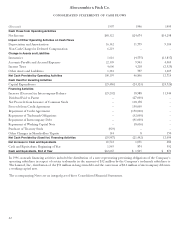

Abercrombie & Fitch 1997 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1997 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

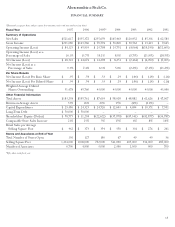

FINANCIAL SUMMARY The following summarized financial

data compares 1997 to the comparable periods for 1996 and 1995:

% Change

1997- 1996-

1997 1996 1995 1996 1995

Net sales (millions) $521.6 $335.4 $235.7 56% 42%

Increase in comparable store sales 21% 13% 5%

Retail sales increase attributable

to new and remodeled stores 34% 29% 37%

Retail sales per average

selling square foot $0,462 $0,373 $0,354 24% 5%

Retail sales per average store

(thousands) $3,653 $2,955 $2,823 24% 5%

Average store size at year end

(selling square feet) 7,910 7,921 7,920 0% 0%

Selling square feet at year end

(thousands) 1,234 1,006 792 23% 27%

Number of stores

Beginning of year 127 100 67

Opened 30 29 33

Closed (1) (2) –

End of year 156 127 100

NET SALES Fourth quarter 1997 net sales as compared to net

sales for the fourth quarter 1996 increased 52% to $212.1 million,

due to a 23% increase in comparable store sales and sales

attributable to new and remodeled stores. Comparable store sales

increases were strong in both the men’s and women’s businesses

as both were driven by a very strong knit business. Additionally,

fourth quarter 1997 net sales included results from the first

Holiday issue of the A&F Quarterly, a catalogue/magazine, which

accounted for 1.7% of total net sales.

Thirteen-week fourth quarter 1996 net sales as compared to

net sales for the fourteen-week fourth quarter 1995 increased

31% to $139.2 million, due to an 8% increase in comparable

store sales and sales attributable to new and remodeled stores.

Comparable store sales increases were strong in both the men’s

and women’s businesses. Sweaters were the best performing

category in each business.

Net sales for 1997 increased 56% to $521.6 million over the

same period in 1996. The sales increase was attributable to the

net addition of 29 stores and a 21% comparable store sales

increase. Comparable store sales increases were equally strong

in both men’s and women’s businesses and their performance

strength was broadly based across all major merchandise

categories. Net sales per selling square foot for the total

RESULTS OF OPERATIONS Net sales for the fourth quarter

were $212.1 million, an increase of 52% from $139.2 million

for the fourth quarter a year ago. Operating income was $59.1

million, up 67% compared to $35.3 million last year. Earnings per

diluted share were $.68, up 70%, from $.40 last year.

Net sales for the fiscal year ended January 31, 1998 increased

56% to $521.6 million from $335.4 million last year. Operating

income for the year increased 83% to $84.1 million from $46.0

million in 1996. Earnings per diluted share were $.94 compared

to $.48 on an adjusted basis a year ago, an increase of 96%.

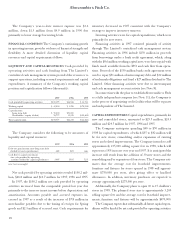

The results of operations shown below are adjusted for both

the historical number of shares outstanding to reflect post-

initial public offering shares outstanding and interest expense to

reflect the Company’s ongoing capital structure and seasonal

borrowings. The following assumptions were used to derive the

adjusted amounts: 1) 51.05 million post-initial public offering

shares outstanding for the periods presented; prior to the initial

public offering on October 1, 1996, there were 43 million shares

outstanding; 2) interest expense on the Company’s seasonal

borrowings which were funded from The Limited’s intercom-

pany cash management system; prior to July 11, 1996, the

intercompany cash management account was noninterest bear-

ing; and 3) interest expense on the Company’s ongoing capital

structure which included interest expense on a $50 million

mirror note distributed to The Limited prior to the initial

public offering but excluded interest expense on the Company’s

$150 million credit agreement, entered into on July 2, 1996,

and repaid in the fourth quarter of 1996.

Year Ended Actual Adjusted Actual

January 31, February 1, February 1,

1998 1997 1997

Operating income $84,125 $45,993 $45,993

Interest expense, net 3,583 5,016 4,919

Income before income taxes 80,542 40,977 41,074

Provision for income taxes 32,220 16,400 16,400

Net income $48,322 $24,577 $24,674

Net income per share:

Basic $00 .95 $00 .48 $00 .54

Diluted $00 .94 $00 .48 $00 .54

Weighted average shares outstanding:

Basic 51,011 51,050 45,749

Diluted 51,478 51,050 45,760

16

MANAGEMENT’S DISCUSSION AND ANALYSIS

Abercrombie &Fitch Co.