Westjet 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 WESTJET ANNUAL REPORT

15

strengthening our relationships with major travel agents

and by launching a very successful advertising campaign

focused upon our service and our people.

Successful initiatives included the introduction of

self-service kiosks and web check-in. These methods now

account for 40% of our check-ins at airports where

kiosks are available and have enabled us to reduce the

cost of providing this service to our guests.

To ensure that we continue to offer our guests the

highest-value product in the Canadian industry, we continued

with our program of outfitting our new Next-Generation

737-700 and 737-800 aircraft with live seatback satellite

television throughout 2005. All of our new aircraft continue

to be configured with more legroom and leather seats.

The comfortable and entertaining environment we offer

our guests is a key competitive advantage that builds on

our long-standing promise of offering low fares and a safe,

friendly travel experience.

SELECTED ANNUAL

AND QUARTERLY INFORMATION

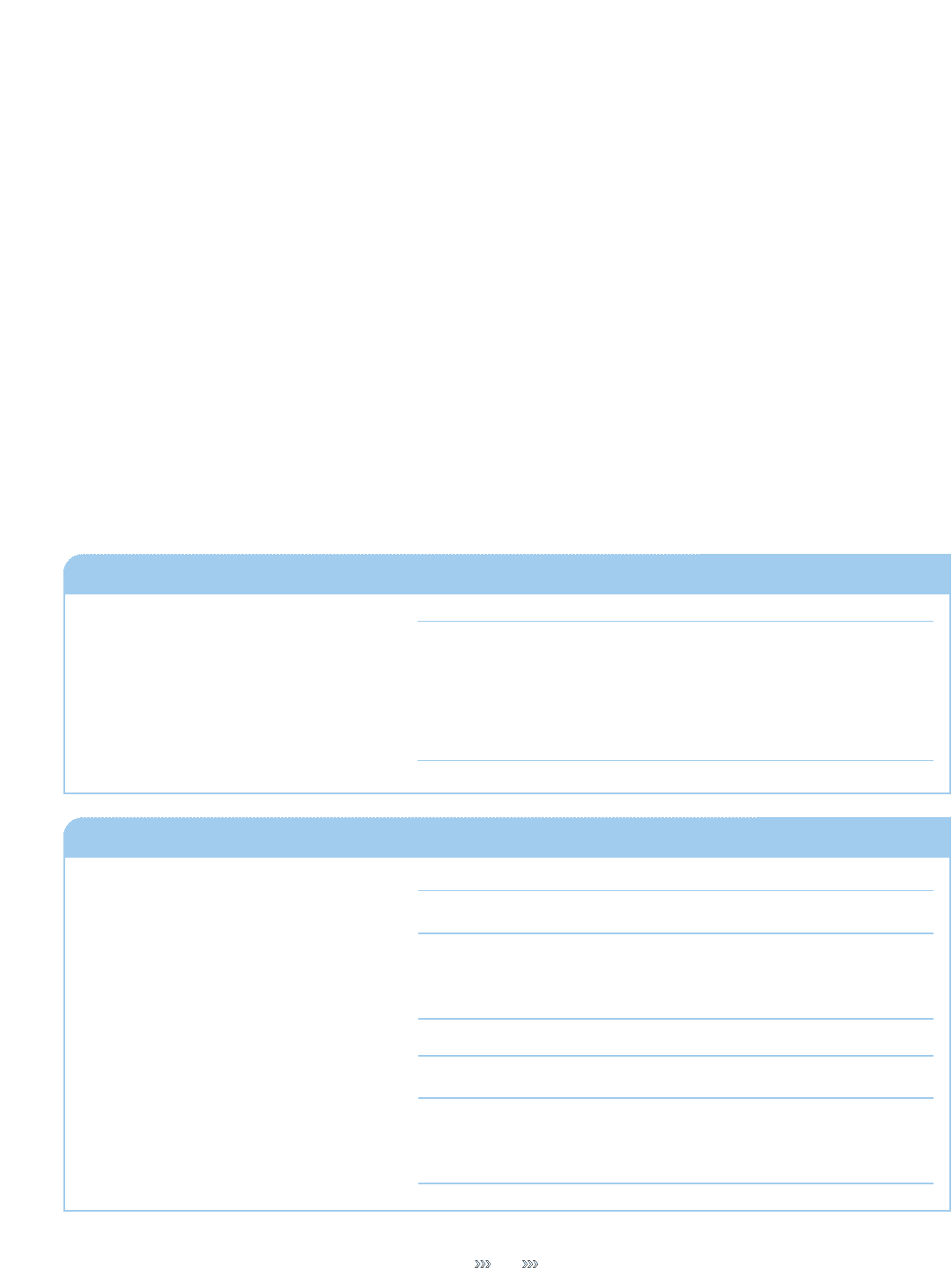

The tables below (“Annual audited financial information”

and “Quarterly unaudited financial information”) set forth

selected data derived from our consolidated financial

statements for the three years ended December 31 and

the eight previous quarters ended December 31, 2005.

These tables have been prepared in accordance with

Canadian generally accepted accounting principles and

Three Months Ended

Dec. 31 Sept. 30 June 30 Mar. 31

2005 2005 2005 2005

Total revenues $ 368 $ 406 $ 326 $ 295

Net earnings (loss) $ 2 $ 30 $ 2 $ (10)

Basic earnings (loss) per share

$ 0.01 $ 0.24 $ 0.02 $ (0.08)

Diluted earnings (loss) per share $ 0.01 $ 0.23 $ 0.02 $ (0.08)

Three Months Ended

Dec. 31 Sept. 30 June 30 Mar. 31

2004 2004 2004 2004

Total revenues $ 274 $ 310 $ 257 $ 217

Net earnings (loss) $ (46) $ 21 $ 7 $ 1

Basic earnings (loss) per share

$ (0.37) $ 0.17 $ 0.06 $ 0.00

Diluted earnings (loss) per share $ (0.37) $ 0.17 $ 0.06 $ 0.00

2005 2004 2003

Total revenues $ 1,395 $ 1,058 $ 864

Net earnings (loss) $ 24 $ (17) $ 61

Basic earnings (loss) per share

$ 0.19 $ (0.14) $ 0.52

Diluted earnings (loss) per share

$ 0.19 $ (0.14) $ 0.52

Total assets $ 2,213 $ 1,877 $ 1,477

Total long-term liabilities(1) $ 1,180 $ 1,020 $ 662

Shareholders’ equity $ 670 $ 590 $ 581

(1) Long-term liabilities include current and long-term portions of long-term debt and obligations under capital leases and other liabilities.

Annual audited financial information (IN MILLIONS EXCEPT PER SHARE DATA)

Quarterly unaudited financial information (IN MILLIONS EXCEPT PER SHARE DATA)