Xcel Energy 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

‘‘Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans — an amendment of FASB

Statements No. 87, 88, 106, and 132(R)’’ (SFAS No. 158) — In September 2006, the FASB issued SFAS No. 158,

which requires companies to fully recognize the funded status of each pension and other postretirement benefit plan as

a liability or asset on their balance sheets with all unrecognized amounts to be recorded in other comprehensive income.

Xcel Energy applied regulatory accounting treatment for unrecognized amounts of regulated utility subsidiary

employees, which allowed recognition as a regulatory asset or liability rather than as a charge to accumulated other

comprehensive income, as future costs are expected to be included in rates. The effect of adopting in 2006 for the

remaining unrecognized amounts was an increase in accumulated other comprehensive income of $72.8 million.

Pension Benefits

Xcel Energy has several noncontributory, defined benefit pension plans that cover almost all employees. Benefits are

based on a combination of years of service, the employee’s average pay and social security benefits. Xcel Energy’s policy

is to fully fund into an external trust the actuarially determined pension costs recognized for ratemaking and financial

reporting purposes, subject to the limitations of applicable employee benefit and tax laws.

Pension Plan Assets — Plan assets principally consist of the common stock of public companies, corporate bonds and

U.S. government securities. The target range for our pension asset allocation is 60 percent in equity investments,

20 percent in fixed income investments and 20 percent in nontraditional investments, such as real estate, private equity

and a diversified commodities index.

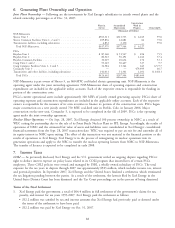

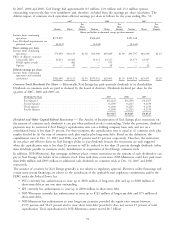

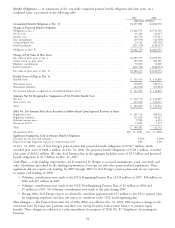

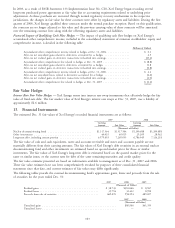

The actual composition of pension plan assets at Dec. 31 was:

2007 2006

Equity securities ............................................ 60% 63%

Debt securities ............................................. 22 22

Real estate ................................................ 4 4

Cash ................................................... 2 2

Nontraditional investments ..................................... 12 9

100% 100%

Xcel Energy bases its investment-return assumption on expected long-term performance for each of the investment types

included in its pension asset portfolio. Xcel Energy considers the actual historical returns achieved by its asset portfolio

over the past 20-year or longer period, as well as the long-term return levels projected and recommended by investment

experts. The historical weighted average annual return for the past 20 years for the Xcel Energy portfolio of pension

investments is 11.8 percent, which is greater than the current assumption level. The pension cost determination assumes

the continued current mix of investment types over the long term. The Xcel Energy portfolio is heavily weighted

toward equity securities and includes nontraditional investments. A higher weighting in equity investments can increase

the volatility in the return levels achieved by pension assets in any year. Investment returns in 2007 were below the

assumed level of 8.75 percent while returns in 2006 and 2005 exceeded the assumed level of 8.75 percent. Xcel Energy

continually reviews its pension assumptions. In 2008, Xcel Energy will continue to use an investment-return assumption

of 8.75 percent.

97