Abercrombie & Fitch 1997 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1997 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

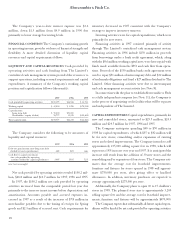

Abercrombie &Fitch Co.

The Company has no arrangements with The Limited which

result in the Company’s guarantee, pledge of assets or stock to

provide security for The Limited’s debt obligations.

The Company’s proprietary credit card processing is per-

formed by Alliance Data Systems which is approximately 40%

owned by The Limited.

9. STOCK OPTIONS AND RESTRICTED STOCK Under the

Company’s stock plan, associates may be granted up to a total of

3.5 million restricted shares and options to purchase the

Company’s common stock at the market price on the date of

grant. In 1997, associates of the Company were granted approx-

imately 1.7 million options, most of which are expected to vest

on a graduated basis over six years, subject to certain performance

goals. The remaining options generally vest 25% per year over the

first four years of the grant. A total of 12,000 shares have been

issued to nonassociate directors, all of which vest over four years.

All options have a maximum term of ten years.

The Company adopted the disclosure requirements of SFAS

No. 123, “Accounting for Stock-Based Compensation,” effective

with the 1996 financial statements, but elected to continue to

measure compensation expense in accordance with APB

Opinion No. 25, “Accounting for Stock Issued to Employees.”

Accordingly, no compensation expense for stock options has been

recognized. If compensation expense had been determined

based on the estimated fair value of options granted in 1997 and

1996, consistent with the methodology in SFAS No. 123, the

effect on net income and earnings per diluted share would

have been a reduction of approximately $1.7 million, or $.03 per

share in 1997. In 1996, the pro forma effect would have no

impact on net income and earnings per diluted share. The

weighted average fair value of options granted during fiscal

1997 and 1996 was $8.50 and $6.67. The fair value of each

option was estimated using the Black-Scholes option-pricing

model with the following weighted average assumptions for

1997 and 1996: no expected dividends, price volatility of 35%,

risk-free interest rates of 6.0% and 6.25%, assumed forfeiture rate

of 10% and expected lives of 6.5 and 5 years.

The pro forma effect on net income for 1997 and 1996 is not

representative of the pro forma effect on net income in future

years because it takes into consideration pro forma compensa-

tion expense related only to those grants made subsequent to

the Company’s initial public offering.

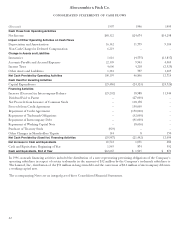

A summary of option activity for 1997 and 1996 follows:

1997 1996

Weighted Weighted

Average Average

00Shares Option Price Shares Option Price

Outstanding at

beginning of year 240,000 $16.00 – –

Granted 1,669,000 18.03 240,000 $16.00

Exercised (4,000) 16.00 – –

Canceled (21,000) 16.00 – –

Outstanding at

end of year 1,884,000 $17.81 240,000 $16.00

Options exercisable

at year end 35,000 $16.00 –

Approximately 88% of the options outstanding at year end

are at $16 per share. Most of the remaining options outstanding

are at $31 per share.

A total of 547,000 restricted shares were granted in 1997,

with at total market value at grant date of $8.7 million. Of this

total, 500,000 shares were subject to performance require-

ments and a defined vesting schedule over six years. The

remaining restricted stock grants generally vest either on a

graduated scale over four years or 100% at the end of a fixed

vesting period, principally five years. The market value of

restricted stock, subject to adjustment at the measurement date

for shares with performance requirements, is being amortized

as compensation expense over the vesting period, generally

four to six years. Compensation expenses related to restricted

stock awards amounted to $6.2 million, $.5 million and

$.4 million in 1997, 1996 and 1995.