Abercrombie & Fitch 1997 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1997 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

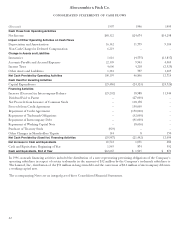

inventory decreased in 1997 consistent with the Company’s

strategy to improve inventory turnover.

Investing activities were for capital expenditures, which were

primarily for new stores.

Financing activities in 1997 consisted primarily of activity

through The Limited’s centralized cash management system.

Financing activities in 1996 include $150 million in proceeds

from borrowings under a bank credit agreement, which, along

with the $8.6 million working capital note, were later repaid with

funds made available from the IPO and cash flow from opera-

tions. Proceeds of the $150 million bank credit agreement were

used to repay $91 million of intercompany debt and $32 million

of trademark obligations and fund a $27 million dividend to The

Limited. Other financing activities were due to intercompany

and cash management account activity (see Note 8).

In connection with the plan to establish Abercrombie & Fitch

as a fully independent company (see Note 11), the Company is

in the process of negotiating credit facilities that will be separate

and independent of The Limited.

CAPITAL EXPENDITURES Capital expenditures, primarily for

new and remodeled stores, amounted to $29.5 million, $24.3

million and $24.5 million for 1997, 1996 and 1995.

The Company anticipates spending $40 to $50 million in

1998 for capital expenditures, of which $35 to $42 million will

be for new stores, remodeling and/or expansion of existing

stores and related improvements. The Company intends to add

approximately 235,000 selling square feet in 1998, which will

represent a 19% increase over year end 1997. It is anticipated the

increase will result from the addition of 30 new stores and the

remodeling and/or expansion of four stores. The Company esti-

mates that the average cost for leasehold improvements,

furniture and fixtures for stores opened in 1998 will approxi-

mate $750,000 per store, after giving effect to landlord

allowances. In addition, inventory purchases are expected to

average approximately $275,000 per store.

Additionally, the Company plans to open 10 to 15 children’s

stores in 1998. The planned store size is approximately 3,200

selling square feet and the average cost for leasehold improve-

ments, furniture and fixtures will be approximately $470,000.

The Company expects that substantially all future capital expen-

ditures will be funded by net cash provided by operating activities.

18

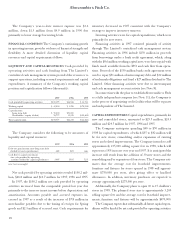

The Company’s year-to-date interest expense was $3.6

million, down $1.3 million from $4.9 million in 1996 due

primarily to lower average borrowing levels.

FINANCIAL CONDITION The Company’s continuing growth

in operating income provides evidence of financial strength and

flexibility. A more detailed discussion of liquidity, capital

resources and capital requirements follows.

LIQUIDITY AND CAPITAL RESOURCES Cash provided by

operating activities and cash funding from The Limited’s

centralized cash management system provided the resources to

support operations, including seasonal requirements and capital

expenditures. A summary of the Company’s working capital

position and capitalization follows (thousands):

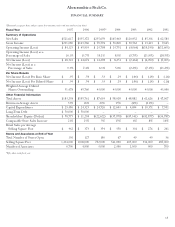

1997 1996 1995

Cash provided by operating activities $100,195 $46,836 $(12,714

Working capital $042,000 $01,288 $(70,940)

Capitalization:

Long-term debt $050,000 $50,000 $,000,0–

Shareholders’ equity (deficit) 058,775 11,238 $(22,622)

Total capitalization $108,775 $61,238 $(22,622)

The Company considers the following to be measures of

liquidity and capital resources:

1997 1996 1995

Debt-to-capitalization ratio (long-term debt

divided by total capitalization) 46% 82% n/m

Cash flow to capital investment

(net cash provided by operating

activities divided by capital expenditures) 340% 193% 52%

n/m=not meaningful

Net cash provided by operating activities totaled $100.2 mil-

lion, $46.8 million and $12.7 million for 1997, 1996 and 1995.

In 1997, the $100.2 million net cash provided by operating

activities increased from the comparable period last year due

primarily to the increase in net income before depreciation and

amortization. Accounts payable and accrued expenses in-

creased in 1997 as a result of the increases of $7.8 million in

merchandise payables due to the timing of receipts for Spring

goods and $2.3 million of accrued rent. Cash requirements for

Abercrombie &Fitch Co.