Westjet 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 WESTJET ANNUAL REPORT

45

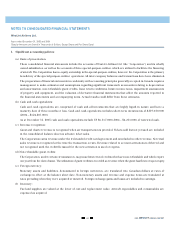

(k) Future income tax:

The Corporation uses the liability method of accounting for future income taxes. Under this method, current income

taxes are recognized for the estimated income taxes payable for the current year. Future income tax assets and liabilities

are recognized for temporary differences between the tax and accounting bases of assets and liabilities, calculated using

the currently enacted or substantively enacted tax rates anticipated to apply in the period that the temporary differences

are expected to reverse.

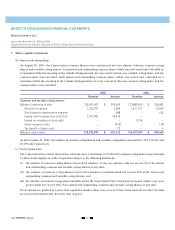

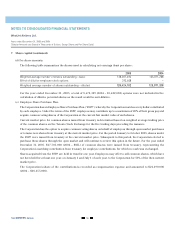

(l) Stock-based compensation plans:

On January 1, 2004, the Corporation changed its accounting policy related to stock options granted on or after January 1, 2002.

Under the new policy, the Corporation determines the fair value of stock options on their grant date and records this

amount as compensation expense over the period that the stock options vest, with a corresponding increase to contributed

surplus. The Corporation has retroactively adopted the changes, without restatement of prior periods, on January 1, 2004

which resulted in retained earnings decreasing by $10,117,000 and an offsetting entry to contributed surplus.

As new options are granted, the fair value of these options will be expensed on a straight-line basis over the applicable

vesting period, with an offsetting entry to contributed surplus. The fair value of each option grant is estimated on the

date of grant using the Black-Scholes option pricing model. Upon the exercise of stock options, consideration received

together with amounts previously recorded in contributed surplus is recorded as an increase in share capital.

(m) Financial instruments:

Derivative financial instruments are utilized by the Corporation from time to time in the management of its foreign

currency, interest rate and fuel price exposures. The Corporation’s policy is not to utilize derivative financial instruments

for trading or speculative purposes.

The Corporation formally documents all relationships between hedging instruments and hedged items, as well as its

risk management objective and strategy for undertaking various hedge transactions. This process includes linking

all derivatives to specific assets and liabilities on the balance sheet or to specific firm commitments or anticipated

transactions. The Corporation also formally assesses, both at the hedge’s inception and on an ongoing basis, whether

the derivatives that are used in hedging transactions are highly effective in offsetting changes in fair values or cash flows

of hedged items. In the event that a derivative financial instrument is not designated for hedge accounting, does not

qualify for hedge accounting or the event that the hedge is ineffective, changes in the fair value of derivative financial

instruments are recorded in non-operating income or expense.

Gains or losses relating to derivatives that are designated as hedges are deferred in other assets and/or other liabilities

and recognized in the same period and in the same financial category as the corresponding hedged transactions.

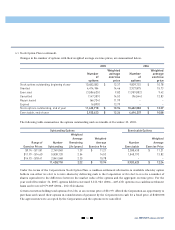

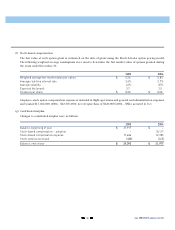

(n) Per share amounts:

Basic per share amounts are calculated using the weighted average number of shares outstanding during the year.

Diluted per share amounts are calculated based on the treasury stock method, which assumes that any proceeds obtained

on the exercise of options would be used to purchase common shares at the average price during the period. The weighted

average number of shares outstanding is then adjusted by the net change.

(o) Comparative figures:

Certain prior-period balances have been reclassified to conform to current period’s presentation.