Xcel Energy 2007 Annual Report Download - page 92

Download and view the complete annual report

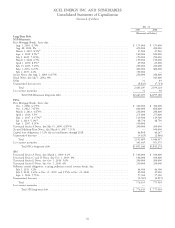

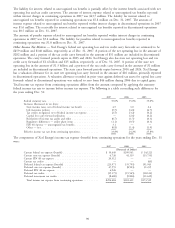

Please find page 92 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Federal income taxes paid by Xcel Energy, as parent of the Xcel Energy consolidated group, are allocated to the Xcel

Energy subsidiaries based on separate company computations of tax. A similar allocation is made for state income taxes

paid by Xcel Energy in connection with combined state filings. The holding company also allocates its own net income

tax benefits to its direct subsidiaries based on the positive tax liability of each company.

Use of Estimates — In recording transactions and balances resulting from business operations, Xcel Energy uses

estimates based on the best information available. Estimates are used for such items as plant depreciable lives, AROs,

decommissioning, tax provisions, uncollectible amounts, environmental costs, unbilled revenues, jurisdictional fuel and

energy cost allocations and actuarially determined benefit costs. The recorded estimates are revised when better

information becomes available or when actual amounts can be determined. Those revisions can affect operating results.

The depreciable lives of certain plant assets are reviewed annually and revised, if appropriate.

Cash and Cash Equivalents — Xcel Energy considers investments in certain instruments, including commercial paper

and money market funds, with a remaining maturity of three months or less at the time of purchase to be cash

equivalents.

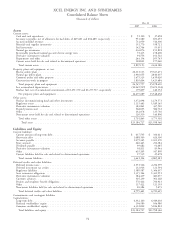

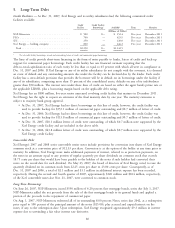

Restricted Cash — At Dec. 31, 2007 and 2006, Xcel Energy had restricted cash of $33 million and $24 million,

respectively. The restricted cash balances primarily represent margin deposits held in conjunction with electric futures

trading contracts. These balances are presented as a component of other long-term assets on the consolidated balance

sheets.

Inventory — All inventory is recorded at average cost.

Regulatory Accounting — Our regulated utility subsidiaries account for certain income and expense items in accordance

with SFAS No. 71 — ‘‘Accounting for the Effects of Certain Types of Regulation.’’ Under SFAS No. 71:

• Certain costs, which would otherwise be charged to expense, are deferred as regulatory assets based on the

expected ability to recover them in future rates; and

• Certain credits, which would otherwise be reflected as income, are deferred as regulatory liabilities based on the

expectation they will be returned to customers in future rates.

Estimates of recovering deferred costs and returning deferred credits are based on specific ratemaking decisions or

precedent for each item. Regulatory assets and liabilities are amortized consistent with the period of expected regulatory

treatment.

If restructuring or other changes in the regulatory environment occur, our regulated utility subsidiaries may no longer

be eligible to apply this accounting treatment, and may be required to eliminate such regulatory assets and liabilities

from their balance sheets. Such changes could have a material effect on Xcel Energy’s results of operations in the period

the write-offs are recorded. See more discussion of regulatory assets and liabilities at Note 17 to the consolidated

financial statements.

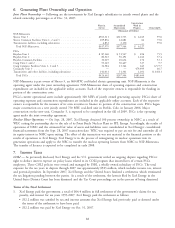

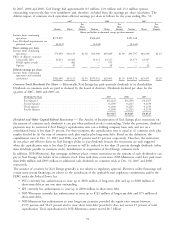

Deferred Financing Costs — Other assets included deferred financing costs, net of amortization, of approximately

$48 million and $47 million at Dec. 31, 2007 and 2006, respectively. Xcel Energy is amortizing these financing costs

over the remaining maturity periods of the related debt.

Debt premiums, discounts, expenses and amounts received or incurred to settle hedges are amortized over the life of the

related debt. The premiums and costs associated with modified debt are deferred and amortized over the life of the

related new issuance, in accordance with regulatory guidelines. If the company extinguishes the debt, all unamortized

balances shall be expensed at the time of the redemption.

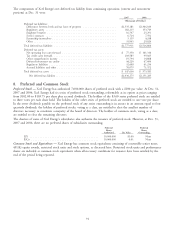

Accounts Receivable and Allowance for Bad Debts — Accounts receivable are stated at the actual billed amount net of

write-offs and allowance for uncollectibles. Xcel Energy establishes an allowance for uncollectibles based on a reserve

policy that reflects its expected exposure to the credit risk of customers.

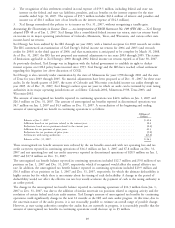

Renewable Energy Credits — Renewable Energy Credits (RECs) are marketable environmental commodities that

represent proof that energy was generated from eligible renewable energy sources. These credits can be bought and sold.

RECs are typically used as a form of measurement of compliance to Renewable Portfolio Standards (RPS) enacted by

those states that are encouraging construction and consumption of renewable energy, but can also be sold separately

from the energy produced. Currently, SPS acquires RECs from the generation or purchase of renewable power.

When RECs are acquired in the course of generation or purchase as a result of meeting the load obligation, they are

recorded as inventory at actual cost. REC’s acquired for trading purposes are recorded as other investments at actual

cost. The cost of RECs that are retired for compliance purposes are recorded as electric fuel and purchased power. The

net margin on sales of RECs for trading purposes is recorded as electric utility operating revenues net of any margin

sharing requirements. As a result of state regulatory orders, we reduce recoverable fuel costs for the value of certain

82