Xcel Energy 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

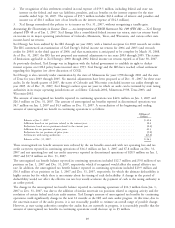

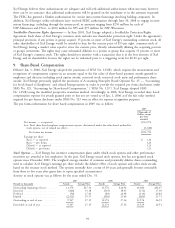

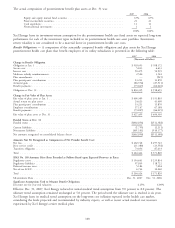

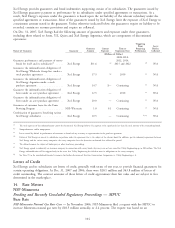

Range of Exercise Prices

$15.94 to $26.01 to $30.01 to

$26.00 $30.00 $51.25

Options outstanding and exercisable:

Number outstanding and exercisable ................... 3,060,850 5,504,321 982,156

Weighted average remaining contractual life (years) .......... 3.2 2.5 2.3

Weighted average exercise price ....................... $ 23.72 $ 26.95 $ 39.32

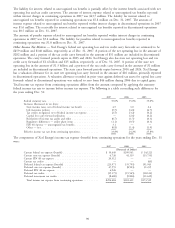

The total fair value of stock options exercised and the total intrinsic value of options exercised during the years ended

Dec. 31, 2007, 2006, 2005 are as follows:

2007 2006 2005

(Thousands of Dollars)

Fair value of stock options exercised ..................... $6,398 $12,108 $2,906

Intrinsic value of options exercised(a) ..................... 1,293 1,795 281

(a) Intrinsic value is calculated as market price at exercise date less the option exercise price

Restricted Stock — Certain employees may elect to receive shares of common or restricted stock under the Xcel Energy

Executive Annual Incentive Award Plan. Restricted stock vests in equal annual installments over a three-year period.

Xcel Energy reinvests dividends on the restricted stock it holds while restrictions are in place. Restrictions also apply to

the additional shares of restricted stock acquired through dividend reinvestment. If the restricted shares are forfeited, the

employee is not entitled to the dividends on those shares. Restricted stock has a value equal to the market-trading price

of Xcel Energy’s stock at the grant date. Xcel Energy granted the shares of restricted stock in 2007, 2006 and 2005 as

follows:

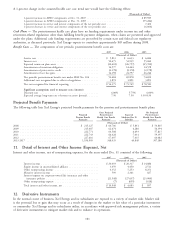

2007 2006 2005

Granted shares ................................... 37,000 10,481 28,626

Grant-date market price ............................. $24.27 $ 19.10 $ 17.81

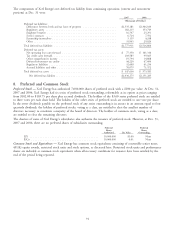

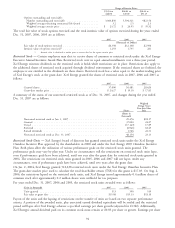

A summary of the status of our nonvested restricted stock as of Dec. 31, 2007, and changes during the year ended

Dec. 31, 2007 are as follows:

Weighted

Average Grant

Date Fair Value

Shares Price

(Shares in

thousands)

Nonvested restricted stock at Jan. 1, 2007 ............................ 29,476 $18.17

Granted ................................................. 37,000 24.27

Vested .................................................. (17,147) 17.89

Forfeited ................................................. (2,941) 18.45

Earned dividends ........................................... 1,766 22.31

Nonvested restricted stock at Dec. 31, 2007 ........................... 48,154 23.13

Restricted Stock Units — Xcel Energy’s board of directors has granted restricted stock units under the Xcel Energy

Omnibus Incentive Plan approved by the shareholders in 2000 and under the Xcel Energy 2005 Omnibus Incentive

Plan. Both plans allow the utilization of various performance goals on the restricted stock units granted. The

performance goals may vary by plan year. Under no circumstances will the restrictions on restricted stock units lapse,

even if performance goals have been achieved, until one year after the grant date for restricted stock units granted in

2004. The restrictions on restricted stock units granted in 2005, 2006 and 2007 will not lapse, under any

circumstances, even if performance goals have been achieved, until two years after the grant date.

On Jan. 2, 2004, Xcel Energy granted 512,638 restricted stock units under the Xcel Energy Omnibus Incentive Plan.

The grant-date market price used to calculate the total shareholder return (TSR) for this grant is $17.03. On Aug. 2,

2006, the restrictions lapsed on the restricted stock units, and Xcel Energy issued approximately 0.4 million shares of

common stock after approximately 0.2 million shares were withheld for tax purposes.

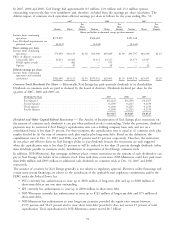

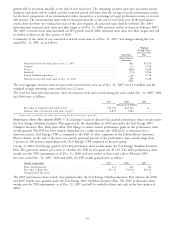

For years ended Dec. 31, 2007, 2006 and 2005, the restricted stock units awarded were as follows:

(Units in thousands) 2007 2006 2005

Units granted ................................... 313 390 519

Fair value at grant date ............................. $19.08 $15.13 $18.10

Payout of the units and the lapsing of restrictions on the transfer of units are based on two separate performance

criteria. A portion of the awarded units, plus associated earned dividend equivalents will be settled and the restricted

period will lapse after Xcel Energy achieves a specified earnings per share growth (adjusted for COLI). Additionally,

Xcel Energy’s annual dividend paid on its common stock must remain at $0.83 per share or greater. Earnings per share

94