Whole Foods 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

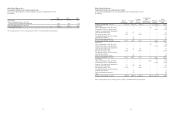

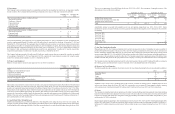

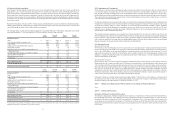

(14) Quarterly Results (unaudited)

The Company’s first fiscal quarter consists of 16 weeks, the second and third fiscal quarters each are 12 weeks, and the fourth

fiscal quarter is 12 or 13 weeks. Fiscal years 2015 and 2014 were 52-week years with twelve weeks in the fourth quarter. Because

the first fiscal quarter is longer than the remaining quarters, it typically represents a larger share of the Company’s annual sales

from existing stores. Quarter-to-quarter comparisons of results of operations have been and may be materially impacted by the

timing of new store openings. The Company believes that the following information reflects all adjustments, consisting of normal

recurring accruals, necessary for a fair presentation. The operating results for any quarter are not necessarily indicative of results

for any future period.

During the fourth quarter of fiscal year 2015, “Selling, general, and administrative expenses” included asset impairment charges

totaling approximately $46 million related to certain locations for which asset value exceeded expected future cash flows and

a one-time termination charge of $34 million related to restructuring.

The following tables set forth selected unaudited quarterly Consolidated Statements of Operations information for the fiscal

years ended September 27, 2015 and September 28, 2014 (in millions, except per share amounts):

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Fiscal Year 2015 (1)

Sales $ 4,671 $ 3,647 $ 3,632 $ 3,438

Cost of goods sold and occupancy costs 3,045 2,337 2,339 2,252

Gross profit 1,626 1,310 1,293 1,186

Selling, general and administrative expenses 1,330 1,029 1,032 1,080

Pre-opening expenses 21 20 12 14

Relocation, store closure and lease termination costs 4624

Operating income 271 255 247 88

Investment and other income, net of interest expense 3454

Income before income taxes 274 259 252 92

Provision for income taxes 107 101 98 36

Net income $ 167 $ 158 $ 154 $ 56

Basic earnings per share $ 0.46 $ 0.44 $ 0.43 $ 0.16

Diluted earnings per share $ 0.46 $ 0.44 $ 0.43 $ 0.16

Dividends declared per common share $ 0.13 $ 0.13 $ 0.13 $ 0.13

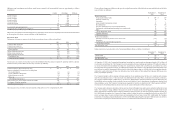

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Fiscal Year 2014 (1)

Sales $ 4,239 $ 3,322 $ 3,377 $ 3,256

Cost of goods sold and occupancy costs 2,754 2,131 2,163 2,102

Gross profit 1,485 1,191 1,214 1,154

Selling, general and administrative expenses 1,209 947 951 925

Pre-opening expenses 16 11 18 22

Relocation, store closure and lease termination costs 5222

Operating income 255 231 243 205

Investment and other income, net of interest expense 4242

Income before income taxes 259 233 247 207

Provision for income taxes 101 91 96 79

Net income $ 158 $ 142 $ 151 $ 128

Basic earnings per share $ 0.42 $ 0.38 $ 0.41 $ 0.35

Diluted earnings per share $ 0.42 $ 0.38 $ 0.41 $ 0.35

Dividends declared per common share $ 0.12 $ 0.12 $ 0.12 $ 0.12

(1) Sum of quarterly amounts, including per share amounts, may not equal fiscal year totals due to the effect of rounding and the

independent quarterly computation of per share amounts.

54

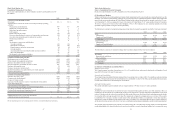

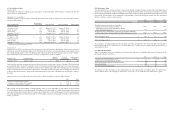

(15) Commitments and Contingencies

The Company is exposed to claims and litigation matters arising in the ordinary course of business and uses various methods

to resolve these matters in a manner that we believe best serves the interests of our stakeholders. From time to time we are a

party to legal proceedings including matters involving shareholder claims, personnel and employment issues, personal injury,

product liability, protecting our intellectual property, acquisitions and other proceedings arising in the ordinary course of business.

These matters have not resulted in any material losses to date. Certain litigation cases have been certified as class or collective

actions and may seek substantial damages.

Our primary contingencies are associated with insurance and self-insurance obligations and litigation matters. Additionally, the

Company has retention agreements with certain members of Company management which provide for payments under certain

circumstances including change of control. Estimation of our insurance and self-insurance liabilities requires significant

judgments, and actual claim settlements and associated expenses may differ from our current provisions for loss. We have

exposures to loss contingencies arising from pending or threatened litigation for which assessing and estimating the outcomes

of these matters involve substantial uncertainties.

The Company evaluates contingencies on an ongoing basis and has established loss provisions for matters in which losses are

probable and the amount of loss can be reasonably estimated, and is not currently a party to any legal proceeding that management

believes could have a material adverse effect on our results of operations. Insurance and legal settlement liabilities are included

in the “Other current liabilities” line item on the Consolidated Balance Sheets. We believe the recorded reserves in our consolidated

financial statements are adequate in light of the probable and estimable liabilities.

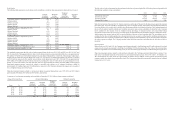

(16) Subsequent Events

Revolving Credit Facility

On November 2, 2015, the Company, as borrower, entered into a new credit facility (the “Credit Agreement”) that provides for

an unsecured revolving credit facility in the aggregate principal amount of $500 million, which may be increased from time to

time by up to $250 million in the aggregate pursuant to an expansion feature set forth in the Credit Agreement. The Credit

Agreement also provides for a letter of credit subfacility and a swingline subfacility. The Credit Agreement contains certain

affirmative covenants including maintenance of certain financial ratios and certain negative covenants including limitations on

additional indebtedness and payments.

Share Repurchase Program

On November 4, 2015, a new share repurchase program was authorized pursuant to the authority of the Company’s Board of

Directors whereby the Company may make up to $1.0 billion in stock repurchases of outstanding shares of the common stock

of the Company. Under the new share repurchase program, purchases can be made from time to time using a variety of methods,

which may include open market purchases. The new repurchase program does not have an expiration date and the specific timing,

price and size of purchases will depend on prevailing stock prices, general economic and market conditions, and other

considerations. Purchases may be made through a Rule 10b5-1 plan pursuant to pre-determined metrics set forth in such plan.

The Board’s authorization of the share repurchase program does not obligate the Company to acquire any particular amount of

common stock, and the program may be suspended or discontinued at any time.

Subsequent to fiscal year end, the Company repurchased approximately 7.8 million shares of the Company’s common stock at

an average price per share of $30.15 for a total of approximately $234 million. The Company’s total authority under existing

repurchase programs was approximately $1.2 billion at November 11, 2015.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

The Company’s management, with the participation of the Company’s co-Chief Executive Officers and Chief Financial Officer,

has evaluated the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15

(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this

report. Based on such evaluation, the Company’s co-Chief Executive Officers and Chief Financial Officer have concluded that,

as of the end of such period, the Company’s disclosure controls and procedures were effective as of the end of the period covered

by this report.