Whole Foods 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

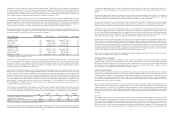

deferred tax assets and liabilities. In the ordinary course of business, there are transactions and calculations where the ultimate

tax outcome is uncertain. In addition, we are subject to periodic audits and examinations by the Internal Revenue Service (“IRS”)

and other state and local taxing authorities. Although we believe that our estimates are reasonable, actual results could differ

from these estimates.

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than not that the tax position

will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits

recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater

than 50% likelihood of being realized upon ultimate settlement.

To the extent we prevail in matters for which reserves have been established, or are required to pay amounts in excess of our

reserves, our effective income tax rate in a given financial statement period could be materially affected. An unfavorable tax

settlement would require use of our cash and would result in an increase in our effective income tax rate in the period of resolution.

A favorable tax settlement would be recognized as a reduction in our effective income tax rate in the period of resolution.

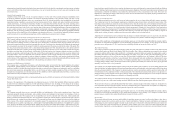

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

We are primarily exposed to interest rate changes on our investments. We do not use financial instruments for trading or other

speculative purposes. We are also exposed to foreign exchange fluctuations on our foreign subsidiaries.

The analysis presented for each of our market risk sensitive instruments is based on a 10% change in interest or currency exchange

rates. These changes are hypothetical scenarios used to calibrate potential risk and do not represent our view of future market

changes. As the hypothetical figures discussed below indicate, changes in fair value based on the assumed change in rates

generally cannot be extrapolated because the relationship of the change in assumption to the change in fair value may not be

linear. The effect of a variation in a particular assumption is calculated without changing any other assumption. In reality, changes

in one factor may result in changes in another, which may magnify or counteract the sensitivities.

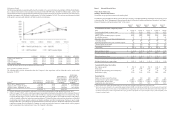

Interest Rate Risk

We seek to minimize the risks from interest rate fluctuations through ongoing evaluation of the composition of our investments.

The Company holds short-term investments that are classified as cash equivalents. We had cash equivalent investments totaling

approximately $32 million and $65 million at September 27, 2015 and September 28, 2014, respectively. The Company also

holds available-for-sale securities generally consisting of state and local municipal obligations and corporate bonds and

commercial paper which hold high credit ratings. We had short-term and long-term investments totaling approximately $155

million and $63 million, respectively, at September 27, 2015 compared to approximately $553 million and $120 million,

respectively, at the end of the prior fiscal year.

These investments are recorded at fair value and are generally short term in nature, and therefore changes in interest rates would

not have a material impact on the valuation of these investments. During fiscal years 2015 and 2014, a hypothetical 10% increase

or decrease in interest rates would not have materially affected interest income earned on these investments.

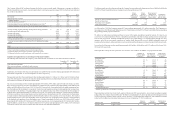

Foreign Currency Risk

The Company is exposed to foreign currency exchange risk. We own and operate ten stores in Canada and nine stores in the

U.K. Sales made from stores in Canada and the U.K. are made in exchange for Canadian dollars and Great Britain pounds

sterling, respectively. The Company does not currently hedge against the risk of exchange rate fluctuations.

At September 27, 2015, a hypothetical 10% change in value of the U.S. dollar relative to the Canadian dollar or Great Britain

pound sterling would not have materially affected our consolidated financial statements.

30

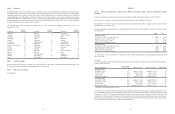

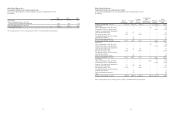

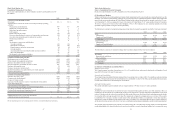

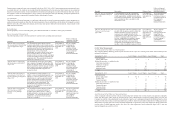

Item 8. Financial Statements and Supplementary Data.

Whole Foods Market, Inc.

Index to Consolidated Financial Statements

Page

Report of Independent Registered Public Accounting Firm

Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting

Consolidated Balance Sheets at September 27, 2015 and September 28, 2014

Consolidated Statements of Operations for the fiscal years ended September 27, 2015, September 28, 2014

and September 29, 2013

Consolidated Statements of Comprehensive Income for the fiscal years ended September 27, 2015,

September 28, 2014 and September 29, 2013

Consolidated Statements of Shareholders’ Equity for the fiscal years ended September 27, 2015,

September 28, 2014 and September 29, 2013

Consolidated Statements of Cash Flows for the fiscal years ended September 27, 2015, September 28, 2014

and September 29, 2013

Notes to Consolidated Financial Statements

31

32

33

34

35

36

37

38