Abercrombie & Fitch 1997 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1997 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

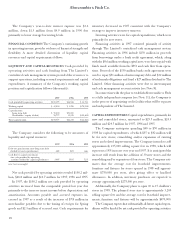

27

Abercrombie &Fitch Co.

The Limited provides certain services to the Company

including, among other things, aircraft, tax, treasury, legal, cor-

porate secretary, accounting, auditing, corporate development,

risk management, associate benefit plan administration, human

resource and compensation, government affairs and public

relation services. Identifiable costs are charged directly to the

Company. All other services-related costs not specifically

attributable to the business have been allocated to the Company

based upon a percentage of sales.

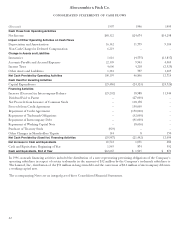

The Company participates in The Limited’s centralized

cash management system whereby cash received from opera-

tions is transferred to The Limited’s centralized cash accounts

and cash disbursements are funded from the centralized cash

accounts on a daily basis. Prior to the initial capitalization of

the Company, the intercompany cash management account

was noninterest bearing. After the initial capitalization of the

Company on July 11, 1996, the intercompany cash manage-

ment account became an interest earning asset or interest

bearing liability of the Company depending upon the level of

cash receipts and disbursements. Interest on the intercompany

cash management account is calculated based on 30-day com-

mercial paper rates for “AA” rated companies as reported in the

Federal Reserve’s H.15 statistical release. The average out-

standing balance of the noninterest bearing intercompany

payable to The Limited in the twenty-six week period ending

August 3, 1996 and fifty-three weeks ended February 3, 1996

approximated $64.5 million and $89.8 million. A summary of

the intercompany payment activity during the noninterest

bearing periods follows:

Twenty-six Fifty-three

weeks ended weeks ended

August 3, 1996 February 3, 1996

Balance at beginning of period $86,045 $74,101

Mast and Gryphon purchases $23,178 35,167

Other transactions with related parties $09,667 33,546

Centralized cash management (16,417) (64,269)

Settlement of current period income taxes $05,700 7,500

Payment to The Limited (91,000) –

Conversion to Working Capital Note (8,616) –

Balance at end of period $08,557 $86,045

The Company is charged rent expense, common area main-

tenance charges and utilities for stores shared with other

consolidated subsidiaries of The Limited. The charges are

based on square footage and represent the proportionate share

of the underlying leases with third parties.

The Company is also charged rent expense and utilities for

the distribution and home office space occupied (which

approximates fair market value).

The Company and The Limited have entered into inter-

company agreements that establish the provision of services

in accordance with the terms described above. The prices

charged to the Company for services provided under these

agreements may be higher or lower than prices that may be

charged by third parties. It is not practicable, therefore, to

estimate what these costs would be if The Limited were not

providing these services and the Company was required to

purchase these services from outsiders or develop internal

expertise. Management believes the charges and allocations

described above are fair and reasonable.

The following table summarizes the related party transac-

tions between the Company and The Limited and its subsidiaries,

for the years indicated (thousands):

1997 1996 1995

Mast and Gryphon purchases $089,892 $61,776 $35,167

Capital expenditures 27,012 20,839 20,280

Inbound and outbound transportation 5,524 3,326 2,869

Corporate charges 6,857 3,989 4,019

Store leases and other occupancy, net 1,184 1,509 1,397

Distribution center, IT and home

office expenses 3,102 2,696 2,564

Centrally managed benefits 3,596 3,136 2,417

Interest charges 3,583 2,190 –

$140,750 $99,461 $68,713

The Company and The Limited are parties to a corporate

agreement under which the Company granted to The Limited a

continuing option to purchase, under certain circumstances,

additional shares of Class B common stock or shares of nonvot-

ing capital stock of the Company.