Abercrombie & Fitch 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

certain affiliated persons) will be entitled to purchase, upon

exercise of the Right, shares of Common Stock having a mar-

ket value two times the exercise price of the Right. At any time

after any person becomes an Acquiring Person (but before any

person becomes the beneficial owner of 50% or more of the out-

standing shares), A&F’s Board of Directors may exchange all or

part of the Rights (other than Rights beneficially owned by an

Acquiring Person and certain affiliated persons) for shares of

Common Stock at an exchange ratio of one share of Common

Stock per Right. In the event that, at any time following the

Share Acquisition Date, A&F is acquired in a merger or other

business combination transaction in which A&F is not the sur-

viving corporation, the Common Stock is exchanged for other

securities or assets or 50% or more of A&F’s assets or earning

power is sold or transferred, the holder of a Right will be enti-

tled to buy, for the exercise price of the Rights, the number of

shares of Common Stock of the acquiring company which at

the time of such transaction will have a market value of two

times the exercise price of the Right.

The Rights, which do not have any voting rights, expire on

July 16, 2008, and may be redeemed by A&F at a price of $.01

per whole Right at any time before a person becomes an

Acquiring Person.

Rights holders have no rights as a shareholder of A&F,

including the right to vote and to receive dividends.

14. QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized quarterly financial results for 2002 and 2001 fol-

low (thousands except per share amounts):

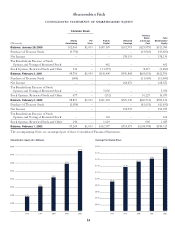

2002 Quarter First Second Third Fourth

Net sales $312,792 $329,154 $419,329 $534,482

Gross income 114,429 131,874 166,736 243,010

Net income 23,289 31,141 47,687 92,818

Net income per basic share $.24 $.32 $.49 $.95

Net income per diluted share $.23 $.31 $.48 $.93

2001 Quarter First Second Third Fourth

Net sales $263,680 $280,116 $354,473 $466,584

Gross income 97,840 108,327 143,403 208,464

Net income 20,603 25,038 43,863 79,168

Net income per basic share $.21 $.25 $.44 $.80

Net income per diluted share $.20 $.24 $.43 $.78

MARKET PRICE INFORMATION A&F’s Class A Common Stock

is traded on the New York Stock Exchange under the symbol

“ANF.” The following is a summary of the high and low sales

prices of A&F’s Class A Common Stock as reported on the New

York Stock Exchange for the 2002 and 2001 fiscal years:

Sales Price

High Low

2002 Fiscal Year

4th Quarter $27.84 $17.76

3rd Quarter $25.18 $15.92

2nd Quarter $33.00 $20.51

1st Quarter $33.30 $23.04

2001 Fiscal Year

4th Quarter $30.40 $18.06

3rd Quarter $38.50 $16.21

2nd Quarter $47.50 $33.10

1st Quarter $37.90 $26.28

A&F has not paid dividends on its shares of Class A Common

Stock in the past and does not presently plan to pay dividends on

the shares. It is presently anticipated that earnings will be

retained and reinvested to support the growth of the Company’s

business. The payment of any future dividends on shares will be

determined by the A&F Board of Directors in light of conditions

then existing, including earnings, financial condition and capi-

tal requirements, restrictions in financing agreements, business

conditions and other factors.

On March 27, 2003, there were approximately 5,000 share-

holders of record. However, when including active associates

who participate in A&F’s stock purchase plan, associates who

own shares through A&F-sponsored retirement plans and others

holding shares in broker accounts under street name, A&F esti-

mates the shareholder base at approximately 55,000.

Abercrombie &Fitch

25