Westjet 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Outlook

Recent announcements, coupled with our already aggressive expansion

plans, will ensure 2002 is another exciting year for WestJet.

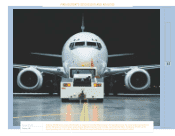

Subsequent to year end, WestJet announced that

it had entered into agreements to lease two

Boeing 737-800 aircraft for a period of seven

months commencing in May 2002. In addition to

these aircraft, WestJet has also entered

agreements to exercise two of its purchase

options for 737-700 aircraft to be delivered in

November and December of 2002, as well as a

letter of intent to acquire a second 737-700 flight

simulator. We have also taken steps to support

these expansion plans and further strengthen our

balance sheet through the planned issuance of

an additional 2.5 million common shares of the

Corporation for net proceeds of approximately

$66 million. This equity issue, which is expected

to close on or about March 7, 2002, also provides

the underwriters with an option to purchase an

additional 500,000 common shares, increasing

net proceeds to WestJet to $79 million.

Including the two recently announced aircraft, ten

Boeing 737-700 aircraft will be delivered to

WestJet in 2002, and 24 more in the three years

following for a total of 38 firmly ordered aircraft.

We also have options and purchase rights for 56

more aircraft between 2005 and 2008. Of the 10

aircraft in 2002, six will be acquired by way of

operating leases. Our first four purchased aircraft

are scheduled to be delivered in the fourth

quarter of 2002. We have the preliminary

commitment from the U.S. Government’s Export-

Import Bank for their loan guarantees to assist in

our financing a total of 26 aircraft with the ability

to apply for more for future capital commitments.

It has been our guidelines generally that one-third

of our fleet would be financed by operating

leases, one-third of the fleet paid for with debt,

and one-third owned or financed with equity. This

means that our purchased aircraft would be 50%

debt and 50% equity. The Ex-Im support is

valuable insurance as it provides financing for up

to 85% of all purchased aircraft. As this is

considerably more than our own philosophy, and

because it is backed by the U.S. Government, the

12-year term financing on our aircraft will be

relatively economical.

We intend to continue to issue shares and raise

equity at appropriate times, and to maintain our

low-cost structure, thereby continuing to increase

our equity through profitability and growth. Our

strategy with all things we do, and especially with

our capital resources and liquidity, is to remain

flexible and adaptable to the changing and

sometimes volatile airline industry environment.

MANAGEMENT’S DISCUSSION AND ANALYSIS

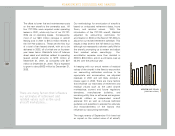

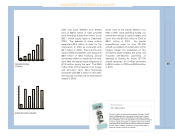

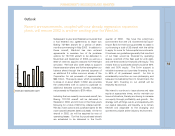

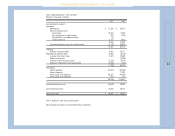

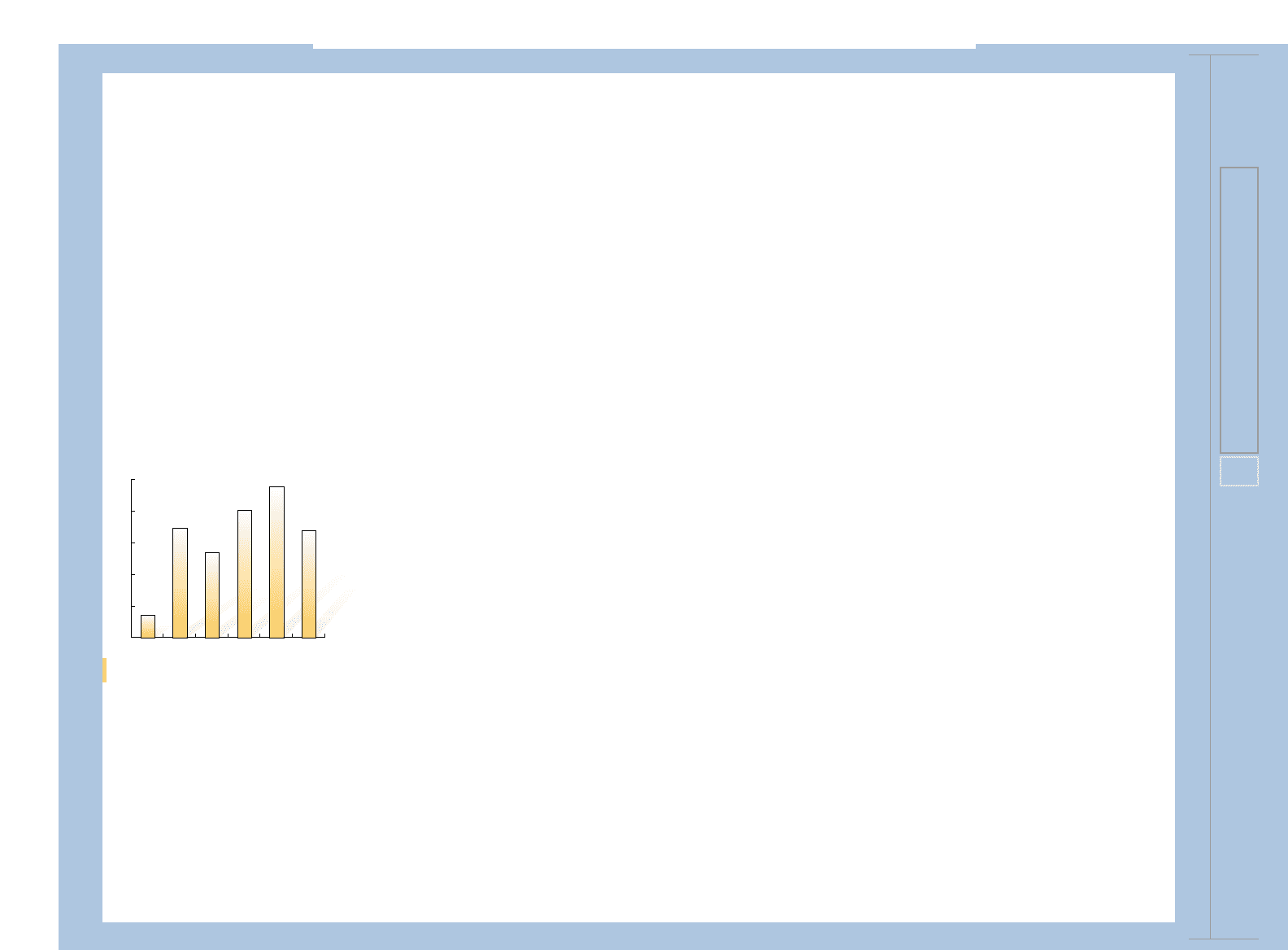

0%

5%

10%

15%

20%

25%

3.6%

17.3%

13.5%

20.1%

23.8%

16.9%

1996 1997 1998 1999 2000 2001

RETURN ON SHAREHOLDERS’ EQUITY