Westjet 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

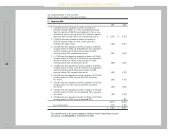

38

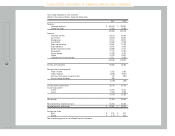

The company’s existing insurance policies for war

and terrorism coverage contains a seven-day

cancellation clause, which the insurers may invoke

at any time. There is also no assurance that the

Government of Canada will continue to provide

insurance for third-party terrorism and war risk

coverage in excess of $50 million after March 21,

2002.

Throughout 2001, WestJet continued to benefit

from our fuel-hedging program, which protected

42% of our jet fuel purchases from high energy

prices and a low Canadian currency. We anticipate

that approximately 34% of our 2002 jet fuel

purchases will be protected by this contract.

WestJet estimates the sensitivity of its exposure

on fuel costs to change in the price of crude oil (WTI

U.S.$/barrel) to be approximately $2 million for

every $1.00 change in the price of crude.

WestJet does not have significant exposure to

changing interest rates on our long-term debt as all

rates are currently fixed in nature.

As with others in the Canadian airline industry,

WestJet is exposed to U.S. dollar currency

fluctuations associated with purchases of

unhedged fuel, aircraft lease payments, aircraft

acquisition payments, and certain maintenance

expenditures. While the cost of protection from

this exposure remains unreasonably high, we will

continue to monitor this uncertainty, and where

appropriate will utilize financial instruments to

mitigate this risk. We estimate the impact to

operating earnings for a $0.01 decline in the

Canadian dollar (e.g. $1.55 to $1.54 CDN for one

U.S. dollar) to be approximately $1 million.

Effective January 1, 2002, WestJet will retroactively

adopt the new CICA standards for accounting for

Foreign Currency Translations. These new rules

eliminate the deferral and amortization of unrealized

translation gains and losses on foreign currency

denominated monetary items that have a fixed or

ascertainable life beyond the end of the fiscal year.

As at December 31, 2001, foreign exchange losses

of $490,000 had been deferred and included in

long-term assets of the Corporation.

MANAGEMENT’S DISCUSSION AND ANALYSIS

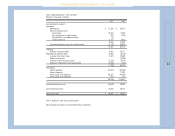

New Destination

YTH - Thompson, Manitoba

Service to Thompson, Manitoba began on December 14, 2001. The

third-largest city in Manitoba made perfect sense for WestJet. All-

jet service is a unique product in Thompson, and people there have

shown their appreciation with positive load factors to Winnipeg,

with connections across the WestJet network. The 45,000 people of

the Thompson area are proud of their city's designation as Canada's

second-coldest city in its size category - it's the perfect place for

that warm WestJet spirit!