Westjet 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 WESTJET ANNUAL REPORT

47

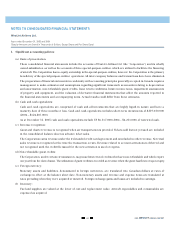

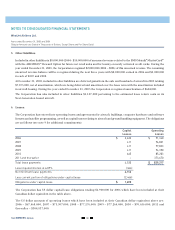

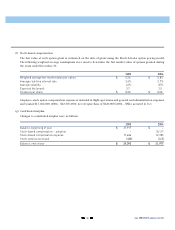

In 2004, the Corporation made the decision to accelerate the retirement dates of its older Boeing 737-200 aircraft to have

virtually all 200-series aircraft retired by the end of 2005 rather than in 2008 as contemplated under the previous fleet plan.

As a result of the accelerated retirement dates on the 200-series aircraft, the Corporation evaluated the recoverability of

the aircraft and the related rotable parts and equipment, and the 200-series flight simulator (the “200-series assets”).

This analysis indicated the estimated undiscounted future cash flows generated by these 200-series assets on a specific

asset by asset basis were less than their carrying values. As a result, the carrying values of the 200-series assets were reduced to

fair market value which resulted in an impairment loss of $47,577,000 which was included in the depreciation and amortization

expense for the year ended December 31, 2004. Management estimated fair market value using third-party appraisals and recent

sales and leasing transactions with consideration made for the currently available market for 200-series assets.

During the year, property and equipment was acquired at an aggregate cost of $2,137,000 (2004 – $NIL) by means of

capital leases.

During 2005, the Corporation disposed of 13 200-series aircraft to an unrelated third party and entered into an agreement

to sell the remaining spare engines, parts and flight simulator. This transaction will be completed in early 2006.

During the year the Corporation capitalized $3,250,000 (2004 – $3,675,000) of interest.

Included in Aircraft – Next-Generation are estimated lease

return costs for these aircraft under operating leases totaling

$1,107,000 (2004 – $NIL). These amounts are amortized on the straight-line basis over the term of each lease.

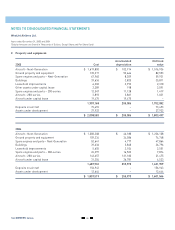

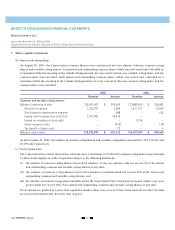

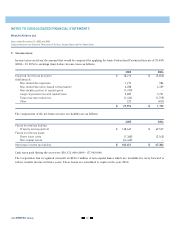

3. Other assets:

2005 2004

Financing fees $ 50,010 $ 39,138

Security deposits on aircraft and other leaseholds 32,086 24,563

Hedge settlements 19,479 19,479

Other amounts 1,017 562

NAV Canada security deposit – 4,500

Accumulated amortization (12,573) (7,509)

$ 90,019 $ 80,733

Financing fees are related to the facility for the purchase of 39 Boeing Next-Generation aircraft and hedge settlements relate

to certain leased Boeing Next-Generation aircraft. Amortization of financing fees totalling $3,673,000 (2004 - $2,753,000) has

been included in depreciation and amortization and amortization of hedge settlements totaling $1,391,000 (2004 - $1,391,000)

has been included in aircraft leasing for the year ended December 31, 2005.