Abercrombie & Fitch 1997 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1997 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

Abercrombie &Fitch Co.

Deferred tax assets and liabilities are measured using enacted

tax rates in effect in the years in which those temporary differ-

ences are expected to reverse. Under SFAS No. 109, the effect on

deferred taxes of a change in tax rates is recognized in income

in the period that includes the enactment date.

The Company is included in The Limited’s consolidated

federal and certain state income tax groups for income tax

reporting purposes and is responsible for its proportionate share

of income taxes calculated upon its federal taxable income at a

current estimate of the annual effective tax rate.

SHAREHOLDERS’ EQUITY At January 31, 1998, there were

150 million of $.01 par value Class A shares authorized, of

which 8.01 million and 8.05 million shares were outstanding

at January 31, 1998 and February 1, 1997 and 150 million of

$.01 par value of Class B shares authorized, of which 43 million

shares were issued and outstanding. In addition, there were

15 million of $.01 par value preferred shares authorized, none

of which have been issued.

Holders of Class A common stock generally have identical

rights to holders of Class B common stock, except that holders

of Class A common stock are entitled to one vote per share

while holders of Class B common stock are entitled to three

votes per share on all matters submitted to a vote of shareholders.

Each share of Class B common stock is convertible while

held by The Limited or any of its subsidiaries into one share of

Class A common stock (see Note 11).

REVENUE RECOGNITION Sales are recorded upon purchase

by customers.

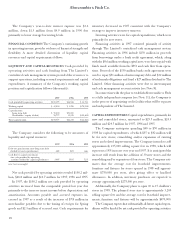

CATALOGUE AND ADVERTISING COSTS Costs related to

the A&F Quarterly, which premiered in 1997, primarily consist of

catalogue production and mailing costs and are expensed as

incurred. Advertising costs consist of in-store photographs and

advertising in selected national publications and are expensed

when the photographs or publications first appear. Catalogue

and advertising costs amounted to $13.7 million in 1997,

$4.1 million in 1996 and $3.1 million in 1995.

STORE PREOPENING EXPENSES Preopening expenses related

to new store openings are charged to operations as incurred.

FAIR VALUE OF FINANCIAL INSTRUMENTS The recorded

values of current assets and current liabilities, including accounts

receivable and accounts payable, approximate fair value due to the

short maturity and because the average interest rate approxi-

mates current market origination rates.

The fair value of the Company’s long-term debt is estimated

based on the quoted market prices for the same or similar issues

or on the current rates offered to the Company for debt of

the same remaining maturity. The estimated fair value of the

Company’s long-term debt was $52.2 million at January 31, 1998

and $50.6 million at February 1, 1997.

EARNINGS PER SHARE Net income per share is computed in

accordance with SFAS No. 128, “Earnings Per Share,” which the

Company adopted in the fourth quarter of 1997. Earnings per basic

share are computed based on the weighted average number of out-

standing common shares. Earnings per diluted share include the

weighted average effect of dilutive stock options and restricted

stock. The common stock issued to The Limited (43 million

Class B shares) in connection with the incorporation of the

Company is assumed to have been outstanding for all periods.

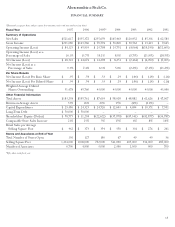

Weighted Average Common Shares Outstanding (thousands):

1997 1996 1995

Common shares issued 51,050 45,749 43,000

Treasury shares (39) – –

Basic shares 51,011 45,749 43,000

Dilutive effect of options and

restricted shares 467 11 –

Diluted shares 51,478 45,760 43,000

Options to purchase 228,000 and 240,000 shares of common stock were outstanding at

year end 1997 and 1996, but were not included in the computation of earnings per

diluted share because the options’ exercise price was greater than the average market

price of the common shares.