favorable impact of the

Company’s stock-based compensation was significantly reduced

reflecting the lower stock prices during 2002 as compared to 2001.

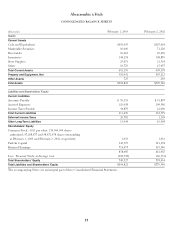

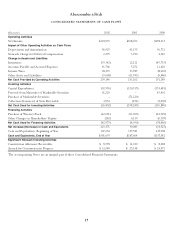

Net deferred income taxes increased in 2002 primarily as a

result of increasing differences between book and tax depreciation

methods due to the accelerated growth of store openings the past

few years and “bonus” accelerated depreciation allowed under

the Job Creation and Worker Assistance Act of 2002.

Inventories increased $35.3 million during 2002 and represented

the primary use of cash. Inventories at fiscal 2002 year-end were 12%

higher on a gross square foot basis versus fiscal 2001 year-end.

Other uses of cash were directly related to store growth and pri-

marily consisted of increases in capitalized store supplies and

prepaid rent related to stores (classified in other current assets).

The Company’s operations are seasonal in nature and typically

peak during the back-to-school and Christmas selling periods.

Accordingly, cash requirements for inventory expenditures are

highest during these periods.

Cash outflows related to investing activities were primarily for

capital expenditures (see the discussion in the “Capital

Expenditures” section below) related to new stores (net of con-

struction allowances) with approximately $20 million invested

in information technology and distribution center projects.

Investing activities also included purchases and maturities of mar-

ketable securities. As of February 1, 2003, the Company held

marketable securities with original maturities of three to five

months. The decrease in note receivable resulted from the repay-

ment of a promissory note by the Chairman (see Note 9 to the

Consolidated Financial Statements).

Financing activities during 2002, 2001 and 2000 consisted pri-

marily of the repurchase of 1,850,000 shares, 600,000 shares, and

3,550,000 shares, respectively, of A&F’s Class A Common Stock

pursuant to previously authorized stock repurchase programs.

The 2002 repurchase completed a previously authorized

6,000,000 share repurchase program. At its August 2002 Board

meeting, the Board of Directors authorized the repurchase of an

additional 5,000,000 shares of the Company’s Class A Common

Stock. As of February 1, 2003, the total number of shares autho-

rized and available for repurchase was 5,000,000. In addition to

stock repurchases, financing activities also consisted of stock

option exercises and restricted stock issuances.

During the first nine months of 2002, the Company had avail-

able a $150 million syndicated unsecured credit agreement. The

Company also had a $75 million facility for trade letters of credit.

The trade letters of credit were issued to numerous overseas sup-

pliers and served as guarantees to the suppliers.

Effective November 14, 2002, the Company entered into a

new $250 million syndicated unsecured credit agreement (the

“New Credit Agreement”), which replaced both the then existing

credit agreement (the “Old Credit Agreement”) and the trade let-

ter of credit facility. Additional details regarding the New Credit

Agreement can be found in the Notes to Consolidated Financial

Statements (see note 8).

Letters of credit totaling approximately $41.8 million were

outstanding under the New Credit Agreement at February 1,

2003. Letters of credit totaling approximately $49.9 million were

outstanding under the trade letter of credit facility at February 2,

2002. No borrowings were outstanding under the New Credit

Agreement at February 1, 2003 or under the Old Credit Agreement

at February 2, 2002.

The Company has standby letters of credit in the amount of $4.7

million that expire in one year. The beneficiary, a merchandise

supplier, has the right to draw upon the standby letters of credit

if the Company has authorized or filed a voluntary petition in

bankruptcy. To date, the beneficiary has not drawn upon the

standby letters of credit.

As of February 1, 2003, the Company was committed to

noncancelable leases with remaining terms of one to fourteen

years. These commitments include store leases with initial

terms ranging primarily from ten to fifteen years. A summary

of minimum rent commitments under noncancelable leases

follows (dollars in thousands):

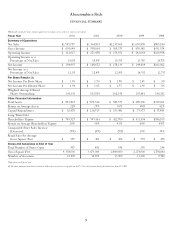

Payments Due by Period

Total Less than 1 Year 1-3 Years 4-5 Years After 5 Years

$889,328 $120,313 $352,910 $186,434 $229,671

9