Westjet 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Years ended December 31, 2001 and 2000

(Tabular Amounts are Stated in Thousands of Dollars)

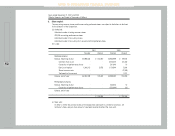

9. Risk management: (continued)

(d) Interest rate risk:

The Corporation has entered into fixed rate debt agreements in order to manage its interest rate

exposure on debt instruments. These agreements are described in note 4.

(e) Credit risk:

The Corporation does not believe it is subject to any significant concentration of credit risk. Most of

the Corporation’s receivables result from tickets sold to individual passengers through the use of

major credit cards and travel agents. These receivables are short-term, generally being settled shortly

after the sale. The Corporation manages the credit exposure related to financial instruments by

selecting counter parties based on credit ratings, limiting its exposure to a single counter party and

monitoring the market position of the program and its relative market position with each counter

party.

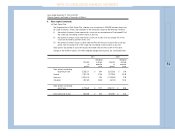

(f) Fair value of financial instruments:

The carrying amounts of financial instruments included in the balance sheet, other than long-term

debt, approximate their fair value due to their short-term to maturity.

At December 31, 2001, the fair value of the long-term debt was approximately $51.9 million, based

on market prices of debt with comparable remaining maturities.

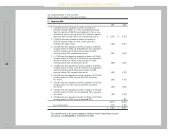

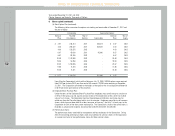

10. Subsequent events:

a) Subsequent to year-end, the Corporation entered into a letter of intent to lease two 737-800 aircraft

for a period of seven months commencing May 1, 2002 to November 30, 2002. In addition, the

Corporation has signed agreements to exercise two of its purchase rights for 737-700 aircraft with

anticipated delivery dates of November and December 2002 as well as a letter of intent for the

acquisition of another next generation flight simulator for the total approximate consideration of

$107 million.

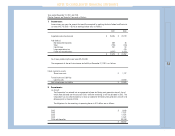

(b) The Corporation has also announced a stock split on the basis of three common shares for each two

common shares held. The proposed stock split is subject to shareholders’ approval and will be

considered at the Corporation’s Annual and Special Meeting.

(c) Subsequent to year-end, the Corporation entered into an Underwriting Agreement to issue 2,500,000

common shares of the Corporation for net proceeds of approximately $66 million. The Agreement

also provides the underwriters the option to purchase an additional 500,000 common shares which,

if fully exercised, would increase the net proceeds to approximately $79 million.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS