Abercrombie & Fitch 1997 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1997 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

Abercrombie &Fitch Co.

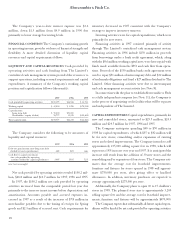

1. BASIS OF PRESENTATION Abercrombie & Fitch Co. (the

“Company”) was incorporated on June 26, 1996, and on July 15,

1996 acquired the stock of Abercrombie & Fitch Holdings, the par-

ent company of the Abercrombie & Fitch business, and A&F

Trademark, Inc., in exchange for 43 million shares of Class B

common stock issued to The Limited, Inc. (“The Limited”).

The Company is a specialty retailer of high quality, casual apparel

for men and women with an active, youthful lifestyle. The busi-

ness was established in 1892 and subsequently acquired by

The Limited in 1988.

An initial public offering (the “Offering”) of 8.05 million

shares of the Company’s Class A common stock, including the

sale of 1.05 million shares pursuant to the exercise by the under-

writers of their options to purchase additional shares, was

consummated on October 1, 1996. As a result of the Offering,

84.2% of the outstanding common stock of the Company is

owned by The Limited.

The net proceeds received by the Company from the

Offering, approximating $118.2 million, and cash from opera-

tions were used to repay the borrowings under a $150 million

credit agreement.

The accompanying consolidated financial statements include

the historical financial statements of, and transactions applicable

to the Company and its subsidiaries and reflect the assets, liabil-

ities, results of operations and cash flows on a historical cost basis.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION The consolidated finan-

cial statements include the accounts of the Company and all

significant subsidiaries that are more than 50% owned and con-

trolled. All significant intercompany balances and transactions

have been eliminated in consolidation.

FISCAL YEAR The Company’s fiscal year ends on the Saturday

closest to January 31. Fiscal years are designated in the financial

statements and notes by the calendar year in which the fiscal

year commences. The results for fiscal years 1997 and 1996

represent the fifty-two week periods ended January 31, 1998

and February 1, 1997. The results for fiscal year 1995 represent the

fifty-three week period ended February 3, 1996.

CASH AND EQUIVALENTS Cash and equivalents include

amounts on deposit with financial institutions and investments

with maturities of less than 90 days.

INVENTORIES Inventories are principally valued at the lower

of average cost or market, on a first-in first-out basis, utilizing

the retail method.

STORE SUPPLIES The initial inventory of supplies for new

stores including, but not limited to, hangers, signage, security tags

and point-of-sale supplies are capitalized at the store opening date.

Subsequent shipments are expensed except for new merchandise

presentation programs which are capitalized.

PROPERTY AND EQUIPMENT Depreciation and amortization

of property and equipment are computed for financial report-

ing purposes on a straight-line basis, using service lives ranging

principally from 10-15 years for building improvements and 3-

10 years for other property and equipment. Beneficial leaseholds

represent the present value of the excess of fair market rent

over contractual rent of existing stores at the 1988 purchase of

the Company by The Limited and are being amortized over the

lives of the related leases. The cost of assets sold or retired and

the related accumulated depreciation or amortization are

removed from the accounts with any resulting gain or loss

included in net income. Maintenance and repairs are charged

to expense as incurred. Major renewals and betterments that

extend service lives are capitalized. Long-lived assets are

reviewed for impairment whenever events or changes in cir-

cumstances indicate that full recoverability is questionable.

Factors used in the valuation include, but are not limited to,

management’s plans for future operations, recent operating

results and projected cash flows.

INCOME TAXES Income taxes are calculated in accordance

with Statement of Financial Accounting Standards (“SFAS”)

No. 109, “Accounting for Income Taxes,” which requires the use

of the liability method. Deferred tax assets and liabilities are rec-

ognized based on the difference between the financial statement

carrying amounts of existing assets and liabilities and their

respective tax bases.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS