Abercrombie & Fitch 1997 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1997 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

Abercrombie &Fitch Co.

10. RETIREMENT BENEFITS The Company participates in a

qualified defined contribution retirement plan and a non-

qualified supplemental retirement plan sponsored by The Limited.

Participation in the qualified plan is available to all associates who

have completed 1,000 or more hours of service with the Company

during certain 12-month periods and attained the age of 21.

Participation in the nonqualified plan is subject to service and

compensation requirements. The Company’s contributions to

these plans are based on a percentage of associates’ eligible annual

compensation. The cost of these plans was $1.6 million in 1997,

$753 thousand in 1996 and $564 thousand in 1995.

11. REGISTRATION STATEMENT FOR EXCHANGE OFFER

On February 17, 1998, a registration statement was filed with the

Securities and Exchange Commission in connection with a plan

to establish the Company as a fully independent company via a

tax-free exchange offer pursuant to which The Limited share-

holders will be given an opportunity to exchange shares of The

Limited for shares of the Company. At year end, The Limited

owned 43 million of the Company’s shares.

12. SUBSEQUENT EVENTS (UNAUDITED) On April 15, 1998,

the Company repaid the $50 million unsecured note plus accrued

interest through issuance of 600,000 shares of Class B common

stock to The Limited at $43.125 per share with the remaining bal-

ance of $25 million paid in cash.

On April 30, 1998, the Company entered into a $150 million

unsecured revolving credit agreement (the “Agreement”).

Borrowings under the Agreement are due April 30, 2003. The

Agreement had several borrowing options, including interest rates

which are based on either the lender’s “Alternate Base Rate,” as

defined, a LIBO based rate or at a rate submitted under a bidding

process. Facilities fees payable under the Agreement are based on

the Company’s “Leverage Ratio,” as defined. The Agreement

contains provisions which (i) limit the incurrence of additional

indebtedness and certain other transactions and (ii) limit the pay-

ment of dividends to shareholders. The Agreement also contains

covenants relating to the Company’s interest coverage and debt.

In connection with the registration statement discussed in

Note 11, the exchange offer was completed in May, 1998.

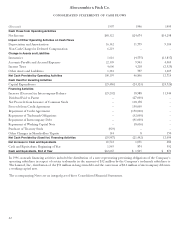

13. QUARTERLY FINANCIAL DATA (UNAUDITED) Summ-

arized quarterly financial results for 1997 and 1996 follow

(thousands except per share amounts):

1997 Quarter First Second Third Fourth

Net sales $74,316 $86,640 $148,516 $212,145

Gross income 23,941 27,786 52,990 96,363

Net income 565 2,053 10,403 35,301

Net income per basic share $.01 $.04 $.20 $.69

Net income per diluted share $.01 $.04 $.20 $.68

1996 Quarter

Net sales $51,020 $57,431 $87,688 $139,233

Gross income 14,894 18,052 30,957 59,863

Net income (loss) (199) 374 3,982 20,517

Net income (loss) per basic share $.00 $.01 $.09 $.40

Net income (loss) per diluted share $.00 $.01 $.09 $.40

MARKET PRICE INFORMATION The following is a summary

of market price since the Company was originally listed on the

New York Stock Exchange (“ANF”) on September 26, 1996:

Market Price

High Low

Fiscal Year End 1997

4th Quarter $3411⁄16 $2511⁄16

3rd Quarter $271⁄4$191⁄4

2nd Quarter $201⁄2$153⁄4

1st Quarter $175⁄8$127⁄8

Fiscal Year End 1996

4th Quarter $233⁄4$125⁄8

3rd Quarter $261⁄4$213⁄4

On January 31, 1998, there were approximately 180 share-

holders of record. However, when including active associates who

participate in the Company’s stock purchase plan, associates who

own shares through Company sponsored retirement plans and

others holding shares in broker accounts under street name, the

Company estimates the shareholder base at approximately 3,300.