Westjet 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 WESTJET ANNUAL REPORT

29

net income tax expense of $28.0 million for the year ended

December 31, 2005. Our effective tax rate realized on

earnings before income taxes for 2005 was higher than the

expected rate due to a number of factors, including the

addition of certain non-deductible expenses, non-deductible

stock-based compensation expense and the non-taxable

portion of capital gains. As well, offsetting our current tax

recovery is our provision for large corporation’s tax and

capital taxes of $5.0 million, an increase of $1.3 million

over 2004. The tax rate changes are primarily related to

non-capital losses being carried back to years in which the

tax rate was higher than the current expected tax rate.

Certain provincial rate reductions are also reflected as a

decrease to future tax expense as required under GAAP.

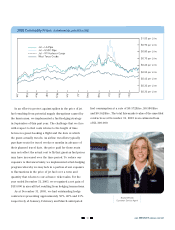

FOURTH QUARTER 2005

OPERATING RESULTS IN REVIEW

Total operating revenue increased by 34.4% to $367.9

million in the last three months of 2005 compared to

$273.7 million in same period in 2004. Operating expenses

for the fourth quarter amounted to $359.8 million, up

from $339.5 million in the fourth quarter of 2004.

Extremely high fuel prices and increasing landing,

terminal and airport improvement fees contributed to the

increase in costs from 2004 to 2005. Fuel costs represent

our largest expense and increased 20.7% on an ASM basis

in the fourth quarter of 2005 over the same period in 2004.

For the three months ended December 31, 2005, the

CASM for airport operations increased by 4.5% over the

same period in 2004. The fourth quarter per-ASM costs

are affected by the natural stage length dilution common

with longer trip lengths and actually increased 9.5% on a

per-departure basis.

The rise in unit costs for the quarter can be attributed

to three main changes in the fourth quarter of 2005 versus

the fourth quarter of 2004:

The weighted average airport rate and fees at

Canadian airports increased by approximately 6.0%.

Transborder and charter activity increased 21.6%,

increasing operations outside Canada as a percentage of

total departures. These activities generally incur higher

airport fees than domestic operations and additional costs

associated with US pre-clearance services.

The airport operations group incurred additional

costs associated with our buy-on-board snack and light

meal program.

Candice Li

Audit & Advisory Services Director

WestJetters have embraced and

benefited from our compensation

strategy of aligning corporate success

with personal success.