Westjet 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

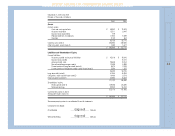

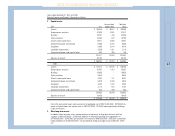

Years ended December 31, 2001 and 2000

(Tabular Amounts are Stated in Thousands of Dollars)

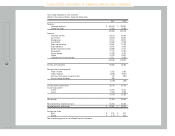

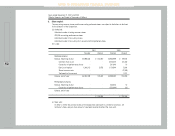

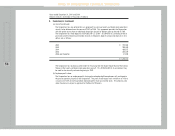

2. Capital assets:

Accumulated Net book

2001 Cost depreciation value

Aircraft $ 188,000 $ 49,912 $ 138,088

Spare engines and parts 42,628 5,551 37,077

Buildings 23,051 446 22,605

Flight simulators 19,455 670 18,785

Aircraft under capital lease 18,617 2,980 15,637

Computer hardware and software 12,388 3,732 8,656

Equipment 6,990 2,614 4,376

Leasehold improvements 3,539 1,421 2,118

Computer hardware under capital lease 643 494 149

315,311 67,820 247,491

Deposits on aircraft 53,194 - 53,194

$ 368,505 $ 67,820 $ 300,685

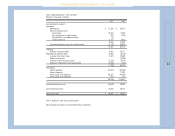

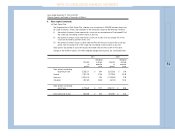

2000

Aircraft $ 174,014 $ 27,676 $ 146,338

Spare engines and parts 26,497 1,410 25,087

Buildings 19,958 - 19,958

Flight simulators 9,624 - 9,624

Aircraft under capital lease 9,202 151 9,051

Computer hardware and software 6,879 2,059 4,820

Equipment 5,003 1,470 3,533

Leasehold improvements 3,112 915 2,197

Computer hardware under capital lease 643 359 284

254,932 34,040 220,892

Deposits on aircraft 18,428 - 18,428

$ 273,360 $ 34,040 $ 239,320

During the year capital assets were acquired at an aggregate cost of $9,415,000 (2000 - $9,780,000) by

means of capital leases and interest costs of $467,000 (2000 - $275,000) were capitalized to buildings

under construction.

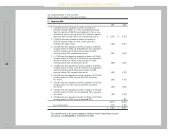

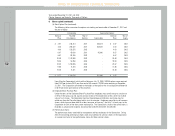

3. Other long-term assets:

Included in other long-term assets are pre-payments of premiums for long-term contracts with fuel

suppliers of $667,000 (2000 – $2,000,000), deposits on long-term operating lease agreements of

$4,748,000 (2000 - $3,435,000), pre-payments of insurance of $496,000 (2000 – $242,000), unamortized

hedge settlement of $1,087,000 (2000 – nil) and deferred foreign exchange losses of $490,000 (2000 –

nil).

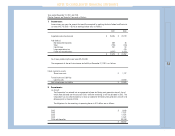

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS