Westjet 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

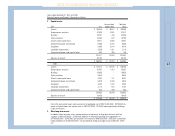

Years ended December 31, 2001 and 2000

(Tabular Amounts are Stated in Thousands of Dollars)

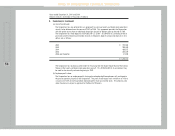

6. Share capital (continued):

(d) Stock Option Plan (continued):

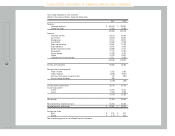

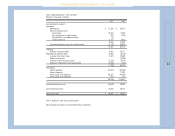

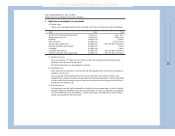

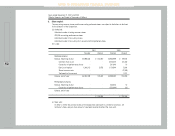

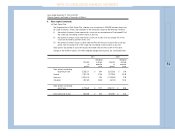

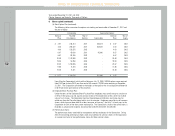

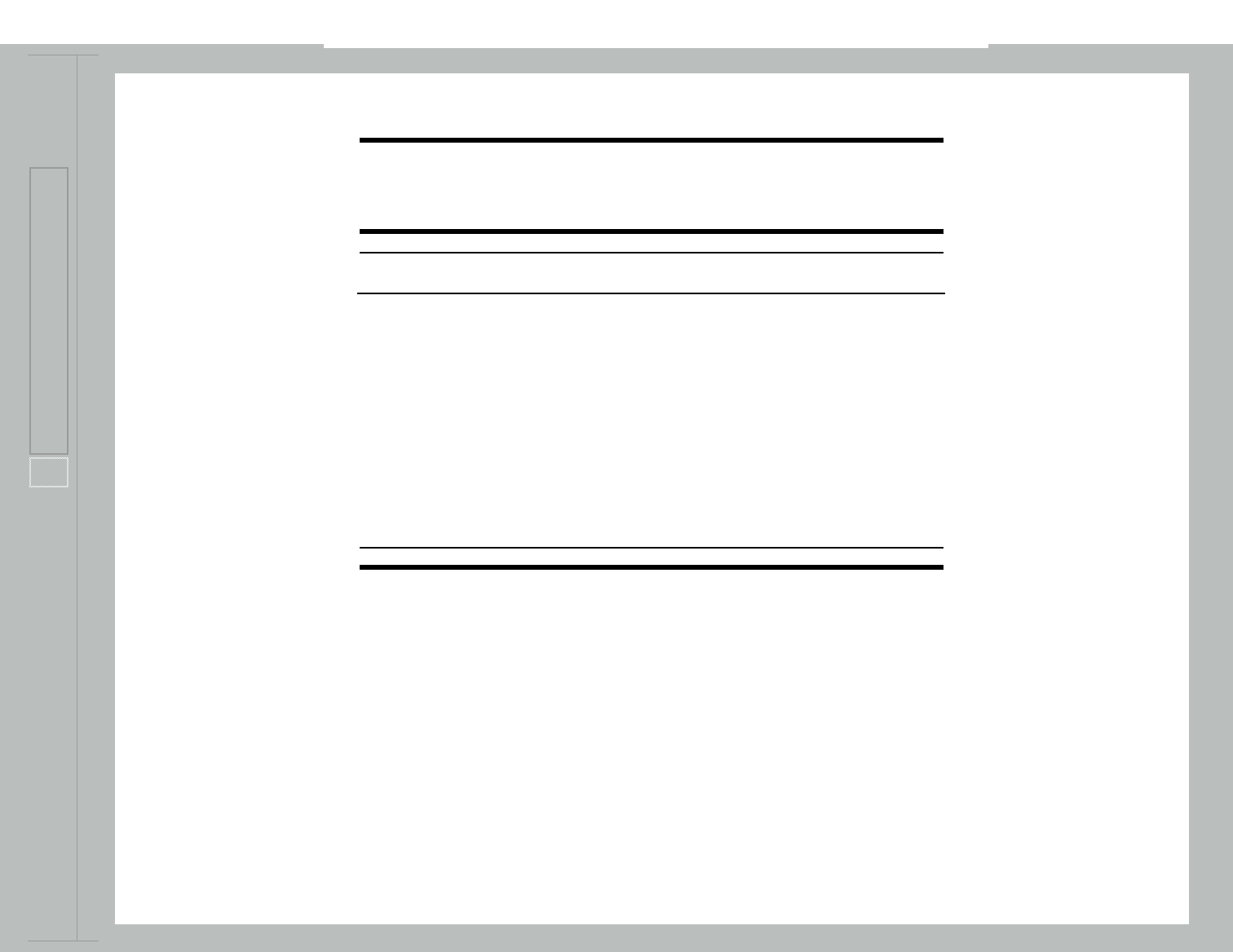

The following table summarizes the options outstanding and exercisable at December 31, 2001 and

the year of expiry:

Outstanding Exercisable Options

Exercise Number Year of Exercise Year of

Price Outstanding Vesting Exercisable Price Expiry

$ 2.67 248,414 2001 248,414 $ 2.67 2002

4.00 259,472 2001 259,472 4.00 2002

4.00 133,875 2002 - 4.00 2003

6.67 45,000 2001 45,000 6.67 2002

6.67 83,355 2002 - 6.67 2003

20.48 1,179,880 2003 - 20.48 2004

19.00 16,850 2004 - 19.00 2005

22.02 1,740,095 2004 - 22.02 2005

17.86 6,416 2004 - 17.86 2005

16.48 6,321 2004 - 16.48 2005

$ 17.77 3,719,678 552,886 $ 3.62

Upon filing the Corporation’s initial public offering on July 13, 1999, 158,355 options were re-priced

from $4.00 per share to $6.67 per share and of this amount 128,355 were remaining at December

31, 2001. The Corporation committed to the holders of the options that it would pay the differential

of $2.67 per share upon exercise of those options.

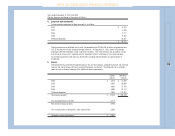

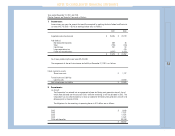

(e) Employee Share Purchase Plan:

Under the terms of the Employee Share Purchase Plan, employees may contribute up to a maximum

of 20% of their gross pay and acquire common shares of the Corporation at the current fair market

value of such shares. The Corporation matches the employee contributions and shares may be

withdrawn from the Plan after being held in trust for one year. Employees may offer to sell common

shares, which have not been held for at least one year, on January 1 and July 1 of each year, to the

Corporation for 50% of the then current market price. The Corporation’s share of the contributions is

recorded as compensation expense and amounted to $6,081,000 (2000 - $4,025,000).

(f) Performance shares:

The performance shares were held by management and key employees of the Corporation. During

2000, the remaining performance shares were all converted into common shares of the Corporation

at a conversion factor of two performance shares for three common shares.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS