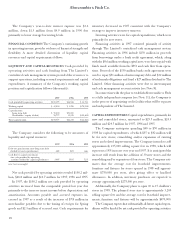

Abercrombie & Fitch 1997 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1997 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

Abercrombie &Fitch Co.

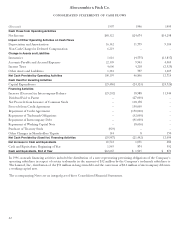

A reconciliation between the statutory Federal income tax

rate and the effective income tax rate follows:

1997 1996 1995

Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of Federal

income tax effect 4.7% 4.7% 5.2%

Other items, net 0.3% 0.2% (0.3)%

40.0% 39.9% 39.9%

Income taxes payable included net current deferred tax assets

of $2.3 million and $1.2 million at January 31, 1998 and

February 1, 1997.

Current income tax obligations are treated as having been set-

tled through the intercompany accounts as if the Company were

filing its income tax returns on a separate company basis. Such

amounts were $27.6 million, $10.6 million and $7.5 million in

1997, 1996 and 1995.

The effect of temporary differences which give rise to

net deferred income tax assets was as follows (thousands):

1997 1996

Depreciation and amortization $1,540 $1,480

Rent 1,510 (413)

Accrued expenses 3,450 1,343

Other, net (450) 683

Total deferred income taxes $6,050 $3,093

No valuation allowance has been provided for deferred tax

assets because management believes that it is more likely than

not that the full amount of the net deferred tax assets will be

realized in the future.

7. LONG-TERM DEBT Long-term debt consists of a 7.80%

unsecured note in the amount of $50 million that matures May

15, 2002, and represents the Company’s proportionate share of

certain long-term debt of The Limited. The interest rate and

maturity of the note parallels that of corresponding debt of

The Limited. The note is to be automatically prepaid concurrently

with any prepayment of the corresponding debt of The Limited.

8. RELATED PARTY TRANSACTIONS Transactions between

the Company, The Limited, and its subsidiaries and affiliates

commonly occur in the normal course of business and principally

consist of the following:

Merchandise purchases

Real estate management and leasing

Capital expenditures

Inbound and outbound transportation

Corporate services

Information with regard to these transactions is as follows:

Significant purchases are made from Mast, a wholly-owned

subsidiary of The Limited. Purchases are also made from

Gryphon, an indirect subsidiary of The Limited. Mast is a con-

tract manufacturer and apparel importer while Gryphon is a

developer of fragrance and personal care products and also a

contract manufacturer. Prices are negotiated on a competitive

basis by merchants of the Company with Mast, Gryphon and

the manufacturers.

The Company’s real estate operations, including all aspects

of lease negotiations and ongoing dealings with landlords and

developers, are handled centrally by the Real Estate Division of

The Limited (“Real Estate Division”). Real Estate Division

expenses are allocated to the Company based on a combination

of new and remodeled store construction projects and open

selling square feet.

The Company’s store design and construction operations

are coordinated centrally by the Store Planning Division of

The Limited (“Store Planning Division”). The Store Planning

Division facilitates the design and construction of the stores and

upon completion transfers the stores to the Company at actual

cost. Store Planning Division expenses are charged to the

Company based on a combination of new and remodeled store

construction projects and open selling square feet.

The Company’s inbound and outbound transportation

expenses are managed centrally by Limited Distribution

Services (“LDS”), a wholly-owned subsidiary of The Limited.

Inbound freight is charged to the Company based on actual

receipts, while outbound freight is charged on a percentage of

cartons shipped basis.