Abercrombie & Fitch 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

not that the full amount of the net deferred tax assets will be

realized in the future.

8. LONG-TERM DEBT The Company entered into a $250 mil-

lion syndicated unsecured credit agreement (the “New Credit

Agreement”) on November 14, 2002 to replace both a $150 mil-

lion syndicated unsecured credit agreement (the “Old Credit

Agreement”) and a separate $75 million facility for the issuance

of trade letters of credit. The primary purposes of the New

Credit Agreement are for trade and stand-by letters of credit and

working capital. The New Credit Agreement is due to expire on

November 14, 2005. The New Credit Agreement has several bor-

rowing options, including interest rates that are based on the agent

bank’s “Alternate Base Rate,” or a LIBO Rate. Facility fees

payable under the New Credit Agreement are based on the

Company’s ratio (the “leverage ratio”) of the sum of total debt plus

800% of forward minimum rent commitments to EBITDAR for

the trailing four-fiscal-quarter period and currently accrues at

.225% of the committed amounts per annum. The New Credit

Agreement contains limitations on indebtedness, liens, sale-

leaseback transactions, significant corporate changes including

mergers and acquisitions with third parties, investments, restricted

payments (including dividends and stock repurchases), hedging

transactions and transactions with affiliates. The New Credit

Agreement also contains financial covenants requiring a mini-

mum ratio of EBITDAR for the trailing four-fiscal-quarter period

to the sum of interest expense and minimum rent for such period,

as well as a maximum leverage ratio. Letters of credit totaling

approximately $41.8 million were outstanding under the New

Credit Agreement at February 1, 2003. Letters of credit totaling

approximately $49.9 million were outstanding under the $75

million facility for the issuance of trade letters of credit at February

2, 2002. No borrowings were outstanding under the New Credit

Agreement at February 1, 2003 or under the Old Credit

Agreement at February 2, 2002.

9. RELATED PARTY TRANSACTIONS Shahid & Company, Inc.

has provided advertising and design services for the Company

since 1995. Sam N. Shahid Jr., who serves on A&F’s Board of

Directors, has been President and Creative Director of Shahid

& Company, Inc. since 1993. Fees paid to Shahid & Company,

Inc. for services provided during fiscal years 2002, 2001 and

2000 were approximately $1.9 million, $1.8 million and $1.7

million, respectively. These amounts do not include reimburse-

ments to Shahid & Company, Inc. for expense incurred while per-

forming these services.

On January 1, 2002, A&F loaned the amount of $4,953,833 to

its Chairman, a major shareholder of A&F, pursuant to the

terms of a replacement promissory note, which provided that

such amount was due and payable on December 31, 2002. The

outstanding principal under the note did not bear interest as the

net sales threshold, per the terms of the note, was met. This note

was paid in full by the Chairman on December 31, 2002.

This note constituted a replacement of, and substitute for, sev-

eral promissory notes dating from November 17, 1999 through

May 18, 2001.

10. STOCK OPTIONS AND RESTRICTED SHARES Under A&F’s

stock plans, associates and non-associate directors may be granted

up to a total of 21.4 million restricted shares and options to pur-

chase A&F’s common stock at the market price on the date of

grant. In 2002, associates of the Company were granted options

covering approximately 3.5 million shares, with vesting periods

from four to five years. Options covering a total of 44,000 shares

were granted to non-associate directors in 2002, all of which vest

over four years. All options have a maximum term of ten years.

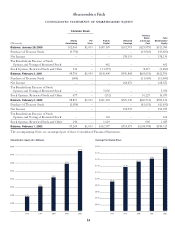

Options Outstanding at February 1, 2003

Options Outstanding Options Exercisable

Weighted–

Average Weighted– Weighted–

Range of Remaining Average Average

Exercise Number Contractual Exercise Number Exercisable

Prices Outstanding Life Price Exercisable Price

$8-$23 4,304,000 5.2 $12.98 2,575,000 $12.01

$23-$38 6,596,000 7.7 $26.40 1,713,000 $26.29

$38-$52 5,159,000 6.5 $43.54 268,000 $41.19

$8-$52 16,059,000 6.6 $28.31 4,556,000 $19.10

A summary of option activity for 2002, 2001 and 2000 follows:

Number of Weighted–Average

2002 Shares Option Price

Outstanding at beginning of year 12,961,000 $28.65

Granted 3,583,000 26.53

Exercised (93,000) 16.44

Canceled (392,000) 26.31

Outstanding at end of year 16,059,000 $28.31

Options exercisable at year-end 4,556,000 $19.10

23