Whole Foods 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

Subsequent to fiscal year end, the Company repurchased approximately 7.8 million shares of the Company’s common stock at

an average price per share of $30.15 for a total of approximately $234 million. On November 4, 2015, the Board authorized a

new share repurchase program whereby the Company may make up to $1.0 billion in stock purchases of outstanding shares of

common stock of the Company. The new repurchase program does not have an expiration date. The Company’s total authority

under existing repurchase programs was approximately $1.2 billion at November 11, 2015.

Under the share repurchase programs, purchases can be made from time to time using a variety of methods, which may include

open market purchases. The specific timing, price and size of purchases will depend on prevailing stock prices, general economic

and market conditions, and other considerations. Purchases may be made through a Rule 10b5-1 plan pursuant to pre-determined

metrics set forth in such plan. The Board’s authorization of the share repurchase program does not obligate the Company to

acquire any particular amount of common stock, and the program may be suspended or discontinued at any time.

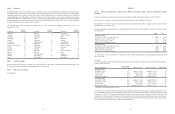

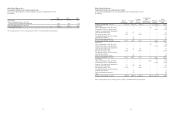

During the first quarter of fiscal year 2015, the Board authorized an increase in the Company’s quarterly dividend to $0.13 per

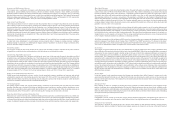

common share from $0.12 per common share. The following table provides a summary of dividends declared per common share

during fiscal years 2015 and 2014 (in millions, except per share amounts):

Date of declaration Dividend per

common share Date of record Date of payment Total amount

)LVFDO\HDU

November 5, 2014 $ 0.13 January 16, 2015 January 27, 2015 $ 47

March 10, 2015 0.13 April 10, 2015 April 21, 2015 47

June 9, 2015 0.13 July 2, 2015 July 14, 2015 47

September 15, 2015 (1) 0.13 October 2, 2015 October 13, 2015 45

)LVFDO\HDU

November 1, 2013 $ 0.12 January 17, 2014 January 28, 2014 $ 45

February 24, 2014 0.12 April 11, 2014 April 22, 2014 44

June 12, 2014 0.12 July 3, 2014 July 15, 2014 44

September 11, 2014 0.12 September 26, 2014 October 7, 2014 43

(1) Dividend accrued at September 27, 2015

On November 4, 2015, the Board authorized an increase in the Company’s quarterly dividend to $0.135 per common share from

$0.13 per common share. The Company will pay future dividends at the discretion of the Board. The continuation of these

payments, the amount of such dividends, and the form in which dividends are paid (cash or stock) depend on many factors,

including the results of operations and the financial condition of the Company. Subject to these qualifications, the Company

currently expects to pay dividends on a quarterly basis.

Net proceeds to the Company from the exercise of stock options by team members are driven by a number of factors, including

fluctuations in our stock price, and totaled approximately $66 million, $42 million and $81 million in fiscal years 2015, 2014

and 2013, respectively. The Company intends to keep its broad-based stock option program in place, but also intends to limit

the number of shares granted in any one year so that annual earnings dilution from share-based payment expense will not exceed

10%. The Company believes this strategy is best aligned with its stakeholder philosophy because it limits future earnings dilution

from options and at the same time retains the broad-based stock option plan, which the Company believes is important to team

member morale, its unique corporate culture and its success. At September 27, 2015, September 28, 2014 and September 29,

2013 approximately 32.9 million shares, 37.6 million shares and 42.3 million shares of our common stock, respectively, were

available for future stock incentive grants.

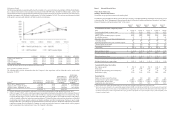

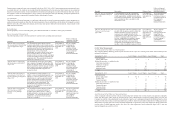

The Company is committed under certain capital leases for rental of certain buildings, land and equipment, and certain operating

leases for rental of facilities and equipment. These leases expire or become subject to renewal clauses at various dates through

2054. The following table shows payments due by period on contractual obligations as of September 27, 2015 (in millions):

Total Less than 1

year

1-3

years

3-5

years

More than 5

years

Capital lease obligations (including interest) $ 102 $ 6 $ 12 $ 10 $ 74

Operating lease obligations (1) 8,902 430 1,018 1,066 6,388

Total $ 9,004 $ 436 $ 1,030 $ 1,076 $ 6,462

(1) Amounts exclude taxes, insurance and other related expense

Gross unrecognized tax benefits and related interest and penalties at September 27, 2015 were not material. Although a reasonably

reliable estimate of the period of cash settlement with respective taxing authorities cannot be determined due to the high degree

26

of uncertainty regarding the timing of future cash outflows associated with the Company’s unrecognized tax benefits, as of

September 27, 2015, the Company does not expect tax audit resolution will reduce its unrecognized tax benefits in the next 12

months.

