Westjet 2001 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

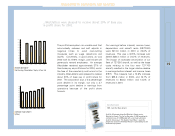

2001’s growth was 57.1%, the greatest full year over

year growth rate in our history just ahead of the

previous high in 1998 of 55.1%. It was also another

year of infrastructure building, a year of transition to

new aircraft and facilities, a year of turbulence in the

competitive environment, and a year of

extraordinary change in the airline industry. We

continued to expense our growth costs in building

for the future, and despite all of the challenges of

2001, measures of financial performance fared well

and our earnings increased from the previous year.

WestJet continued to produce profits in 2001 even

with the high cost of jet fuel, and in spite of the

unprecedented impact of the events of September

11th. Diluted earnings per share grew from $0.69 in

2000 to $0.79, while net earnings rose 23% from

$30.3 million in 2000 to $37.2 million this past year.

Due to the significantly higher amortization in 2001,

on a cash flow basis WestJet generated 47.3% more

cash from operations in 2001, at $76.5 million,

compared with $51.9 million in the year previous.

Since 1997, our earnings from operations have

always exceeded 10% of revenues. In 2001, our

earnings from operations remained in the double-

digit range at 12.4%, as compared with our best

ever performance of 16.1% in 2000.

Notwithstanding the decline in percentage of

revenues, in 2001 we achieved an 11.0% increase in

earnings from operations of $59.4 million, as

compared with $53.5 million one year earlier.

Our employee profit share is based on WestJet’s

annual earnings before tax and profit share itself –

our margin. This increased 3.5% to $68.6 million in

2001 compared with $66.3 million in 2000. As a

percentage of revenues, this margin percentage

declined from 2000’s record high of 19.9% to 2001’s

14.3%. Our methodology for calculating profit

sharing is simple: We calculate the margin

percentage achieved in the profit share period, and

apply that percentage to the margin to determine

the amount for distribution among our people. Thus,

a doubling of WestJet’s margin percentage from

10% to 20% results in a four-fold increase in profit

sharing as both elements double. In 2000, almost

20% was paid to employees, or about $13.5 million

once payroll taxes were accounted for. In 2001,

with our lower margin of 14.3%, $10.3 million went

into the profit share pool.

Results of Operations

This corporation’s annual growth rate, as measured by capacity or available

seat miles (ASMs), has averaged 56% since we started flying in 1996.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Since 1997, our earnings from operations

have always exceeded 10% of revenues.