Westjet 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

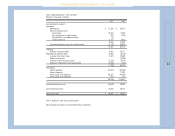

Years ended December 31, 2001 and 2000

(Tabular Amounts are Stated in Thousands of Dollars)

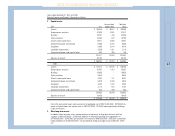

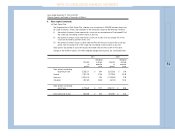

7. Income taxes:

Income taxes vary upon the amount that would be computed by applying the basic Federal and Provincial

tax rate of 43.7% (2000 – 45.0%) to earnings before taxes as follows:

2001 2000

Expected income tax provision $ 25,445 $ 23,718

Add (deduct):

Non-deductible expenses 459 35

Other (729) (124)

Capital taxes 251 170

Large corporations tax - 475

Future tax rate reductions (4,347) (1,822)

$ 21,079 $ 22,452

Cash taxes paid during the year were $25,700,000.

The components of the net future income tax liability at December 31, 2001 is as follows:

Future income tax assets:

Share issue costs $ 1,127

Future income tax liabilities:

Capital assets 22,060

Net future income tax liability $ 20,933

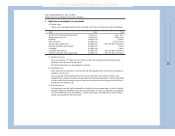

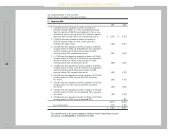

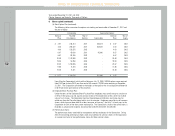

8. Commitments:

(a) Aircraft:

The Corporation has entered into an agreement to lease ten Boeing next generation aircraft, four of

which were delivered over the course of 2001, while the remaining six will be delivered in 2002. The

Corporation has also obtained options to lease an additional ten Boeing next generation aircraft to be

delivered prior to the end of 2006.

The obligations for the remaining six operating leases in U.S. dollars are as follows:

2002 $ 8,066

2003 17,621

2004 17,621

2005 17,621

2006 and thereafter 185,768

$ 246,697

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS