Westjet 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

WestJet has a fixed price, fixed volume jet fuel supply

arrangement with a major fuel supplier that has been in place

since 1999 and does not expire until June 2003. While the

pricing for this jet fuel is in Canadian cents per litre, it is

pegged to a U.S. $18.61 per barrel ceiling price for crude oil.

The fixed volume nature of the contract means that as we

grow the airline, a lesser portion of our fuel purchases fall

under this contract – 42% in 2001 as compared with 61% in

2000. Increasing energy prices in the first half of 2001, and

the fact that a smaller portion of our fuel was protected meant

that our 35.6-cent average jet fuel price in 2000 increased to

36.5 cents in 2001. However, WestJet’s cost per ASM for fuel

did decline year over year by 3.4% due to the longer stage

length and the improved fuel efficiency of the Boeing 737-700

aircraft.

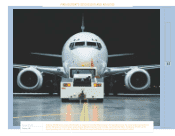

With our 9.3% increase in average stage length in 2001 over

the previous year, we estimate we will achieve a 6% decrease

in unit costs in 2002. The introduction of the state-of-the-art

Boeing 737-700 aircraft to our fleet in 2001 brought, as

expected, significant reductions in operating costs. While

only four 737-700s were added to our fleet of 23 737-200s,

and they were all added in the latter half of the year flying only

11.5% of our ASMs in 2001, their impact on reducing costs per

ASM was noticeable. The 737-700 is approximately 20%

more fuel efficient on a trip basis, but with its 20 additional

available seats, there is about a 30% fuel cost improvement

on a per ASM basis.

Our four 737-700 jets acquired in 2001 are considerably less

than a year old, and including maintenance premiums paid to

the lessor for major overhauls and checks in the future, they

cost 50% less to maintain on a trip basis, and are 58% less

expensive on a per ASM basis. With the 737-700 aircraft,

significant economies are evident for maintenance on a

mature aircraft basis, and much more pronounced in the first

few years of a new aircraft’s operation while it and its multiple

components are under warranty.

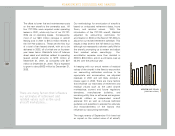

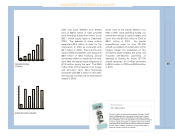

Cost per available seat mile (ASM): 2001 2000 Change

Passenger services 0.032 0.034

Fuel 0.028 0.029

Maintenance 0.024 0.026

Amortization 0.011 0.009

Sales and marketing 0.010 0.011

Flight operations 0.007 0.007

General and administrative 0.007 0.006

Reservations 0.006 0.007

Aircraft leasing 0.005 0.004

Inflight 0.005 0.006

Employee profit share 0.003 0.007

Total 0.140 0.146

5.9%

3.4%

7.7%

(22.2%)

9.9%

0.0%

(16.7%)

14.3%

(25.0%)

16.7%

57.1%

4.1%

With our 9.3% increase in average stage length

in 2001 over the previous year, we estimate we

will achieve a 6% decrease in unit costs in

2002.

MANAGEMENT’S DISCUSSION AND ANALYSIS