Xcel Energy 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

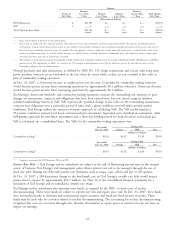

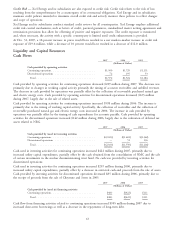

Options

Maturity Maturity

Source of Less Than Maturity Maturity Greater Than Total Options

Fair Value 1 Year 1 to 3 Years 4 to 5 Years 5 Years Fair Value

(Thousands of Dollars)

NSP-Minnesota ............... 2 $(139) $— $— $— $(139)

SPS* ...................... 2 3——— 3

Total Options Fair Value ......... $(136) $— $— $— $(136)

(1) — Prices actively quoted or based on actively quoted prices.

(2) — Prices based on models and other valuation methods. These represent the fair value of positions calculated using internal models when directly and indirectly quoted

external prices or prices derived from external sources are not available. Internal models incorporate the use of options pricing and estimates of the present value of cash

flows based upon underlying contractual terms. The models reflect management’s estimates, taking into account observable market prices, estimated market prices in the

absence of quoted market prices, the risk-free market discount rate, volatility factors, estimated correlations of commodity prices and contractual volumes. Market price

uncertainty and other risks also are factored into the model.

* — SPS conducts an inconsequential amount of commodity trading. Margins from commodity trading activity are partially redistributed to SPS, NSP-Minnesota, and PSCo,

pursuant to the JOA approved by the FERC. As a result of the JOA, margins received pursuant to the JOA are reflected as part of the fair values by source for the

commodity trading net asset or liability balances.

Normal purchases and sales transactions, as defined by SFAS No. 133, hedge transactions and certain other long-term

power purchase contracts are not included in the fair values by source tables as they are not recorded at fair value as

part of commodity trading operations.

At Dec. 31, 2007, a 10-percent increase in market prices over the next 12 months for commodity trading contracts

would decrease pretax income from continuing operations by approximately $0.1 million, whereas a 10-percent decrease

would decrease pretax income from continuing operations by approximately $0.1 million.

Xcel Energy’s short-term wholesale and commodity trading operations measure the outstanding risk exposure to price

changes on transactions, contracts and obligations that have been entered into, but not closed, using an industry

standard methodology known as VaR. VaR expresses the potential change in fair value on the outstanding transactions,

contracts and obligations over a particular period of time, with a given confidence interval under normal market

conditions. Xcel Energy utilizes the variance/covariance approach in calculating VaR. The VaR model employs a

95-percent confidence interval level based on historical price movement, lognormal price distribution assumption, delta

half-gamma approach for non-linear instruments and a three-day holding period for both electricity and natural gas.

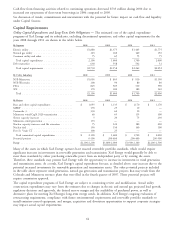

VaR is calculated on a consolidated basis. The VaRs for the commodity trading operations were:

During 2007

Year ended

Dec. 31, 2007 Average High Low

(Millions of Dollars)

Commodity trading(a) ................................ $0.26 $0.47 $1.45 $0.09

During 2006

Year ended

Dec. 31, 2006 Average High Low

(Millions of Dollars)

Commodity trading(a) ................................ $0.49 $1.32 $2.60 $0.39

(a) Comprises transactions for NSP-Minnesota, PSCo and SPS.

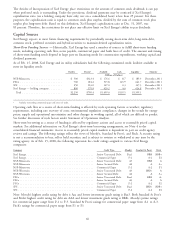

Interest Rate Risk — Xcel Energy and its subsidiaries are subject to the risk of fluctuating interest rates in the normal

course of business. Xcel Energy’s risk management policy allows interest rate risk to be managed through the use of

fixed rate debt, floating rate debt and interest rate derivatives such as swaps, caps, collars and put or call options.

At Dec. 31, 2007, a 100-basis-point change in the benchmark rate on Xcel Energy’s variable rate debt would impact

pretax interest expense by approximately $12.7 million. See Note 12 to the consolidated financial statements for a

discussion of Xcel Energy and its subsidiaries’ interest rate swaps.

Xcel Energy and its subsidiaries also maintain trust funds, as required by the NRC, to fund costs of nuclear

decommissioning. These trust funds are subject to interest rate risk and equity price risk. At Dec. 31, 2007, these funds

were invested primarily in domestic and international equity securities and fixed-rate fixed-income securities. These

funds may be used only for activities related to nuclear decommissioning. The accounting for nuclear decommissioning

recognizes that costs are recovered through rates; therefore fluctuations in equity prices or interest rates do not have an

impact on earnings.

62