Abercrombie & Fitch 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

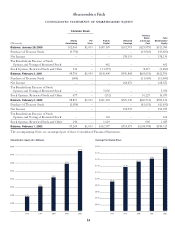

2001

Outstanding at beginning of year 12,994,000 $28.01

Granted 648,000 29.38

Exercised (521,000) 15.00

Canceled (160,000) 24.09

Outstanding at end of year 12,961,000 $28.65

Options exercisable at year-end 3,065,000 $18.49

2000

Outstanding at beginning of year 12,809,000 $28.03

Granted 1,414,000 17.25

Exercised (193,000) 14.57

Canceled (1,036,000) 16.06

Outstanding at end of year 12,994,000 $28.01

Options exercisable at year-end 2,164,000 $16.13

A total of 1,046,000, 19,000 and 102,000 restricted shares were

granted in 2002, 2001 and 2000, respectively, with a total market

value at grant date of $28.0 million, $.6 million and $2.3 million,

respectively. Of the restricted shares granted in 2002, 1,000,000

shares were awarded to the Company’s Chairman, which become

vested on December 31, 2008 provided the Chairman remains

continuously employed by the Company through such date. The

remaining restricted share grants generally vest either on a gradu-

ated scale over four years or 100% at the end of a fixed vesting

period, principally five years. The market value of restricted

shares is being amortized as compensation expense over the vest-

ing period, generally four to five years. Compensation expenses

related to restricted share awards amounted to $2.3 million, $3.9

million and $4.3 million in 2002, 2001 and 2000, respectively.

11. RETIREMENT BENEFITS The Company participates in a

qualified defined contribution retirement plan and a nonqual-

ified supplemental retirement plan. Participation in the

qualified plan is available to all associates who have complet-

ed 1,000 or more hours of service with the Company during

certain 12-month periods and attained the age of 21.

Participation in the nonqualified plan is subject to service and

compensation requirements. The Company’s contributions to

these plans are based on a percentage of associates’ eligible

annual compensation. The cost of these plans was $5.6 mil-

lion in 2002, $3.9 million in 2001 and $3.0 million in 2000.

Effective February 2, 2003, the Company established a

Supplemental Executive Retirement Plan to provide additional

retirement income to its Chairman. Subject to service require-

ments, the Chairman will receive a monthly prorated share of

his final average compensation (as defined in the Plan) for life.

Abercrombie &Fitch

12. CONTINGENCIES The Company is involved in a number

of legal proceedings. Although it is not possible to predict with

any certainty the eventual outcome of any legal proceedings, it is

the opinion of management that the ultimate resolution of these

matters will not have a material impact on the Company’s

results of operations, cash flows or financial position.

The Company has standby letters of credit in the amount of

$4.7 million that expire in 1 year. The beneficiary, a merchan-

dise supplier, has the right to draw upon the standby letters of

credit if the Company has authorized or filed a voluntary peti-

tion in bankruptcy. To date, the beneficiary has not drawn

upon the standby letters of credit

The Company enters into agreements with professional

services firms, in the ordinary course of business and, in

most agreements, indemnifies these firms from any harm.

There is no financial impact on the Company related to these

indemnifications.

13. PREFERRED STOCK PURCHASE RIGHTS On July 16,

1998, A&F’s Board of Directors declared a dividend of .50 of a

Series A Participating Cumulative Preferred Stock Purchase

Right (Right) for each outstanding share of Class A Common

Stock, par value $.01 per share (Common Stock), of A&F. The

dividend was paid to shareholders of record on July 28, 1998.

Shares of Common Stock issued after July 28, 1998 and prior to

the Distribution Date described below will be issued with a

Right attached. Under certain conditions, each whole Right

may be exercised to purchase one one-thousandth of a share of

Series A Participating Cumulative Preferred Stock at an initial

price of $250. The Rights initially will be attached to the shares

of Common Stock. The Rights will separate from the Common

Stock and a Distribution Date will occur upon the earlier of 10

business days after a public announcement that a person or

group has acquired beneficial ownership of 20% or more of

A&F’s outstanding shares of Common Stock and become an

“Acquiring Person” (Share Acquisition Date) or 10 business

days (or such later date as the Board shall determine before any

person has become an Acquiring Person) after commencement

of a tender or exchange offer which would result in a person or

group beneficially owning 20% or more of A&F’s outstanding

Common Stock. The Rights are not exercisable until the

Distribution Date.

In the event that any person becomes an Acquiring Person,

each holder of a Right (other than the Acquiring Person and

24