Westjet 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 WESTJET ANNUAL REPORT

31

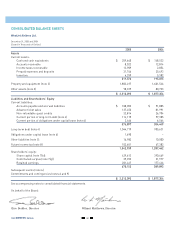

the year. Included in investing activities in 2005 is both

the purchase and sale of eight Next-Generation aircraft

for which we completed sale and leaseback transactions

in the year, resulting in a gain on disposal of $8.5 million

that we have deferred on our balance sheet. These deferred

gains are being amortized as an offset to the aircraft

leasing costs over the lease term. Aircraft additions in

2005 consist of payments totalling $574.2 million for three

737-600 aircraft, seven 737-700 aircraft, five 737-800

aircraft net of previous deposits paid on those aircraft and

the purchase of two previously leased 200-series aircraft.

In addition to those payments, aircraft additions also

include $39.2 million paid in progress payments on future

aircraft deliveries. Aircraft disposals in 2005 includes

the subsequent sale of three 737-700 and five 737-800

aircraft for which we entered into sale and leaseback

transactions in the year, as previously mentioned. We also

disposed of 13 737-200 aircraft during the year.

During 2005, we also incurred other capital expenditures

for $33.7 million relating to information technology and

$59.9 million to purchase live satellite television,

miscellaneous aircraft parts and ground handling and

training equipment.

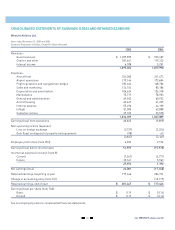

The year 2005 was another important year in securing

the future financial strength and flexibility of our balance

sheet, as we were able to secure a final commitment

from the Ex-Im Bank to support the financing of 13

aircraft consisting of five Boeing 737-700s and eight

Boeing 737-600s. With the support of the Ex-Im Bank

guarantee, we completed financing arrangements for US

$386 million for the delivery of all 13 aircraft. This facility

will be drawn in Canadian dollars in separate instalments

with 12-year terms for each new aircraft. During 2005,

we took delivery of seven aircraft under this facility, and

have drawn a total of $256.4 million at an average fixed

rate of 4.79%. This financing activity brings the cumulative

number of aircraft financed with loan guarantees to 33,

with an outstanding debt balance of $1.12 billion associated

with those aircraft. All of this debt has been financed in

Canadian dollars at fixed rates ranging from 4.62% to 5.98%,

thus eliminating all future foreign exchange and interest

rate exposure on these US-dollar aircraft purchases.

In addition to the final commitment described above, Ex-Im

Bank has also provided us with a preliminary commitment

of US $324 million to cover an additional 10 aircraft to be

delivered between July 2006 and November 2007.

Maika Schulz

Maintenance Administrator

The year 2005 was another important year

in securing the future financial strength

and flexibility of our balance sheet...