Xcel Energy 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

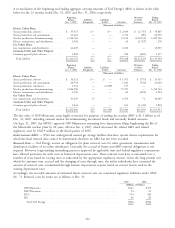

PSCo and SPS have various pay-for-performance contracts with expiration dates through the year 2033. In general,

these contracts provide for capacity payments, subject to meeting certain contract obligations, and energy payments

based on actual power taken under the contracts. Certain contractual payment obligations are adjusted based on indices.

However, the effects of price adjustments are mitigated through cost-of-energy rate adjustment mechanisms.

Xcel Energy has also executed five additional purchase power agreements that are conditional upon achievement of

certain conditions, including becoming operational. Estimated payments under these conditional obligations are

$52.8 million, $82.7 million, $83.0 million, $83.4 million, $94.5 million and $1.7 billion for 2008 to 2012 and

thereafter, respectively.

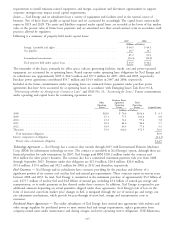

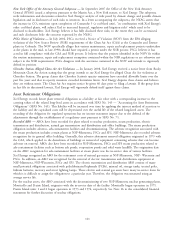

At Dec. 31, 2007, the estimated future payments for capacity, accounted for as executory contracts, that the utility

subsidiaries of Xcel Energy are obligated to purchase, subject to availability, are as follows:

(Millions of Dollars)

2008 ........................................................... $ 496.7

2009 ........................................................... 479.2

2010 ........................................................... 452.3

2011 ........................................................... 438.7

2012 ........................................................... 365.1

2013 and thereafter .................................................. 1,354.9

Total ......................................................... $3,586.9

Environmental Contingencies

Xcel Energy and its subsidiaries have been, or are currently involved with, the cleanup of contamination from certain

hazardous substances at several sites. In many situations, the subsidiary involved believes it will recover some portion of

these costs through insurance claims. Additionally, where applicable, the subsidiary involved is pursuing, or intends to

pursue, recovery from other potentially responsible parties and through the rate regulatory process. New and changing

federal and state environmental mandates can also create added financial liabilities for Xcel Energy and its subsidiaries,

which are normally recovered through the rate regulatory process. To the extent any costs are not recovered through the

options listed above, Xcel Energy would be required to recognize an expense.

Site Remediation — Xcel Energy must pay all or a portion of the cost to remediate sites where past activities of its

subsidiaries and some other parties have caused environmental contamination. Environmental contingencies could arise

from various situations, including the following categories of sites:

• Sites of former manufactured gas plants (MGPs) operated by Xcel Energy subsidiaries, predecessors, or other

entities; and

• Third-party sites, such as landfills, to which Xcel Energy is alleged to be a potentially responsible party (PRP)

that sent hazardous materials and wastes.

Xcel Energy records a liability when enough information is obtained to develop an estimate of the cost of

environmental remediation and revises the estimate as information is received. The estimated remediation cost may vary

materially from the initial estimate.

To estimate the remediation cost for these sites, assumptions are made when facts are not fully known. For instance,

assumptions may be made about the nature and extent of site contamination, the extent of required cleanup efforts,

costs of alternative cleanup methods and pollution-control technologies, the period over which remediation will be

performed and paid for, changes in environmental remediation and pollution-control requirements, the potential effect

of technological improvements, the number and financial strength of other PRPs and the identification of new

environmental cleanup sites.

Estimates are revised as facts become known. At Dec. 31, 2007, the liability for the cost of remediating these sites was

estimated to be $46.9 million, of which $2.5 million was considered to be a current liability. Some of the cost of

remediation may be recovered from:

• Insurance coverage;

• Other parties that have contributed to the contamination; and

• Customers.

Neither the total remediation cost nor the final method of cost allocation among all PRPs of the unremediated sites has

been determined. Estimates have been recorded for Xcel Energy’s future costs for these sites.

116