Westjet 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

YOUR OWNERS’ MANUAL

As at February 28, 2006, we had 120,028,091 common

voting shares outstanding, 9,550,214 variable voting shares

outstanding and 11,359,986 stock options outstanding.

To facilitate the financing of our Ex-Im Bank supported

aircraft, we utilize three special-purpose entities. We

have no equity ownership in the special-purpose entities;

however, we are the primary beneficiary of the

special-purpose entities’ operations. The accounts of

the special-purpose entities have been consolidated in

the financial statements.

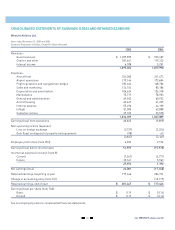

Contractual Obligations (MILLIONS)

Total 2006 2007 2008 2009 2010 Thereafter

Long-term debt repayments $ 1,160 $ 114 $ 114 $ 127 $ 112 $ 112 $ 581

Capital lease obligations(1), (2) 531––1–

Operating leases(3) 839 91 97 98 94 85 374

Purchase obligations(4) 728432167129–––

Total contractual obligations $ 2,732 $ 640 $ 379 $ 354 $ 206 $ 198 $ 955

(1) The Company’s capital leases are denominated in US dollars. The obligation in 2006 is US $1,900.000.

(2) Includes imputed interest at 6.09% totalling $364,000.

(3) Included in operating leases are US-dollar operating leases primarily related to aircraft. The obligations of these operating leases in US dollars are: 2006 – $67,468,000;

2007 – $75,507,000; 2008 – $77,276,000; 2009 – $77,264,000; 2010 – $70,636,000; 2011 and thereafter – $304,837,000.

(4) Relates to purchases of aircraft, live satellite television systems, winglets and a Next-Generation flight simulator.

Russell Munroe

Shipping Administrator

Contractual Obligations,

Off-Balance Sheet Arrangements

and Commitments

Our contractual obligations for each of the next five

years, which do not include commitments for goods and

services required in the ordinary course of business, are

indicated in the table below (see “Contractual Obligations”).

We currently have 18 Next-Generation aircraft under

operating leases in our fleet, and have entered into an

agreement with an independent third party to lease two

additional 737-700 aircraft to be delivered during February

and April 2007 for an eight-year term in US dollars. These

amounts have been included at their Canadian-dollar

equivalent in the table below. Although the obligations

related to these agreements are not recognized on our

balance sheet, we nevertheless include these commitments

in assessing our overall leverage. Our debt-to-equity ratio,

including off-balance-sheet debt of $481.3 million, was

2.5 to 1 at the end of 2005 compared to 2.2 to 1 at the end of

2004. In an industry that is often characterized by high debt,

we believe the ideal debt-to-equity ratio is no more than 3.0

to 1. Although we have increasing debt obligations from

new

aircraft purchases, we have successfully maintained an

enviable debt-to-equity ratio that reflects our ability to

effectively manage our balance sheet.