Whole Foods 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

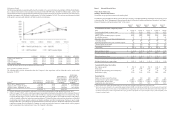

Sales

Sales totaled approximately $15.4 billion, $14.2 billion and $12.9 billion in fiscal years 2015, 2014 and 2013, respectively,

representing increases of 8.4%, 9.9% and 10.4% over the previous fiscal years, respectively. Sales increases for all years are

due to comparable store sales increases and stores opened or acquired less than one fiscal year. Total sales increased 12.6% in

fiscal year 2013 over the previous fiscal year on a comparative 52-week basis. Comparable store sales increased 2.5%, 4.4%

and 7.0% during fiscal years 2015, 2014 and 2013, respectively, and contributed approximately 93.3%, 94.0% and 94.1% to

total sales in fiscal years 2015, 2014 and 2013, respectively. As of September 27, 2015, there were 390 locations in the comparable

store base as compared to 358 locations and 331 locations as of September 28, 2014 and September 29, 2013, respectively.

Gross Profit

Gross profit totaled approximately $5.4 billion, $5.0 billion and $4.6 billion in fiscal years 2015, 2014 and 2013, respectively.

Gross profit as a percentage of sales decreased 34 basis points in fiscal year 2015 compared to the prior fiscal year. Net LIFO

inventory reserves increased approximately $1 million during fiscal year 2015 compared to an increase of approximately $16

million in fiscal year 2014, resulting in a positive impact of 11 basis points year over year. In fiscal year 2013, the net LIFO

inventory reserve increase totaled approximately $2 million. Results also include a supplier credit of approximately $9 million,

or six basis points, during fiscal year 2015. Excluding these charges, gross profit as a percentage of sales decreased 51 basis

points in fiscal year 2015 compared to the prior fiscal year, reflecting our ongoing value strategy and increased spoilage in an

environment of weaker-than-anticipated sales. Gross profit as a percentage of sales decreased 30 basis points and increased 31

basis points in fiscal years 2014 and 2013, respectively, compared to the prior fiscal year. The decrease in fiscal year 2014 was

the result of the decision not to pass through all product cost increases to customers, while the increase in fiscal year 2013 was

driven primarily by an improvement in occupancy costs.

Our gross profit may increase or decrease slightly depending on the mix of sales from new stores, our value strategy, or the

impact of commodity costs or a host of other factors, including possible supply shortages and extreme weather-related disruptions.

Relative to existing stores, gross profit margins tend to be lower for new stores and increase as stores mature, reflecting lower

shrink as volumes increase, as well as increasing experience levels and operational efficiencies of the store teams.

Selling, General and Administrative Expenses

Selling, general and administrative expenses totaled approximately $4.5 billion, $4.0 billion and $3.7 billion in fiscal years 2015,

2014 and 2013, respectively. During fiscal year 2015, selling, general, and administrative expenses included asset impairment

charges totaling approximately $47 million, one-time termination charges of $34 million, and approximately $8 million of

expense related to the implementation of California’s new paid sick leave law. Excluding these charges, selling, general and

administrative expenses increased eight basis points as a percentage of sales compared to the prior year. Selling, general, and

administrative expenses decreased nine basis points and 18 basis points as a percentage of sales in fiscal years 2014 and 2013,

respectively, compared to the prior year.

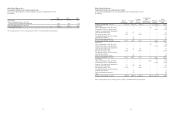

Share-based payment expense was included in the following line items on the Consolidated Statements of Operations for the

fiscal years indicated (in millions):

2015 2014 2013

Cost of goods sold and occupancy costs $ 2 $ 2 $ 2

Selling, general and administrative expenses 62 66 55

Share-based payment expense before income taxes 64 68 57

Income tax benefit (25) (26) (22)

Net share-based payment expense $ 39 $ 42 $ 35

Pre-opening Expenses

Pre-opening expenses totaled approximately $67 million, $67 million and $52 million in fiscal years 2015, 2014 and 2013,

respectively.

Relocation, Store Closure and Lease Termination Costs

Relocation, store closure and lease termination costs totaled approximately $16 million, $11 million and $12 million in fiscal

years 2015, 2014 and 2013, respectively.

22

The numbers of stores opened, acquired and relocated were as follows:

2015 2014 2013

New and acquired stores 32 37 27

Relocated stores 6 1 5

Investment and Other Income, net of Interest Expense

Investment and other income, net of interest expense, which includes gift card breakage, interest income, investment gains and

losses and other income, totaled approximately $17 million, $12 million and $11 million in fiscal years 2015, 2014 and 2013,

respectively.

Income Taxes

Income taxes resulted in an effective tax rate of approximately 39.0%, 38.8% and 38.4% in fiscal years 2015, 2014 and 2013,

respectively. The higher effective tax rate in fiscal year 2015 primarily reflects a shift in the mix and level of earnings throughout

the jurisdictions in which we operate.

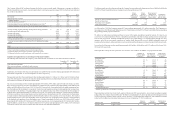

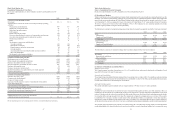

Non-GAAP measures

In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company

provides information regarding Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), adjusted EBITDA,

free cash flow and Return on Invested Capital (“ROIC”) as additional information about its operating results. These measures

are not in accordance with, or an alternative to, GAAP. We believe that these presentations provide useful information to

management, analysts and investors regarding certain additional financial and business trends relating to our results of operations

and financial condition. In addition, management uses these measures for reviewing the financial results of the Company as

well as a component of incentive compensation.

The Company defines adjusted EBITDA as EBITDA plus non-cash share-based payment expense and deferred rent. The following

is a tabular reconciliation of the non-GAAP financial measure adjusted EBITDA to GAAP net income, which the Company

believes is the most directly comparable GAAP financial measure. Adjusted EBITDA for the fiscal years indicated was as follows

(in millions):

2015 2014 2013

Net income $ 536 $ 579 $ 551

Provision for income taxes 342 367 343

Investment and other income, net of interest expense (17) (12) (11)

Operating income 861 934 883

Depreciation and amortization 439 377 339

EBITDA 1,300 1,311 1,222

Share-based payment expense 64 68 57

Deferred rent 34 40 37

Adjusted EBITDA $ 1,398 $ 1,419 $ 1,316

The Company defines free cash flow as net cash provided by operating activities less capital expenditures. The following is a

tabular reconciliation of the non-GAAP financial measure free cash flow for the fiscal years indicated (in millions):

2015 2014 2013

Net cash provided by operating activities $ 1,129 $ 1,088 $ 1,009

Development cost of new locations (516) (447) (339)

Other property and equipment expenditures (335) (263) (198)

Free cash flow $ 278 $ 378 $ 472