We periodically make other commitments and become subject to other contractual obligations that we believe to be routine in

nature and incidental to the operation of the business. Management believes that such routine commitments and contractual

obligations do not have a material impact on our business, financial condition or results of operations.

Our principal historical sources of liquidity have included cash generated by operations, available cash and cash equivalents,

and short-term investments. Absent any significant change in market conditions, we expect planned expansion and other

anticipated working capital and capital expenditure requirements for the next 12 months will be funded by these sources.

Subsequent to fiscal year 2015, the Company entered into a new credit facility (“the Credit Agreement”) that provides for an

unsecured revolving credit facility in the aggregate principal amount of $500 million, which may be increased from time to time

by up to $250 million in the aggregate pursuant to an expansion feature set forth in the Credit Agreement. The Credit Agreement

also provides for a letter of credit subfacility of up to $250 million and a swingline subfacility of up to $50 million. The Credit

Agreement is scheduled to mature, and the commitments thereunder will terminate, on November 2, 2020.

In addition, prior to the end of the first quarter of fiscal year 2016, the Company intends to incur additional long-term debt of

up to $1.0 billion. The amount and composition of this debt will depend on market conditions and capital allocation considerations

at the time the debt is incurred. The Company may also incur additional short-term debt of up to $350 million, which would be

repaid with proceeds from the long-term debt. The Company intends on continuing to maintain a strong investment-grade profile

and a balance sheet that provides the financial flexibility to pursue its strategic growth initiative. Proceeds from any debt incurred

would be used for general corporate purposes, including the repurchase of stock. The Company’s intent is to spend the majority

of the new $1.0 billion share repurchase authorization in the first half of fiscal year 2016.

There can be no assurance, however, that the Company will continue to generate cash flows at or above current levels or that

other sources of capital will be available to us in the future.

Off-Balance Sheet Arrangements

Our off-balance sheet arrangements at September 27, 2015 consisted of operating leases disclosed in the above contractual

obligations table, as well as the Credit Agreement discussed above. Additionally, we enter into forward purchase agreements

for certain products in the ordinary course of business. Purchase commitments do not exceed anticipated use within an operating

cycle. We have no other off-balance sheet arrangements that have had, or are reasonably likely to have, a material current or

future effect on our consolidated financial statements or financial condition.

Critical Accounting Policies

The preparation of our financial statements in conformity with generally accepted accounting principles requires us to make

estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, expenses and related disclosures of

contingent assets and liabilities. Actual amounts may differ from these estimates. We base our estimates on historical experience

and on various other assumptions and factors that we believe to be reasonable under the circumstances. On an ongoing basis,

we evaluate the continued appropriateness of our accounting policies and resulting estimates to make adjustments we consider

appropriate under the facts and circumstances.

We have chosen accounting policies that we believe are appropriate to report accurately and fairly our operating results and

financial position, and we apply those accounting policies in a consistent manner. Our significant accounting policies are

summarized in Note 2 of the Notes to Consolidated Financial Statements in “Item 8. Financial Statements and Supplementary

Data” of this report. We believe that the following accounting policies are the most critical in the preparation of our financial

statements because they involve the most difficult, subjective or complex judgments about the effect of matters that are inherently

uncertain.

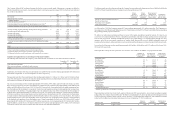

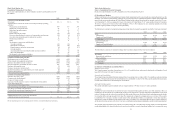

Inventories

The Company values inventories at the lower of cost or market. Cost was determined using the dollar value retail last-in, first-

out (“LIFO”) method for approximately 92.2% and 93.5% of inventories in fiscal years 2015 and 2014, respectively. Under the

LIFO method, the cost assigned to items sold is based on the cost of the most recent items purchased. As a result, the costs of

the first items purchased remain in inventory and are used to value ending inventory. The excess of estimated current costs over

LIFO carrying value, or LIFO reserve, was approximately $49 million and $48 million at September 27, 2015 and September 28,

2014, respectively. Costs for remaining inventories are determined by the first-in, first-out method. Cost before the LIFO