Westjet 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 WESTJET ANNUAL REPORT

53

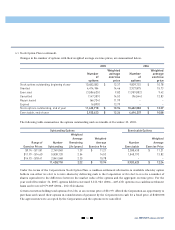

(c) Stock Option Plan (continued):

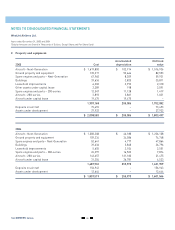

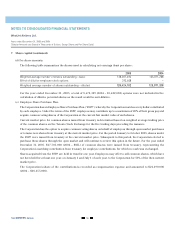

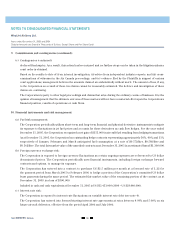

Changes in the number of options, with their weighted average exercise prices, are summarized below:

2005 2004

Weighted Weighted

Number average Number average

of exercise of exercise

options price options price

Stock options outstanding, beginning of year

10,682,082 $ 12.37 9,809,753 $ 10.78

Granted 4,474,184 14.46 2,927,875 15.73

Exercised (3,506,625) 9.82 (1,959,002) 9.42

Cancelled (147,309) 14.53 (96,544) 12.83

Repurchased (66,724) 11.99 – –

Expired (6,890) 13.79 – –

Stock options outstanding, end of year 11,428,718 $ 13.94 10,682,082 $ 12.37

Exercisable, end of year 3,920,623 $ 12.24 4,694,357 $ 10.88

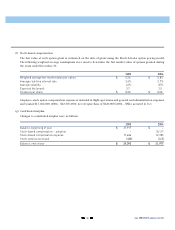

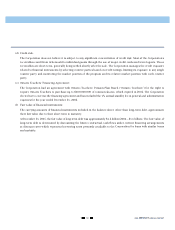

The following table summarizes the options outstanding and exercisable at December 31, 2005:

Outstanding Options Exercisable Options

Weighted

Average Weighted Weighted

Range of Number Remaining Average Number Average

Exercise Prices Outstanding Life (years) Exercise Price Exercisable Exercise Price

$9.74 - $11.81 2,749,040 1.39 $ 11.21 2,380,430 $ 11.21

$11.99 - $14.60 5,838,130 2.54 14.53 1,540,193 13.82

$14.93 - $18.41 2,841,548 2.35 15.78 – –

11,428,718 2.22 $ 13.94 3,920,623 $ 12.24

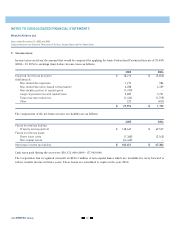

Under the terms of the Corporation’s Stock Option Plan, a cashless settlement alternative is available whereby option

holders can either (a) elect to receive shares by delivering cash to the Corporation or (b) elect to receive a number of

shares equivalent to the difference between the market value of the options and the aggregate exercise price. For the

year ended December 31, 2005, options holders exercised 3,151,923 (2004 – 449,635) options on a cashless settlement

basis and received 979,089 (2004 – 102,354) shares.

Certain executives holding total options of 66,724, at an exercise price of $11.99, offered the Corporation an opportunity to

purchase and cancel their options in consideration of payment by the Corporation in cash for a fixed price of $320,000.

The agreements were accepted by the Corporation and the options were cancelled.