Abercrombie & Fitch 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

Employee discounts are classified as a reduction of revenue. The

Company reserves for sales returns through estimates based on his-

torical experience and various other assumptions that management

believes to be reasonable.

Inventory Valuation – Inventories are principally valued at the

lower of average cost or market, on a first-in first-out basis, utilizing

the retail method. The retail method of inventory valuation is an

averaging technique applied to different categories of inventory. At

A&F, the averaging is determined at the stock keeping unit (SKU)

level by averaging all costs for each SKU. An initial markup is

applied to inventory at cost in order to establish a cost-to-retail ratio.

Permanent markdowns, when taken, reduce both the retail and cost

components of inventory on hand so as to maintain the already

established cost–to-retail relationship. The use of the retail method

and the recording of markdowns effectively values inventory at the

lower of cost or market. The Company further reduces inventory

by recording an additional markdown reserve using the retail

carrying value of inventory from the season just passed.

Markdowns on this carryover inventory represent estimated

future anticipated selling price declines. Additionally, as part of

inventory valuation, an inventory shrinkage estimate is made

each period that reduces the value of inventory for lost or stolen

items. Inherent in the retail method calculation are certain sig-

nificant judgments and estimates including, among others, initial

markup, markdowns and shrinkage, which could significantly

impact the ending inventory valuation at cost as well as the result-

ing gross margins. Management believes that this inventory

valuation method provides a conservative inventory valuation as

it preserves the cost-to-retail relationship in ending inventory.

Property and Equipment – Depreciation and amortization of

property and equipment are computed for financial reporting pur-

poses on a straight-line basis, using service lives ranging principally

from 10-15 years for leasehold improvements and 3-10 years for

other property and equipment. Beneficial leaseholds represent the

present value of the excess of fair market rent over contractual rent

of existing stores at the 1988 purchase of the Abercrombie &

Fitch business by The Limited, Inc. (now known as Limited

Brands, Inc., “The Limited”) and are being amortized over the

lives of the related leases. The cost of assets sold or retired and the

related accumulated depreciation or amortization are removed

from the accounts with any resulting gain or loss included in net

income. Maintenance and repairs are charged to expense as

incurred. Major renewals and betterments that extend service

lives are capitalized. Long-lived assets are reviewed at the store

level at least annually for impairment or whenever events or

changes in circumstances indicate that full recoverability is ques-

tionable. Factors used in the evaluation include, but are not

limited to, management’s plans for future operations, recent

operating results and projected cash flows.

Income Taxes – Income taxes are calculated in accordance with

SFAS No. 109, "Accounting for Income Taxes,” which requires the

use of the liability method. Deferred tax assets and liabilities are

recognized based on the difference between the financial statement

carrying amounts of existing assets and liabilities and their respec-

tive tax bases. Inherent in the measurement of deferred balances

are certain judgments and interpretations of enacted tax law and

published guidance with respect to applicability to the Company’s

operations. Significant examples of this concept include capital-

ization policies for various tangible and intangible costs, income

and expense recognition and inventory valuation methods. No val-

uation allowance has been provided for deferred tax assets because

management believes the full amount of the net deferred tax assets

will be realized in the future. The effective tax rate utilized by the

Company reflects management’s judgment of the expected tax lia-

bilities within the various taxing jurisdictions.

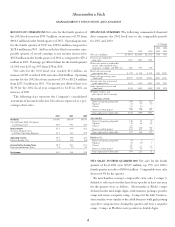

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

The Financial Accounting Standards Board (“FASB”) issued

Statement of Financial Accounting Standards (“SFAS”) No. 142,

“Goodwill and Other Intangible Assets.” The standard was effec-

tive February 3, 2002 for the Company. SFAS No. 142 addresses

how intangible assets that are acquired individually or with a

group of other assets should be accounted for in financial state-

ments upon their acquisition. It also addresses how goodwill and

other intangible assets should be accounted for after they have been

initially recognized in the financial statements. The adoption of

SFAS No. 142 did not have an impact on the Company’s results

of operations or its financial position in 2002.

SFAS No. 143, “Accounting for Asset Retirement Obligations,”

was effective February 2, 2003 for the Company. The standard

requires entities to record the fair value of a liability for an asset

retirement obligation in the period in which it is a cost by increas-

ing the carrying amount of the related long-lived asset. Over time,

the liability is accreted to its present value each period, and the

11