Westjet 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

YOUR OWNERS’ MANUAL

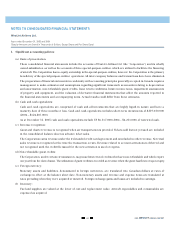

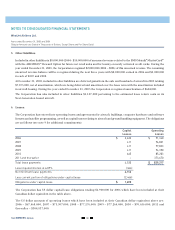

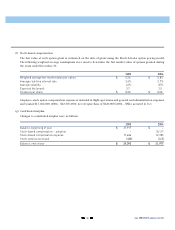

5. Other liabilities:

Included in other liabilities is $8,000,000 (2004 - $10,000,000) of unearned revenue related to the BMO Mosaik®MasterCard®*

with the AIR MILES®†Reward Option for future net retail sales and for bounty on newly activated credit cards. During the

year ended December 31, 2005, the Corporation recognized $2,000,000 (2004 – $NIL) of this unearned revenue. The remaining

unearned revenue balance will be recognized during the next three years with $2,000,000 earned in 2006 and $3,000,000

in each of 2007 and 2008.

At December 31, 2005, included in other liabilities are deferred gains from the sale and leaseback of aircraft in 2005 totaling

$7,875,000, net of amortization, which are being deferred and amortized over the lease term with the amortization included

in aircraft leasing. During the year ended December 31, 2005 the Corporation recognized amortization of $604,000.

The Corporation has also included in other liabilities $1,107,000 pertaining to the estimated lease return costs on its

Next-Generation leased aircraft.

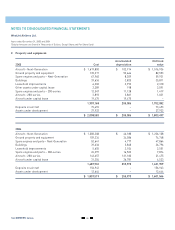

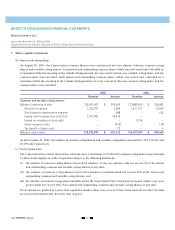

6. Leases:

The Corporation has entered into operating leases and agreements for aircraft, buildings, computer hardware and software

licenses and satellite programming, as well as capital leases relating to aircraft and ground handling equipment. The obligations

are as follows (see note 9 for additional commitments):

Capital Operating

Leases Leases

2006 $ 2,622 $ 91,340

2007 411 96,821

2008 411 97,833

2009 411 94,350

2010 665 85,203

2011 and thereafter – 373,670

Total lease payments 4,520 $ 839,217

Less imputed interest at 6.09% (364)

Net minimum lease payments 4,156

Less current portion of obligations under capital lease (2,466)

Obligations under capital lease $ 1,690

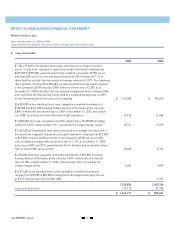

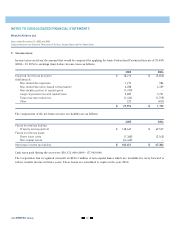

The Corporation has US dollar capital lease obligations totaling $1,900,000 for 2006 which have been included at their

Canadian dollar equivalent in the table above.

The US dollar amounts of operating leases which have been included at their Canadian dollar equivalent above are:

2006 – $67,468,000, 2007 – $75,507,000, 2008 – $77,276,000, 2009 – $77,264,000, 2010 – $70,636,000, 2011 and

thereafter – $304,837,000.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

WestJet Airlines Ltd.

Years ended December 31, 2005 and 2004

(Tabular Amounts are Stated in Thousands of Dollars, Except Share and Per Share Data)