Abercrombie & Fitch 1997 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1997 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company increased 24%, driven principally by an increase in

the number of transactions per store.

Net sales for 1996 increased 42% to $335.4 million over the

fifty-three week 1995 fiscal year. The sales increase was

attributable to the net addition of 27 stores and a 13% compara-

ble store sales increase. Consistent with the Company’s strategy,

the women’s business continued to increase as a proportion of

the total business, with sweaters and pants the strongest

performing categories. The men’s business also achieved signif-

icant growth with its strongest categories being sweaters, pants

and denim. Net sales per selling square foot for the total

Company increased 5%.

GROSS INCOME Gross income increased, expressed as a per-

centage of net sales, to 45.4% for the fourth quarter of 1997 from

43.0% for the same period in 1996. The increase was attributable

to improved merchandise margins (representing gross income

before the deduction of buying and occupancy costs) resulting from

higher initial markups (IMU) and a lower markdown rate. As a

result of improved inventory turnover, fewer markdowns, expressed

as a percentage of net sales, were needed in the fourth quarter of

1997 to clear season-end merchandise as compared to the same

period in 1996.

Gross income increased, expressed as a percentage of net

sales, to 43.0% for the fourth quarter of 1996 from 37.4% for the

same period in 1995. The increase was due to a significant

increase in merchandise margins and a reduction in buying and

occupancy costs, expressed as a percentage of net sales. The

increase in merchandise margins was the result of higher IMU.

The decrease in buying and occupancy costs was primarily

attributable to higher sales productivity associated with the 8%

increase in comparable store sales.

For the year, the gross income rate increased to 38.5% in

1997 from 36.9% in 1996. The improvement was the result of

higher merchandise margins, expressed as a percentage of net

sales. Improved IMU in both the men’s and women’s busi-

nesses drove the increase in merchandise margins. Buying and

occupancy costs, expressed as a percentage of net sales,

declined slightly due to leverage achieved from comparable

store sales increases.

In 1996, the gross income rate increased to 36.9% from 33.9%

in 1995. Merchandise margins, expressed as a percentage of net

17

Abercrombie &Fitch Co.

sales, improved due to a higher IMU in both the men’s and

women’s businesses. Buying and occupancy costs, expressed as

a percentage of net sales, declined due to a 13% increase in

comparable store sales, including a 5% increase in net sales per

selling square foot.

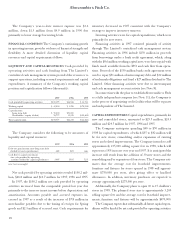

GENERAL, ADMINISTRATIVE AND STORE OPERATING

EXPENSES General, administrative and store operating

expenses, expressed as a percentage of net sales, were 17.5%

in the fourth quarter of 1997 and 17.6% in the comparable

period in 1996. The improvement resulted primarily from

favorable leveraging of expenses due to higher sales volume.

Included in these expenses for the fourth quarter of 1997 was

approximately $2.6 million of compensation expense associated

with restricted stock grants awarded to key executives of

the Company.

For the year, general, administrative and store operating

expenses, expressed as a percentage of net sales, were 22.4%,

23.2% and 23.8% for 1997, 1996 and 1995. The improvement

during the three-year period resulted from management’s

continued emphasis on expense control and favorable lever-

aging of expenses, primarily stores expenses, due to higher

sales volume.

OPERATING INCOME Operating income, expressed as a per-

centage of net sales, was 27.9%, 25.4% and 19.8% for the fourth

quarter of 1997, 1996 and 1995 and 16.1%, 13.7% and 10.1% for

fiscal years 1997, 1996 and 1995. The improvement was the

result of higher merchandise margins coupled with lower general,

administrative and store operating expenses, expressed as a per-

centage of net sales. Sales volume and gross income have increased

at a faster rate than general, administrative and store operating

expenses as the Company continues to emphasize cost controls.

INTEREST EXPENSE Fourth quarter 1997 net interest expense

of $305 thousand improved $820 thousand from 1996 fourth

quarter net interest expense of $1.1 million. Interest expense in

the fourth quarter of 1997 and 1996 included $975 thousand

associated with $50 million of long-term debt. The balance rep-

resented net interest income from temporary investments in the

fourth quarter of 1997, while net interest expense in the fourth

quarter of 1996 was primarily due to higher borrowing levels.