Abercrombie & Fitch 1997 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 1997 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

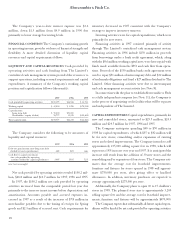

INFORMATION SYSTEMS AND “YEAR 2000” COMPLIANCE

The Company recently completed a comprehensive review of

its information systems and is involved in a program to update

computer systems and applications in preparation for the year

2000. The Company will incur internal staff costs as well as out-

side consulting and other expenditures related to this initiative.

Total expenditures related to remediation, testing, conversion,

replacement and upgrading system applications are expected to

range from $3.0 to $4.0 million from 1997 through 2000. Total

incremental expenses, including depreciation and amortization

of new package systems, remediation to bring current systems into

compliance and writing off legacy systems are not expected to have

a material impact on the Company’s financial condition in any

year during the conversion process from 1997 through 2000.

The Company is attempting to contact vendors and others on

whom it relies to ensure that their systems will be converted in a

timely fashion. However, there can be no assurance that the sys-

tems of other companies on which the Company’s systems rely

will also be converted in a timely fashion or that any such failure

to convert by another company would not have an adverse effect

on the Company’s systems. Furthermore, no assurance can be

given that any or all of the Company’s systems are or will be Year

2000 compliant, or that the ultimate costs required to address the

Year 2000 issue or the impact of any failure to achieve substantial

Year 2000 compliance will not have a material adverse effect on

the Company’s financial condition.

REGISTRATION STATEMENT FOR EXCHANGE OFFER

The Company and The Limited will enter into certain service

agreements upon the consummation of the Exchange Offer (see

Note 11) which will include among other things, tax, information

technology and store design and construction. These agree-

ments generally will be for a term of one year. Service agreements

will also be entered into for the continued use by the Company

of its distribution and home office space and transportation and

logistic services. These agreements generally will be for a term of

three years. Costs for these services will generally be the costs and

expenses incurred by The Limited plus 5% of such amounts.

Upon expiration of these agreements with The Limited, the

Company may bring certain services in-house, contract with

other outside parties or take other actions the Company deems

appropriate at that time.

Abercrombie &Fitch Co.

The Company does not anticipate that costs associated with

these service agreements or costs to be incurred upon their

expiration will have a material impact on its financial condition.

IMPACT OF INFLATION The Company’s results of operations

and financial condition are presented based upon historical

cost. While it is difficult to accurately measure the impact of infla-

tion due to the imprecise nature of the estimates required, the

Company believes that the effects of inflation, if any, on its

results of operations and financial condition have been minor.

ADOPTION OF NEW ACCOUNTING STANDARDS During

the fourth quarter of 1997, the Company adopted Statement of

Financial Accounting Standards (SFAS) No. 128, “Earnings

Per Share” which requires the Company to disclose earnings per

basic and diluted share for all periods presented.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECUR-

ITIES LITIGATION REFORM ACT OF 1995 The Company

cautions that any forward-looking statements (as such term is

defined in the Private Securities Litigation Reform Act of 1995)

contained in this Report, the Company’s Form 10-K or made by

management of the Company involve risks and uncertainties, and

are subject to change based on various important factors. The

following factors, among others, in some cases have affected and

in the future could affect the Company’s financial performance

and actual results and could cause actual results for 1998 and

beyond to differ materially from those expressed or implied in any

such forward-looking statements: changes in consumer spend-

ing patterns, consumer preferences and overall economic

conditions, the impact of competition and pricing, changes in

weather patterns, political stability, currency and exchange risks

and changes in existing or potential duties, tariffs or quotas, avail-

ability of suitable store locations at appropriate terms, ability to

develop new merchandise and ability to hire and train associates.