Abercrombie & Fitch 2002 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2002 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

current year’s fourth quarter. This improvement was offset some-

what by a higher general, administrative and store operating

expense rate.

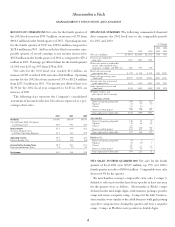

FISCAL 2002 The operating income rate for the fiscal year 2002

was 19.6% versus 19.9% in fiscal year 2001. The decline was

attributable to a higher general, administrative and store oper-

ating expense rate due to the inability to leverage fixed costs on

a comp store decrease. The increased expense rate was partially

offset by a gross income rate increase.

FOURTH QUARTER 2001 AND FISCAL 2001 The operating

income rate was 27.6% and 19.9% for the fourth quarter and fis-

cal year of 2001, respectively, compared to 28.2% and 20.5% for

the same periods in 2000. The decline in operating income rate

in these periods was primarily due to lower gross income per-

centages resulting from planned promotional strategies

executed in the fourth quarter of 2001. Lower general, admin-

istrative and store operating expenses, expressed as a percentage

of net sales, partially offset the lower gross income rate in the

fourth quarter of 2001. For the year, higher general, adminis-

trative and store operating expenses, expressed as a percentage

of net sales, added to the decrease in operating income rate.

INTEREST INCOME AND INCOME TAXES Fourth quarter and

year-to-date net interest income were $1.3 and $3.8 million in 2002

as compared with net interest income of $1.2 and $5.1 million for

the comparable periods in 2001. The decrease in net interest

income in the year-to-date period was a result of the Company’s

strategy at the beginning of 2002 to invest cash in tax-free secu-

rities due to the decline in short-term market interest rates.

Previously, the Company primarily invested in the commercial

paper market.

The tax-free investments contributed to a lower effective tax

rate of 38.5% and 38.4% for the fourth quarter and year-to-date

periods of 2002 as compared to 39.0% for both of 2001’s compa-

rable periods.

Net interest income was $1.2 million in the fourth quarter of

2001 and $5.1 million for the 2001 fiscal year compared with net

interest income of $2.5 million and $7.8 million for the corre-

sponding periods in 2000. The decrease in net interest income for

both the quarter and the year was due to the decline in market

interest rates. Net interest income in 2001 and 2000 was primarily

from short-term investments.

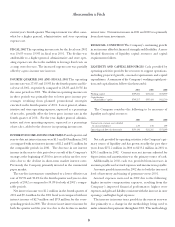

FINANCIAL CONDITION The Company's continuing growth

in net income affords it financial strength and flexibility. A more

detailed discussion of liquidity, capital resources and capital

requirements follows.

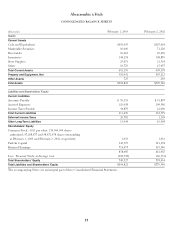

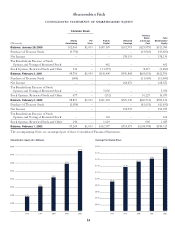

LIQUIDITY AND CAPITAL RESOURCES Cash provided by

operating activities provides the resources to support operations,

including projected growth, seasonal requirements and capital

expenditures. A summary of the Company’s working capital posi-

tion and capitalization follows (in thousands):

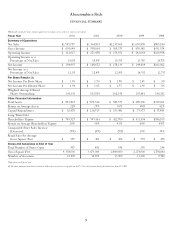

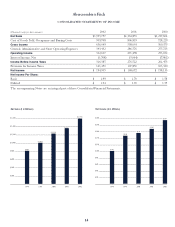

2002 2001 2000

Working capital $389,686 $241,616 $146,939

Capitalization:

Shareholders’ equity $749,527 $595,434 $422,700

The Company considers the following to be measures of

liquidity and capital resources:

2002 2001 2000

Current ratio (current assets divided

by current liabilities) 2.84 2.48 1.94

Operating cash flow (in thousands) $293,146 $232,202 $151,189

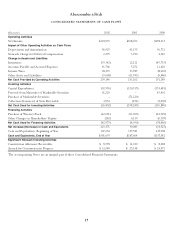

Net cash provided by operating activities is the Company’s pri-

mary source of liquidity and has grown steadily the past three

years from $151.2 million in 2000 to $233.2 million in 2001 to

$293.1 million in 2002. Current year net income adjusted for

depreciation and amortization was the primary source of cash.

Additionally, in 2002, cash was provided from increases in

accounts payable and accrued expenses and income taxes payable.

Accounts payable increased in 2002 due to both the increased

level of inventory and timing of payments versus 2001.

Accrued expenses increased in 2002 due to the following:

higher incentive compensation expenses, resulting from the

Company’s improved financial performance; higher store

expenses and gift card liability, consistent with the increase in store

openings; and higher legal expenses.

The increase in income taxes payable in the current year was

due primarily to a change in the methodology being used to

make estimated tax payments throughout 2002. This methodology

8